Baron Funds, an investment management company, released its “Baron Opportunity Fund” third quarter 2024 investor letter. A copy of the letter can be downloaded here. In the third quarter, the fund rose 4.04% (Institutional Shares), outperformed the Russell 3000 Growth Index, which gained 3.42%, and lagged the S&P 500 Index, which advanced 5.89%. In the first nine months ended 2024, the fund posted solid gains, rising 25.31% compared to a 24.00% return for the Russell 3000 Growth Index and beating the S&P 500 Index’s 22.08% gain. Due to a significant rotation away from large-cap Magnificent Seven stocks and toward value/cyclical and small-cap stocks, as well as generally positive economic data that supported the soft-landing narrative and the Federal Reserve’s long-awaited dovish pivot, U.S. stocks ended the quarter higher for the fourth consecutive quarter. In addition, you can check the fund’s top 5 holdings to determine its best picks for 2024.

Baron Opportunity Fund highlighted stocks like Broadcom Inc. (NASDAQ:AVGO) in the third quarter 2024 investor letter. Broadcom Inc. (NASDAQ:AVGO) designs and develops various semiconductor and infrastructure software solutions. The one-month return of Broadcom Inc. (NASDAQ:AVGO) was -0.78%, and its shares gained 104.39% of their value over the last 52 weeks. On October 24, 2024, Broadcom Inc. (NASDAQ:AVGO) stock closed at $171.35 per share with a market capitalization of $810.391 billion.

Baron Opportunity Fund stated the following regarding Broadcom Inc. (NASDAQ:AVGO) in its Q3 2024 investor letter:

“We continued to build our position in Broadcom Inc. (NASDAQ:AVGO), a global technology leader that designs, develops, and supplies a broad range of semiconductor and infrastructure software solutions. As AI continues to proliferate, we believe hyperscalers – such as Meta, Microsoft Azure, Google Cloud Compute, and Amazon Web Services, to name just a few – will increasingly deploy custom accelerator chips for their AI workloads as they can be more cost-effective and energy-efficient than using NVIDIA’s general-purpose GPUs. Broadcom has a leading position partnering with hyperscalers to develop these custom chips, with its AI customer accelerator business up 3.5-times year-over-year in its most recently reported quarter, and a goal of at least $8 billion in custom accelerator revenues for this fiscal year. Additionally, VMware continues to perform better than expected as Broadcom is implementing its product simplification and subscription revenue model strategy. Further, its non-AI related semiconductor business, which tends to be more cyclical, is in the early stages of a recovery. Combined, all these factors will drive strong revenue and earnings growth over the next several years.”

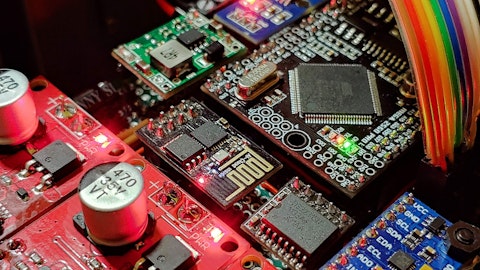

A technician working at a magnified microscope, developing a new integrated circuit.

Broadcom Inc. (NASDAQ:AVGO) is in 15th position on our list of 31 Most Popular Stocks Among Hedge Funds. As per our database, 130 hedge fund portfolios held Broadcom Inc. (NASDAQ:AVGO) at the end of the second quarter which was 115 in the previous quarter. While we acknowledge the potential of Broadcom Inc. (NASDAQ:AVGO) as an investment, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is as promising as NVIDIA but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

In another article, we discussed Broadcom Inc. (NASDAQ:AVGO) and shared the list of best FAANG stocks to buy according to analysts. In the Q2 2024 investor letter, Baron Opportunity Fund highlighted Broadcom Inc.’s (NASDAQ:AVGO) rise, attributing to its key growth drivers, AI semiconductors and its acquired VMware software business. In addition, please check out our hedge fund investor letters Q3 2024 page for more investor letters from hedge funds and other leading investors.

READ NEXT: Michael Burry Is Selling These Stocks and A New Dawn Is Coming to US Stocks.

Disclosure: None. This article is originally published at Insider Monkey.