We hate to say this but, we told you so. On February 27th we published an article with the title Recession is Imminent: We Need A Travel Ban NOW and predicted a US recession when the S&P 500 Index was trading at the 3150 level. We also told you to short the market and buy long-term Treasury bonds. Our article also called for a total international travel ban. While we were warning you, President Trump minimized the threat and failed to act promptly. As a result of his inaction, we will now experience a deeper recession (read our latest 10 coronavirus predictions).

In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. With the first-quarter round of 13F filings behind us it is time to take a look at the stocks in which some of the best money managers in the world preferred to invest or sell heading into the first quarter. One of these stocks was CNH Industrial NV (NYSE:CNHI).

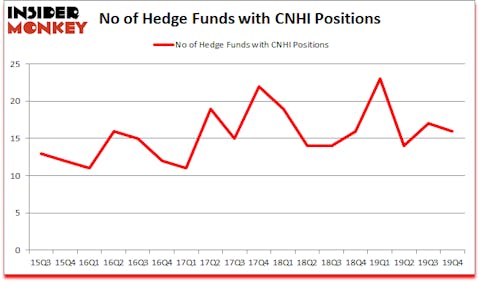

Is CNH Industrial NV (NYSE:CNHI) a marvelous investment now? Money managers are turning less bullish. The number of long hedge fund bets were trimmed by 1 recently. Our calculations also showed that CNHI isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video below for Q3 rankings). CNHI was in 16 hedge funds’ portfolios at the end of December. There were 17 hedge funds in our database with CNHI holdings at the end of the previous quarter.

To the average investor there are a multitude of tools stock market investors employ to analyze publicly traded companies. Some of the less known tools are hedge fund and insider trading activity. Our experts have shown that, historically, those who follow the top picks of the elite fund managers can outperform their index-focused peers by a very impressive margin (see the details here).

Mario Gabelli of GAMCO Investors

We leave no stone unturned when looking for the next great investment idea. For example we recently identified a stock that trades 25% below the net cash on its balance sheet. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences, and go through short-term trade recommendations like this one. We even check out the recommendations of services with hard to believe track records. Our best call in 2020 was shorting the market when S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. Keeping this in mind we’re going to take a look at the recent hedge fund action surrounding CNH Industrial NV (NYSE:CNHI).

How have hedgies been trading CNH Industrial NV (NYSE:CNHI)?

At the end of the fourth quarter, a total of 16 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -6% from one quarter earlier. By comparison, 16 hedge funds held shares or bullish call options in CNHI a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, GAMCO Investors, managed by Mario Gabelli, holds the biggest position in CNH Industrial NV (NYSE:CNHI). GAMCO Investors has a $122.9 million position in the stock, comprising 1% of its 13F portfolio. The second largest stake is held by Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, which holds a $109.8 million position; 0.3% of its 13F portfolio is allocated to the stock. Some other hedge funds and institutional investors that are bullish consist of Mason Hawkins’s Southeastern Asset Management, Michael Cowley’s Sandbar Asset Management and Steve Cohen’s Point72 Asset Management. In terms of the portfolio weights assigned to each position Sandbar Asset Management allocated the biggest weight to CNH Industrial NV (NYSE:CNHI), around 5.04% of its 13F portfolio. Southeastern Asset Management is also relatively very bullish on the stock, setting aside 0.98 percent of its 13F equity portfolio to CNHI.

Seeing as CNH Industrial NV (NYSE:CNHI) has witnessed a decline in interest from the smart money, we can see that there was a specific group of fund managers who were dropping their positions entirely last quarter. It’s worth mentioning that Mitch Kuflik and Rob Sobel’s Brahman Capital sold off the biggest position of the “upper crust” of funds followed by Insider Monkey, totaling an estimated $15.1 million in stock, and Qing Li’s Sciencast Management was right behind this move, as the fund cut about $0.9 million worth. These transactions are important to note, as aggregate hedge fund interest dropped by 1 funds last quarter.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as CNH Industrial NV (NYSE:CNHI) but similarly valued. We will take a look at Evergy, Inc. (NYSE:EVRG), Cardinal Health, Inc. (NYSE:CAH), Agnico Eagle Mines Limited (NYSE:AEM), and Brookfield Infrastructure Partners L.P. (NYSE:BIP). This group of stocks’ market values resemble CNHI’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EVRG | 25 | 942248 | -2 |

| CAH | 34 | 667856 | 6 |

| AEM | 34 | 413114 | 0 |

| BIP | 11 | 59005 | 3 |

| Average | 26 | 520556 | 1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 26 hedge funds with bullish positions and the average amount invested in these stocks was $521 million. That figure was $333 million in CNHI’s case. Cardinal Health, Inc. (NYSE:CAH) is the most popular stock in this table. On the other hand Brookfield Infrastructure Partners L.P. (NYSE:BIP) is the least popular one with only 11 bullish hedge fund positions. CNH Industrial NV (NYSE:CNHI) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks lost 22.3% in 2020 through March 16th but beat the market by 3.2 percentage points. Unfortunately CNHI wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); CNHI investors were disappointed as the stock returned -41.2% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as most of these stocks already outperformed the market in Q1.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.