We at Insider Monkey have gone over 738 13F filings that hedge funds and prominent investors are required to file by the SEC The 13F filings show the funds’ and investors’ portfolio positions as of March 31st. In this article, we look at what those funds think of PCM, Inc. (NASDAQ:PCMI) based on that data.

Is PCM, Inc. (NASDAQ:PCMI) a superb stock to buy now? Hedge funds are betting on the stock. The number of long hedge fund positions moved up by 6 lately. Our calculations also showed that pcmi isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to analyze the recent hedge fund action encompassing PCM, Inc. (NASDAQ:PCMI).

Hedge fund activity in PCM, Inc. (NASDAQ:PCMI)

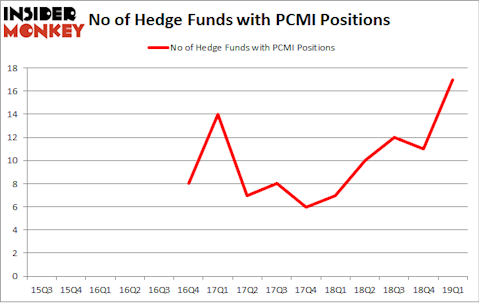

Heading into the second quarter of 2019, a total of 17 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 55% from the fourth quarter of 2018. Below, you can check out the change in hedge fund sentiment towards PCMI over the last 15 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists a select group of key hedge fund managers who were increasing their stakes substantially (or already accumulated large positions).

The largest stake in PCM, Inc. (NASDAQ:PCMI) was held by Royce & Associates, which reported holding $12 million worth of stock at the end of March. It was followed by Renaissance Technologies with a $5.9 million position. Other investors bullish on the company included Arrowstreet Capital, Millennium Management, and Laurion Capital Management.

As industrywide interest jumped, some big names were breaking ground themselves. GLG Partners, managed by Noam Gottesman, created the most valuable position in PCM, Inc. (NASDAQ:PCMI). GLG Partners had $1.6 million invested in the company at the end of the quarter. Michael Gelband’s ExodusPoint Capital also initiated a $0.7 million position during the quarter. The other funds with brand new PCMI positions are Ken Griffin’s Citadel Investment Group, Michael Platt and William Reeves’s BlueCrest Capital Mgmt., and Mike Vranos’s Ellington.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as PCM, Inc. (NASDAQ:PCMI) but similarly valued. These stocks are CVR Partners LP (NYSE:UAN), Gravity Co., LTD. (NASDAQ:GRVY), Corbus Pharmaceuticals Holdings Inc (NASDAQ:CRBP), and New Senior Investment Group Inc (NYSE:SNR). This group of stocks’ market values are closest to PCMI’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| UAN | 5 | 43910 | 1 |

| GRVY | 1 | 693 | 0 |

| CRBP | 9 | 47522 | 3 |

| SNR | 17 | 66998 | -1 |

| Average | 8 | 39781 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 8 hedge funds with bullish positions and the average amount invested in these stocks was $40 million. That figure was $41 million in PCMI’s case. New Senior Investment Group Inc (NYSE:SNR) is the most popular stock in this table. On the other hand Gravity Co., LTD. (NASDAQ:GRVY) is the least popular one with only 1 bullish hedge fund positions. PCM, Inc. (NASDAQ:PCMI) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately PCMI wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on PCMI were disappointed as the stock returned -31.3% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.