Russell 2000 ETF (IWM) lagged the larger S&P 500 ETF (SPY) by more than 10 percentage points since the end of the third quarter of 2018 as investors first worried over the possible ramifications of rising interest rates and the escalation of the trade war with China. The hedge funds and institutional investors we track typically invest more in smaller-cap stocks than an average investor (i.e. only about 60% S&P 500 constituents were among the 500 most popular stocks among hedge funds), and we have seen data that shows those funds paring back their overall exposure. Those funds cutting positions in small-caps is one reason why volatility has increased. In the following paragraphs, we take a closer look at what hedge funds and prominent investors think of Health Catalyst, Inc (NASDAQ:HCAT) and see how the stock is affected by the recent hedge fund activity.

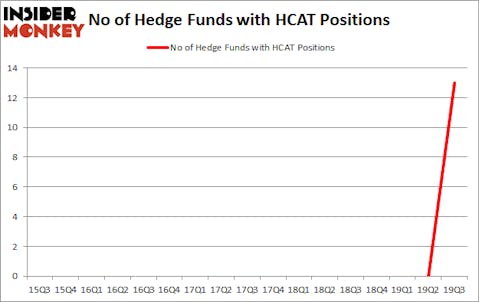

Health Catalyst, Inc (NASDAQ:HCAT) investors should pay attention to an increase in hedge fund interest recently. Our calculations also showed that HCAT isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the eyes of most investors, hedge funds are viewed as unimportant, outdated investment tools of yesteryear. While there are over 8000 funds with their doors open today, Our experts look at the top tier of this group, approximately 750 funds. It is estimated that this group of investors direct the majority of all hedge funds’ total asset base, and by tailing their matchless picks, Insider Monkey has figured out various investment strategies that have historically beaten Mr. Market. Insider Monkey’s flagship short hedge fund strategy exceeded the S&P 500 short ETFs by around 20 percentage points annually since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Samuel Isaly of OrbiMed Advisors

We leave no stone unturned when looking for the next great investment idea. For example Discover is offering this insane cashback card, so we look into shorting the stock. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We even check out this option genius’ weekly trade ideas. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock already gained 20 percent. With all of this in mind we’re going to go over the recent hedge fund action surrounding Health Catalyst, Inc (NASDAQ:HCAT).

What does smart money think about Health Catalyst, Inc (NASDAQ:HCAT)?

At Q3’s end, a total of 13 of the hedge funds tracked by Insider Monkey were long this stock, a change of 13 from one quarter earlier. On the other hand, there were a total of 0 hedge funds with a bullish position in HCAT a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Alkeon Capital Management was the largest shareholder of Health Catalyst, Inc (NASDAQ:HCAT), with a stake worth $15.9 million reported as of the end of September. Trailing Alkeon Capital Management was Perceptive Advisors, which amassed a stake valued at $6.7 million. OrbiMed Advisors, Rock Springs Capital Management, and Alyeska Investment Group were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Perceptive Advisors allocated the biggest weight to Health Catalyst, Inc (NASDAQ:HCAT), around 0.18% of its 13F portfolio. Rock Springs Capital Management is also relatively very bullish on the stock, designating 0.16 percent of its 13F equity portfolio to HCAT.

As one would reasonably expect, specific money managers have been driving this bullishness. Alkeon Capital Management, managed by Panayotis Takis Sparaggis, created the biggest position in Health Catalyst, Inc (NASDAQ:HCAT). Alkeon Capital Management had $15.9 million invested in the company at the end of the quarter. Joseph Edelman’s Perceptive Advisors also initiated a $6.7 million position during the quarter. The following funds were also among the new HCAT investors: Samuel Isaly’s OrbiMed Advisors, Kris Jenner, Gordon Bussard, Graham McPhail’s Rock Springs Capital Management, and Anand Parekh’s Alyeska Investment Group.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Health Catalyst, Inc (NASDAQ:HCAT) but similarly valued. We will take a look at Ballard Power Systems Inc. (NASDAQ:BLDP), LendingClub Corp (NYSE:LC), Central European Media Enterprises Ltd. (NASDAQ:CETV), and The Marcus Corporation (NYSE:MCS). This group of stocks’ market values match HCAT’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BLDP | 6 | 3386 | 2 |

| LC | 8 | 3937 | -2 |

| CETV | 10 | 13280 | 2 |

| MCS | 10 | 47370 | -4 |

| Average | 8.5 | 16993 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 8.5 hedge funds with bullish positions and the average amount invested in these stocks was $17 million. That figure was $45 million in HCAT’s case. Central European Media Enterprises Ltd. (NASDAQ:CETV) is the most popular stock in this table. On the other hand Ballard Power Systems Inc. (NASDAQ:BLDP) is the least popular one with only 6 bullish hedge fund positions. Compared to these stocks Health Catalyst, Inc (NASDAQ:HCAT) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Hedge funds were also right about betting on HCAT as the stock returned 25.6% during the first two months of Q4 and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.