Insider Monkey has processed numerous 13F filings of hedge funds and successful value investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds’ and successful investors’ positions as of the end of the first quarter. You can find articles about an individual hedge fund’s trades on numerous financial news websites. However, in this article we will take a look at their collective moves over the last 4.5 years and analyze what the smart money thinks of CompX International Inc. (NYSE:CIX) based on that data.

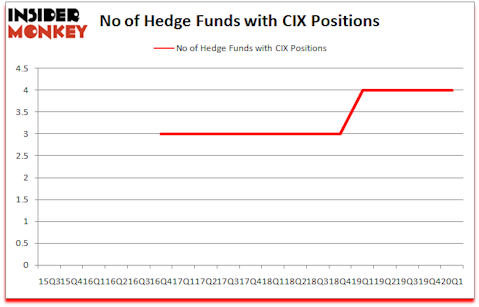

Hedge fund interest in CompX International Inc. (NYSE:CIX) shares was flat at the end of last quarter. This is usually a negative indicator. At the end of this article we will also compare CIX to other stocks including Genie Energy Ltd (NYSE:GNE), Secoo Holding Limited (NASDAQ:SECO), and Cutera, Inc. (NASDAQ:CUTR) to get a better sense of its popularity.

Video: Watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 72% since March 2017 and outperformed the S&P 500 ETFs by more than 44 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, legendary investor Bill Miller told investors to sell 7 extremely popular recession stocks last month. So, we went through his list and recommended another stock with 100% upside potential instead. We interview hedge fund managers and ask them about their best ideas. If you want to find out the best healthcare stock to buy right now, you can watch our latest hedge fund manager interview here. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. Keeping this in mind let’s view the new hedge fund action surrounding CompX International Inc. (NYSE:CIX).

Hedge fund activity in CompX International Inc. (NYSE:CIX)

At Q1’s end, a total of 4 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from the fourth quarter of 2019. By comparison, 4 hedge funds held shares or bullish call options in CIX a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, John Petry’s Sessa Capital has the number one position in CompX International Inc. (NYSE:CIX), worth close to $6.6 million, accounting for 0.8% of its total 13F portfolio. Sitting at the No. 2 spot is Royce & Associates, led by Chuck Royce, holding a $3.2 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Some other professional money managers that hold long positions consist of Renaissance Technologies, David P. Cohen’s Minerva Advisors and . In terms of the portfolio weights assigned to each position Sessa Capital allocated the biggest weight to CompX International Inc. (NYSE:CIX), around 0.8% of its 13F portfolio. Minerva Advisors is also relatively very bullish on the stock, dishing out 0.37 percent of its 13F equity portfolio to CIX.

Earlier we told you that the aggregate hedge fund interest in the stock was unchanged and we view this as a negative development. Even though there weren’t any hedge funds dumping their holdings during the third quarter, there weren’t any hedge funds initiating brand new positions. This indicates that hedge funds, at the very best, perceive this stock as dead money and they haven’t identified any viable catalysts that can attract investor attention.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as CompX International Inc. (NYSE:CIX) but similarly valued. We will take a look at Genie Energy Ltd (NYSE:GNE), Secoo Holding Limited (NASDAQ:SECO), Cutera, Inc. (NASDAQ:CUTR), and Mesabi Trust (NYSE:MSB). This group of stocks’ market values resemble CIX’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GNE | 12 | 6963 | 2 |

| SECO | 3 | 16793 | -1 |

| CUTR | 12 | 35456 | -2 |

| MSB | 2 | 10828 | -6 |

| Average | 7.25 | 17510 | -1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 7.25 hedge funds with bullish positions and the average amount invested in these stocks was $18 million. That figure was $13 million in CIX’s case. Genie Energy Ltd (NYSE:GNE) is the most popular stock in this table. On the other hand Mesabi Trust (NYSE:MSB) is the least popular one with only 2 bullish hedge fund positions. CompX International Inc. (NYSE:CIX) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 8.3% in 2020 through the end of May and surpassed the market by 13.2 percentage points. Unfortunately CIX wasn’t nearly as popular as these 10 stocks (hedge fund sentiment was quite bearish); CIX investors were disappointed as the stock returned -7.4% during the second quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 10 most popular stocks among hedge funds as most of these stocks already outperformed the market in 2020.

Follow Compx International Inc (AMEX:CIX)

Follow Compx International Inc (AMEX:CIX)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.