Coronavirus is probably the #1 concern in investors’ minds right now. It should be. On February 27th we published an article with the title Recession is Imminent: We Need A Travel Ban NOW. We predicted that a US recession is imminent and US stocks will go down by at least 20% in the next 3-6 months. We also told you to short the market ETFs and buy long-term bonds. Investors who agreed with us and replicated these trades are up double digits whereas the market is down double digits. Our article also called for a total international travel ban to prevent the spread of the coronavirus especially from Europe. We were one step ahead of the markets and the president (10 coronavirus predictions).

In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. The Insider Monkey team has completed processing the quarterly 13F filings for the December quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge fund investors experienced strong gains on the back of a strong market performance, which certainly propelled them to adjust their equity holdings so as to maintain the desired risk profile. As a result, the relevancy of these public filings and their content is indisputable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards Proofpoint Inc (NASDAQ:PFPT).

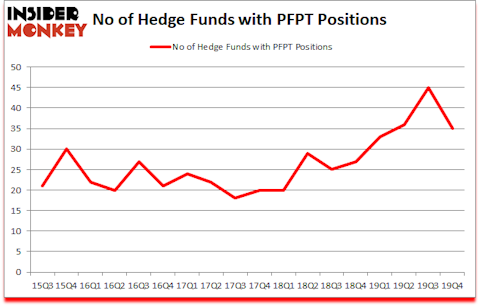

Proofpoint Inc (NASDAQ:PFPT) investors should be aware of a decrease in hedge fund interest in recent months. PFPT was in 35 hedge funds’ portfolios at the end of the fourth quarter of 2019. There were 45 hedge funds in our database with PFPT positions at the end of the previous quarter. Our calculations also showed that PFPT isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video at the end of this article for Q3 rankings).

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research was able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by more than 41 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 35.3% through March 3rd. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

John Overdeck of Two Sigma Advisors

We leave no stone unturned when looking for the next great investment idea. For example we recently identified a stock that trades 25% below the net cash on its balance sheet. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences, and go through short-term trade recommendations like this one. We even check out the recommendations of services with hard to believe track records. Our best call in 2020 was shorting the market when S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. Keeping this in mind we’re going to review the recent hedge fund action encompassing Proofpoint Inc (NASDAQ:PFPT).

What does smart money think about Proofpoint Inc (NASDAQ:PFPT)?

At Q4’s end, a total of 35 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -22% from one quarter earlier. By comparison, 27 hedge funds held shares or bullish call options in PFPT a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, RGM Capital, managed by Robert G. Moses, holds the largest position in Proofpoint Inc (NASDAQ:PFPT). RGM Capital has a $71 million position in the stock, comprising 4.1% of its 13F portfolio. The second largest stake is held by Brett Barakett of Tremblant Capital, with a $57.5 million position; the fund has 2.9% of its 13F portfolio invested in the stock. Remaining professional money managers with similar optimism comprise John Overdeck and David Siegel’s Two Sigma Advisors, Brandon Haley’s Holocene Advisors and Brian Ashford-Russell and Tim Woolley’s Polar Capital. In terms of the portfolio weights assigned to each position RGM Capital allocated the biggest weight to Proofpoint Inc (NASDAQ:PFPT), around 4.06% of its 13F portfolio. Crosslink Capital is also relatively very bullish on the stock, dishing out 3.75 percent of its 13F equity portfolio to PFPT.

Judging by the fact that Proofpoint Inc (NASDAQ:PFPT) has experienced declining sentiment from hedge fund managers, logic holds that there were a few funds that elected to cut their positions entirely last quarter. Interestingly, Panayotis Takis Sparaggis’s Alkeon Capital Management dumped the largest position of all the hedgies tracked by Insider Monkey, comprising close to $102.1 million in stock. Edmond M. Safra’s fund, EMS Capital, also said goodbye to its stock, about $31.4 million worth. These bearish behaviors are interesting, as total hedge fund interest was cut by 10 funds last quarter.

Let’s now take a look at hedge fund activity in other stocks similar to Proofpoint Inc (NASDAQ:PFPT). We will take a look at Morningstar, Inc. (NASDAQ:MORN), Paylocity Holding Corp (NASDAQ:PCTY), American Campus Communities, Inc. (NYSE:ACC), and Oshkosh Corporation (NYSE:OSK). All of these stocks’ market caps are similar to PFPT’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MORN | 21 | 286273 | -4 |

| PCTY | 26 | 588280 | -4 |

| ACC | 21 | 342481 | -1 |

| OSK | 28 | 406897 | 2 |

| Average | 24 | 405983 | -1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24 hedge funds with bullish positions and the average amount invested in these stocks was $406 million. That figure was $395 million in PFPT’s case. Oshkosh Corporation (NYSE:OSK) is the most popular stock in this table. On the other hand Morningstar, Inc. (NASDAQ:MORN) is the least popular one with only 21 bullish hedge fund positions. Compared to these stocks Proofpoint Inc (NASDAQ:PFPT) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks lost 22.3% in 2020 through March 16th but still managed to beat the market by 3.2 percentage points. Hedge funds were also right about betting on PFPT as the stock returned -12% so far in Q1 (through March 16th) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.