Coronavirus is probably the #1 concern in investors’ minds right now. It should be. On February 27th we published an article with the title Recession is Imminent: We Need A Travel Ban NOW. We predicted that a US recession is imminent and US stocks will go down by at least 20% in the next 3-6 months. We also told you to short the market ETFs and buy long-term bonds. Investors who agreed with us and replicated these trades are up double digits whereas the market is down double digits. Our article also called for a total international travel ban to prevent the spread of the coronavirus especially from Europe. We were one step ahead of the markets and the president. In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. With the first-quarter round of 13F filings behind us it is time to take a look at the stocks in which some of the best money managers in the world preferred to invest or sell heading into the second quarter. One of these stocks was MPLX LP (NYSE:MPLX).

Hedge fund interest in MPLX LP (NYSE:MPLX) shares was flat at the end of last quarter. This is usually a negative indicator. At the end of this article we will also compare MPLX to other stocks including Square, Inc. (NYSE:SQ), TD Ameritrade Holding Corp. (NYSE:AMTD), and Sun Life Financial Inc. (NYSE:SLF) to get a better sense of its popularity.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research was able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by more than 41 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 35.3% through March 3rd. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

James Dondero of Highland Capital Management

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences, and and go through short-term trade recommendations like this one. We even check out the recommendations of services with hard to believe track records. In January, we recommended a long position in one of the most shorted stocks in the market, and that stock returned more than 50% despite the large losses in the market since our recommendation. Keeping this in mind we’re going to take a gander at the key hedge fund action encompassing MPLX LP (NYSE:MPLX).

How have hedgies been trading MPLX LP (NYSE:MPLX)?

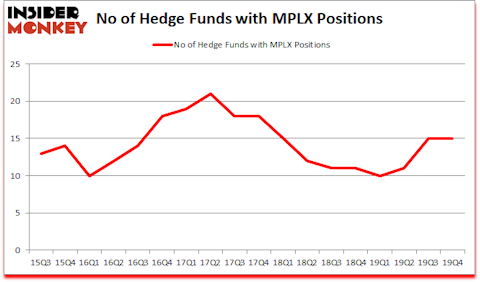

At Q4’s end, a total of 15 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the third quarter of 2019. On the other hand, there were a total of 11 hedge funds with a bullish position in MPLX a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Stockbridge Partners, managed by Sharlyn C. Heslam, holds the largest position in MPLX LP (NYSE:MPLX). Stockbridge Partners has a $261.3 million position in the stock, comprising 9.5% of its 13F portfolio. Sitting at the No. 2 spot is Zimmer Partners, managed by Stuart J. Zimmer, which holds a $110.8 million position; the fund has 1.5% of its 13F portfolio invested in the stock. Other professional money managers that are bullish include Alec Litowitz and Ross Laser’s Magnetar Capital, James Dondero’s Highland Capital Management and David M. Knott’s Dorset Management. In terms of the portfolio weights assigned to each position Stockbridge Partners allocated the biggest weight to MPLX LP (NYSE:MPLX), around 9.48% of its 13F portfolio. BP Capital is also relatively very bullish on the stock, designating 6.99 percent of its 13F equity portfolio to MPLX.

Since MPLX LP (NYSE:MPLX) has witnessed a decline in interest from the entirety of the hedge funds we track, it’s safe to say that there is a sect of hedgies that elected to cut their entire stakes heading into Q4. Interestingly, Paul Marshall and Ian Wace’s Marshall Wace LLP dumped the largest investment of the “upper crust” of funds watched by Insider Monkey, worth close to $22.2 million in stock. David Ezra Gerstenhaber’s fund, Acorn Advisory Capital, also sold off its stock, about $8 million worth. These moves are important to note, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s check out hedge fund activity in other stocks similar to MPLX LP (NYSE:MPLX). These stocks are Square, Inc. (NYSE:SQ), TD Ameritrade Holding Corp. (NYSE:AMTD), Sun Life Financial Inc. (NYSE:SLF), and Discover Financial Services (NYSE:DFS). All of these stocks’ market caps match MPLX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SQ | 56 | 2386749 | 6 |

| AMTD | 50 | 1411932 | 19 |

| SLF | 16 | 132762 | 3 |

| DFS | 39 | 830938 | -2 |

| Average | 40.25 | 1190595 | 6.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 40.25 hedge funds with bullish positions and the average amount invested in these stocks was $1191 million. That figure was $438 million in MPLX’s case. Square, Inc. (NYSE:SQ) is the most popular stock in this table. On the other hand Sun Life Financial Inc. (NYSE:SLF) is the least popular one with only 16 bullish hedge fund positions. Compared to these stocks MPLX LP (NYSE:MPLX) is even less popular than SLF. Hedge funds dodged a bullet by taking a bearish stance towards MPLX. Our calculations showed that the top 20 most popular hedge fund stocks returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks lost 11.7% in 2020 through March 11th but managed to beat the market by 3.1 percentage points. Unfortunately MPLX wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); MPLX investors were disappointed as the stock returned -37.7% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as most of these stocks already outperformed the market so far in Q1.

Disclosure: None. This article was originally published at Insider Monkey.