Middle Coast Investing, an investment advisor firm, released its first-quarter investor letter. A copy of the letter can be downloaded here. Middle Coast Investing had a difficult but manageable first quarter, but everyone has suffered since the Liberation Day crash at the beginning of the second quarter. To manage the volatility, the firm decided to increase cash goal levels by roughly 5% for each portfolio. In the quarter, the firm sold 3% more than it bought. In Q1 2025, the US Portfolios returned -3.7% compared to -4.6% for the S&P 500. It’s Core U.S. portfolios returned -0.7% while Russell 2000 returned -9.8%, S&P 600 returned -9.3% and Nasdaq generated -10.4% for the same period. However, its European Portfolios appreciated by 9.2%. In addition, please check the fund’s top five holdings to know its best picks in 2025.

In its first quarter 2025 investor letter, Middle Coast Investing emphasized stocks such as Astronics Corporation (NASDAQ:ATRO). Astronics Corporation (NASDAQ:ATRO) designs and manufactures products for the aerospace, defense, and electronics industries. The one-month return of Astronics Corporation (NASDAQ:ATRO) was -7.38%, and its shares gained 44.48% of their value over the last 52 weeks. On April 15, 2025, Astronics Corporation (NASDAQ:ATRO) stock closed at $23.23 per share with a market capitalization of $818.497 million.

Middle Coast Investing stated the following regarding Astronics Corporation (NASDAQ:ATRO) in its Q1 2025 investor letter:

“Astronics Corporation (NASDAQ:ATRO) had two things go right in the quarter. The expected one is its results: there is a lot of aerospace demand to catch up to in the post Covid period. Boeing’s struggles, supply chain snarls, and that demand pause five years ago have ensured that the backlog and growth outlook for Astronics is good, and their Q4 report supported that. The company has generally reached or beat its top guidance estimates, and top guidance calls for 8% revenue growth in 2025.

The unexpected good thing – a U.K. judge ruled Astronics has to pay Lufthansa $11.9M over a patent dispute. Lufthansa was seeking $105M. That’s a big difference for a company that entered Q1 with a market cap under $600M.

The aerospace supply chain is susceptible to tariffs, and Boeing is one of the star exporters of the U.S. and so in theory liable to be a target of other countries. The essential nature of aerospace makes me think Astronics’s business should hold up, and its balance sheet has improved to help it survive any hiccups.”

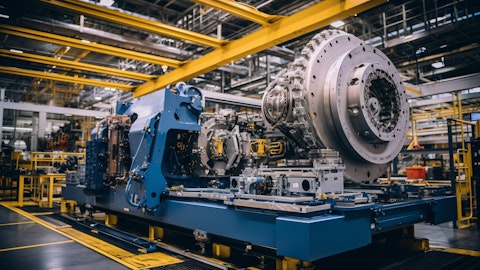

A complex assembly line producing aircraft structures for aerospace applications.

Astronics Corporation (NASDAQ:ATRO) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 32 hedge fund portfolios held Astronics Corporation (NASDAQ:ATRO) at the end of the fourth quarter which was 22 in the previous quarter. While we acknowledge the potential of Astronics Corporation (NASDAQ:ATRO) as an investment, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is as promising as NVIDIA but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

We covered Astronics Corporation (NASDAQ:ATRO) in another article, where we shared the list of best performing defense stocks so far in 2025. In addition, please check out our hedge fund investor letters Q1 2025 page for more investor letters from hedge funds and other leading investors.

READ NEXT: Michael Burry Is Selling These Stocks and A New Dawn Is Coming to US Stocks.

Disclosure: None. This article is originally published at Insider Monkey.