Coronavirus is probably the #1 concern in investors’ minds right now. It should be. We estimate that COVID-19 will kill around 5 million people worldwide and there is a 3.3% probability that Donald Trump will die from the new coronavirus (see the details). So, how do we invest in this environment? Our extensive research has shown that imitating the smart money can generate significant returns for retail investors, which is why we track nearly 850 active prominent money managers and analyze their quarterly 13F filings. The stocks that are heavily bought by hedge funds historically outperformed the market, though there is no shortage of high profile failures like hedge funds’ 2018 losses in Facebook and Apple. Let’s take a closer look at what the funds we track think about Apple Inc. (NASDAQ:AAPL) in this article.

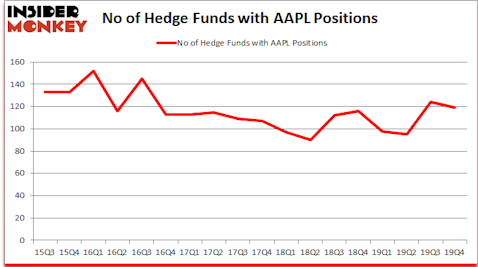

Apple Inc. (NASDAQ:AAPL) was in 119 hedge funds’ portfolios at the end of December. AAPL has seen a decrease in activity from the world’s largest hedge funds recently. There were 124 hedge funds in our database with AAPL holdings at the end of the previous quarter. Our calculations also showed that AAPL ranked 11th among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video below for Q3 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 72.9% since March 2017 and outperformed the S&P 500 ETFs by more than 41 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We leave no stone unturned when looking for the next great investment idea. We read hedge fund investor letters, listen to stock pitches at hedge fund conferences, and go through short-term trade recommendations like this one. We even check out recommendations of services with hard to believe track records. Last month, we recommended a long position in one of the most shorted stocks in the market. No, our recommendation wasn’t Tesla (TSLA). It was a better pick than Tesla as this stock gained nearly 50% in 3 weeks. Keeping this in mind let’s take a peek at the fresh hedge fund action encompassing Apple Inc. (NASDAQ:AAPL).

What have hedge funds been doing with Apple Inc. (NASDAQ:AAPL)?

At Q4’s end, a total of 119 of the hedge funds tracked by Insider Monkey were long this stock, a change of -4% from one quarter earlier. On the other hand, there were a total of 116 hedge funds with a bullish position in AAPL a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Berkshire Hathaway, managed by Warren Buffett, holds the number one position in Apple Inc. (NASDAQ:AAPL). Berkshire Hathaway has a $71.9899 billion position in the stock, comprising 29.7% of its 13F portfolio. On Berkshire Hathaway’s heels is Fisher Asset Management, led by Ken Fisher, holding a $4.121 billion position; 4.2% of its 13F portfolio is allocated to the company. Remaining hedge funds and institutional investors that hold long positions contain Ken Griffin’s Citadel Investment Group, Cliff Asness’s AQR Capital Management and Phill Gross and Robert Atchinson’s Adage Capital Management. In terms of the portfolio weights assigned to each position Berkshire Hathaway allocated the biggest weight to Apple Inc. (NASDAQ:AAPL), around 29.74% of its 13F portfolio. Tairen Capital is also relatively very bullish on the stock, dishing out 11.01 percent of its 13F equity portfolio to AAPL.

Seeing as Apple Inc. (NASDAQ:AAPL) has witnessed declining sentiment from the smart money, logic holds that there is a sect of money managers that slashed their positions entirely in the third quarter. Intriguingly, Michael Kharitonov and Jon David McAuliffe’s Voleon Capital said goodbye to the largest investment of all the hedgies followed by Insider Monkey, worth close to $77.9 million in stock, and Lei Zhang’s Hillhouse Capital Management was right behind this move, as the fund sold off about $28.6 million worth. These transactions are important to note, as aggregate hedge fund interest dropped by 5 funds in the third quarter.

Let’s now take a look at hedge fund activity in other stocks similar to Apple Inc. (NASDAQ:AAPL). These stocks are Microsoft Corporation (NASDAQ:MSFT), Alphabet Inc (NASDAQ:GOOGL), Alphabet Inc (NASDAQ:GOOG), and Amazon.com, Inc. (NASDAQ:AMZN). This group of stocks’ market valuations are closest to AAPL’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MSFT | 189 | 27422676 | -2 |

| GOOGL | 163 | 13078124 | 5 |

| GOOG | 148 | 16215698 | 0 |

| AMZN | 202 | 28001232 | 21 |

| Average | 175.5 | 21179433 | 6 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 175.5 hedge funds with bullish positions and the average amount invested in these stocks was $21.2 billion. That figure was $83.5 billion in AAPL’s case thanks to Warren Buffett. Amazon.com, Inc. (NASDAQ:AMZN) is the most popular stock in this table. On the other hand Alphabet Inc (NASDAQ:GOOG) is the least popular one with only 148 bullish hedge fund positions. Compared to these stocks Apple Inc. (NASDAQ:AAPL) is even less popular than GOOG. Hedge funds clearly thought that AAPL shares were becoming overvalued and some ditched the stock. Our calculations showed that top 20 most popular stocks among hedge funds returned 0.1% in 2020 through March 2nd and outperformed the S&P 500 ETF (SPY) by 4.1 percentage points. A small number of hedge funds were also right about betting on AAPL as the stock returned 2% so far during the first quarter (through March 2nd) and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.