We hate to say this but, we told you so. On February 27th we published an article with the title Recession is Imminent: We Need A Travel Ban NOW and predicted a US recession when the S&P 500 Index was trading at the 3150 level. We also told you to short the market and buy long-term Treasury bonds. Our article also called for a total international travel ban. While we were warning you, President Trump minimized the threat and failed to act promptly. As a result of his inaction, we will now experience a deeper recession (10 coronavirus predictions).

In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. Insider Monkey finished processing 835 13F filings submitted by hedge funds and prominent investors. These filings show these funds’ portfolio positions as of December 31st, 2019. In this article we are going to take a look at smart money sentiment towards Avantor, Inc. (NYSE:AVTR).

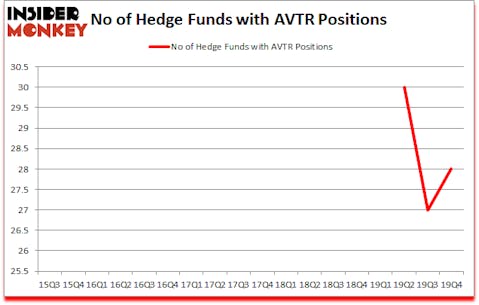

Is Avantor, Inc. (NYSE:AVTR) a buy, sell, or hold? Prominent investors are buying. The number of bullish hedge fund bets advanced by 1 lately. Our calculations also showed that AVTR isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video at the end of this article for Q3 rankings).

At the moment there are dozens of gauges investors can use to size up publicly traded companies. Some of the most under-the-radar gauges are hedge fund and insider trading indicators. Our researchers have shown that, historically, those who follow the top picks of the elite investment managers can outpace the S&P 500 by a healthy amount (see the details here).

We leave no stone unturned when looking for the next great investment idea. For example we recently identified a stock that trades 25% below the net cash on its balance sheet. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences, and go through short-term trade recommendations like this one. We even check out the recommendations of services with hard to believe track records. Our best call in 2020 was shorting the market when S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. Keeping this in mind we’re going to view the key hedge fund action encompassing Avantor, Inc. (NYSE:AVTR).

What does smart money think about Avantor, Inc. (NYSE:AVTR)?

Heading into the first quarter of 2020, a total of 28 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 4% from one quarter earlier. By comparison, 0 hedge funds held shares or bullish call options in AVTR a year ago. With the smart money’s sentiment swirling, there exists an “upper tier” of notable hedge fund managers who were boosting their stakes substantially (or already accumulated large positions).

Among these funds, Viking Global held the most valuable stake in Avantor, Inc. (NYSE:AVTR), which was worth $151.4 million at the end of the third quarter. On the second spot was Egerton Capital Limited which amassed $133.6 million worth of shares. Third Point, Marshall Wace LLP, and Millennium Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Adi Capital Management allocated the biggest weight to Avantor, Inc. (NYSE:AVTR), around 7.39% of its 13F portfolio. Red Cedar Management is also relatively very bullish on the stock, earmarking 5.06 percent of its 13F equity portfolio to AVTR.

As industrywide interest jumped, key hedge funds were breaking ground themselves. Egerton Capital Limited, managed by John Armitage, initiated the most valuable position in Avantor, Inc. (NYSE:AVTR). Egerton Capital Limited had $133.6 million invested in the company at the end of the quarter. Dan Loeb’s Third Point also initiated a $127.1 million position during the quarter. The other funds with new positions in the stock are Lee Ainslie’s Maverick Capital, Robert Pohly’s Samlyn Capital, and Samuel Isaly’s OrbiMed Advisors.

Let’s now review hedge fund activity in other stocks similar to Avantor, Inc. (NYSE:AVTR). We will take a look at Mylan N.V. (NASDAQ:MYL), Comerica Incorporated (NYSE:CMA), Tradeweb Markets Inc. (NASDAQ:TW), and Companhia de Saneamento Basico do Estado de Sao Paulo – SABESP (NYSE:SBS). This group of stocks’ market values match AVTR’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MYL | 47 | 1849229 | 12 |

| CMA | 36 | 542380 | 4 |

| TW | 36 | 566781 | -2 |

| SBS | 12 | 446923 | 1 |

| Average | 32.75 | 851328 | 3.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 32.75 hedge funds with bullish positions and the average amount invested in these stocks was $851 million. That figure was $833 million in AVTR’s case. Mylan N.V. (NASDAQ:MYL) is the most popular stock in this table. On the other hand Companhia de Saneamento Basico do Estado de Sao Paulo – SABESP (NYSE:SBS) is the least popular one with only 12 bullish hedge fund positions. Avantor, Inc. (NYSE:AVTR) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks lost 22.3% in 2020 through March 16th but beat the market by 3.2 percentage points. Unfortunately AVTR wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); AVTR investors were disappointed as the stock returned -44.6% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as most of these stocks already outperformed the market in Q1.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.