At the end of February we announced the arrival of the first US recession since 2009 and we predicted that the market will decline by at least 20% in (Recession is Imminent: We Need A Travel Ban NOW). In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. In this article, we will take a closer look at hedge fund sentiment towards Franklin Financial Network Inc (NYSE:FSB).

Hedge fund interest in Franklin Financial Network Inc (NYSE:FSB) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Liberty Oilfield Services Inc. (NYSE:LBRT), Viomi Technology Co., Ltd (NASDAQ:VIOT), and Pfenex Inc (NYSE:PFNX) to gather more data points. Our calculations also showed that FSB isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

To most market participants, hedge funds are assumed to be underperforming, old investment vehicles of the past. While there are more than 8000 funds with their doors open at present, Our researchers choose to focus on the masters of this group, approximately 850 funds. It is estimated that this group of investors preside over the majority of the smart money’s total capital, and by tracking their inimitable picks, Insider Monkey has come up with a number of investment strategies that have historically defeated Mr. Market. Insider Monkey’s flagship short hedge fund strategy outperformed the S&P 500 short ETFs by around 20 percentage points per year since its inception in March 2017. Our portfolio of short stocks lost 36% since February 2017 (through May 18th) even though the market was up 30% during the same period. We just shared a list of 8 short targets in our latest quarterly update .

Chuck Royce of Royce & Associates

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, legendary investor Bill Miller told investors to sell 7 extremely popular recession stocks last month. So, we went through his list and recommended another stock with 100% upside potential instead. We interview hedge fund managers and ask them about their best ideas. If you want to find out the best healthcare stock to buy right now, you can watch our latest hedge fund manager interview here. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. With all of this in mind we’re going to take a peek at the recent hedge fund action regarding Franklin Financial Network Inc (NYSE:FSB).

What does smart money think about Franklin Financial Network Inc (NYSE:FSB)?

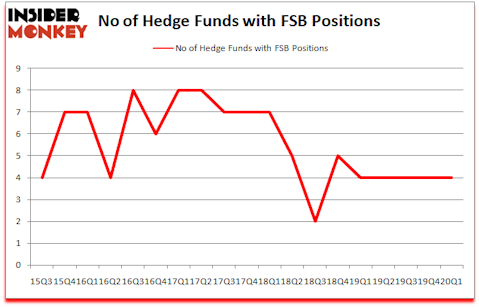

Heading into the second quarter of 2020, a total of 4 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from the fourth quarter of 2019. Below, you can check out the change in hedge fund sentiment towards FSB over the last 18 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists a select group of key hedge fund managers who were upping their holdings considerably (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Royce & Associates, managed by Chuck Royce, holds the number one position in Franklin Financial Network Inc (NYSE:FSB). Royce & Associates has a $4 million position in the stock, comprising 0.1% of its 13F portfolio. The second most bullish fund manager is Renaissance Technologies, which holds a $3.1 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Other peers that hold long positions contain Greg Eisner’s Engineers Gate Manager, Ken Griffin’s Citadel Investment Group and . In terms of the portfolio weights assigned to each position Royce & Associates allocated the biggest weight to Franklin Financial Network Inc (NYSE:FSB), around 0.05% of its 13F portfolio. Engineers Gate Manager is also relatively very bullish on the stock, earmarking 0.03 percent of its 13F equity portfolio to FSB.

We view hedge fund activity in the stock unfavorable, but in this case there was only a single hedge fund selling its entire position: Millennium Management. One hedge fund selling its entire position doesn’t always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don’t think this is the case in this case because only one of the 800+ hedge funds tracked by Insider Monkey identified as a viable investment and initiated a position in the stock (that fund was Engineers Gate Manager).

Let’s now take a look at hedge fund activity in other stocks similar to Franklin Financial Network Inc (NYSE:FSB). These stocks are Liberty Oilfield Services Inc. (NYSE:LBRT), Viomi Technology Co., Ltd (NASDAQ:VIOT), Pfenex Inc (NYSE:PFNX), and US Concrete Inc (NASDAQ:USCR). This group of stocks’ market caps match FSB’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LBRT | 12 | 11323 | -4 |

| VIOT | 5 | 15007 | -2 |

| PFNX | 14 | 41255 | -2 |

| USCR | 12 | 23829 | -1 |

| Average | 10.75 | 22854 | -2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10.75 hedge funds with bullish positions and the average amount invested in these stocks was $23 million. That figure was $8 million in FSB’s case. Pfenex Inc (NYSE:PFNX) is the most popular stock in this table. On the other hand Viomi Technology Co., Ltd (NASDAQ:VIOT) is the least popular one with only 5 bullish hedge fund positions. Compared to these stocks Franklin Financial Network Inc (NYSE:FSB) is even less popular than VIOT. Hedge funds clearly dropped the ball on FSB as the stock delivered strong returns, though hedge funds’ consensus picks still generated respectable returns. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 8.3% in 2020 through the end of May and still beat the market by 13.2 percentage points. A small number of hedge funds were also right about betting on FSB as the stock returned 21.3% so far in the second quarter and outperformed the market by an even larger margin.

Follow Franklin Financial Network Inc. (NYSE:FSB)

Follow Franklin Financial Network Inc. (NYSE:FSB)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.