It is already common knowledge that individual investors do not usually have the necessary resources and abilities to properly research an investment opportunity. As a result, most investors pick their illusory “winners” by making a superficial analysis and research that leads to poor performance on aggregate. Since stock returns aren’t usually symmetrically distributed and index returns are more affected by a few outlier stocks (i.e. the FAANG stocks dominating and driving S&P 500 Index’s returns in recent years), more than 50% of the constituents of the Standard and Poor’s 500 Index underperform the benchmark. Hence, if you randomly pick a stock, there is more than 50% chance that you’d fail to beat the market. At the same time, the 20 most favored S&P 500 stocks by the hedge funds monitored by Insider Monkey generated an outperformance of more than 10 percentage points in 2019. Of course, hedge funds do make wrong bets on some occasions and these get disproportionately publicized on financial media, but piggybacking their moves can beat the broader market on average. That’s why we are going to go over recent hedge fund activity in Herc Holdings Inc. (NYSE:HRI).

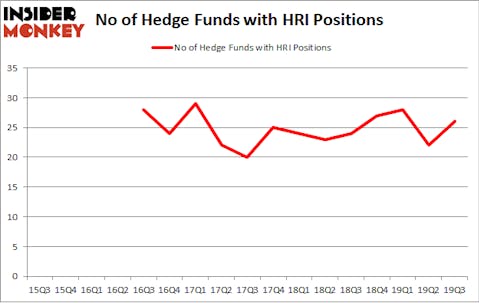

Herc Holdings Inc. (NYSE:HRI) shareholders have witnessed an increase in hedge fund sentiment in recent months. Our calculations also showed that HRI isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video at the end of this article for Q2 rankings).

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 91% since May 2014 and outperformed the Russell 2000 ETFs by nearly 40 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock is still extremely cheap despite already gaining 20 percent. Keeping this in mind we’re going to take a look at the recent hedge fund action surrounding Herc Holdings Inc. (NYSE:HRI).

Hedge fund activity in Herc Holdings Inc. (NYSE:HRI)

Heading into the fourth quarter of 2019, a total of 26 of the hedge funds tracked by Insider Monkey were long this stock, a change of 18% from the second quarter of 2019. By comparison, 24 hedge funds held shares or bullish call options in HRI a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Carl Icahn’s Icahn Capital has the number one position in Herc Holdings Inc. (NYSE:HRI), worth close to $209.1 million, comprising 0.8% of its total 13F portfolio. The second largest stake is held by GAMCO Investors, managed by Mario Gabelli, which holds a $167.1 million position; the fund has 1.4% of its 13F portfolio invested in the stock. Remaining members of the smart money with similar optimism contain Jared Nussbaum’s Nut Tree Capital, Renaissance Technologies and Chuck Royce’s Royce & Associates. In terms of the portfolio weights assigned to each position Nut Tree Capital allocated the biggest weight to Herc Holdings Inc. (NYSE:HRI), around 10.69% of its 13F portfolio. ACK Asset Management is also relatively very bullish on the stock, dishing out 3.52 percent of its 13F equity portfolio to HRI.

As aggregate interest increased, key money managers were breaking ground themselves. Driehaus Capital, managed by Richard Driehaus, established the most outsized position in Herc Holdings Inc. (NYSE:HRI). Driehaus Capital had $9.3 million invested in the company at the end of the quarter. Mark Coe’s Intrinsic Edge Capital also initiated a $8.1 million position during the quarter. The following funds were also among the new HRI investors: Ken Grossman and Glen Schneider’s SG Capital Management, Minhua Zhang’s Weld Capital Management, and Matthew Hulsizer’s PEAK6 Capital Management.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Herc Holdings Inc. (NYSE:HRI) but similarly valued. We will take a look at Getty Realty Corp. (NYSE:GTY), Synaptics Incorporated (NASDAQ:SYNA), Golar LNG Limited (NASDAQ:GLNG), and BELLUS Health Inc. (NASDAQ:BLU). This group of stocks’ market valuations match HRI’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GTY | 9 | 92245 | -1 |

| SYNA | 19 | 266720 | 6 |

| GLNG | 24 | 249259 | 1 |

| BLU | 13 | 82956 | 13 |

| Average | 16.25 | 172795 | 4.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.25 hedge funds with bullish positions and the average amount invested in these stocks was $173 million. That figure was $566 million in HRI’s case. Golar LNG Limited (NASDAQ:GLNG) is the most popular stock in this table. On the other hand Getty Realty Corp. (NYSE:GTY) is the least popular one with only 9 bullish hedge fund positions. Compared to these stocks Herc Holdings Inc. (NYSE:HRI) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. Hedge funds were also right about betting on HRI as the stock returned 88.3% in 2019 and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.