“Since 2006, value stocks (IVE vs IVW) have underperformed 11 of the 13 calendar years and when they beat growth, it wasn’t by much. Cumulatively, through this week, it has been a 122% differential (up 52% for value vs up 174% for growth). This appears to be the longest and most severe drought for value investors since data collection began. It will go our way eventually as there are too many people paying far too much for today’s darlings, both public and private. Further, the ten-year yield of 2.5% (pre-tax) isn’t attractive nor is real estate. We believe the value part of the global equity market is the only place to earn solid risk adjusted returns and we believe those returns will be higher than normal,” said Vilas Fund in its Q1 investor letter. We aren’t sure whether value stocks outperform growth, but we follow hedge fund investor letters to understand where the markets and stocks might be going. That’s why we believe it would be worthwhile to take a look at the hedge fund sentiment on DuPont de Nemours, Inc. (NYSE:DD) in order to identify whether reputable and successful top money managers continue to believe in its potential.

Is DuPont de Nemours, Inc. (NYSE:DD) a buy, sell, or hold? Investors who are in the know are taking an optimistic view. The number of bullish hedge fund positions moved up by 5 lately. Our calculations also showed that DD isn’t among the 30 most popular stocks among hedge funds.

If you’d ask most traders, hedge funds are perceived as slow, outdated investment tools of yesteryear. While there are more than 8000 funds in operation at the moment, Our experts hone in on the leaders of this club, around 750 funds. These investment experts command the lion’s share of the smart money’s total asset base, and by paying attention to their finest stock picks, Insider Monkey has figured out a number of investment strategies that have historically outperformed the market. Insider Monkey’s flagship short hedge fund strategy surpassed the S&P 500 short ETFs by around 20 percentage points annually since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Clint Carlson of Carlson Capital

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. Let’s take a gander at the recent hedge fund action encompassing DuPont de Nemours, Inc. (NYSE:DD).

Hedge fund activity in DuPont de Nemours, Inc. (NYSE:DD)

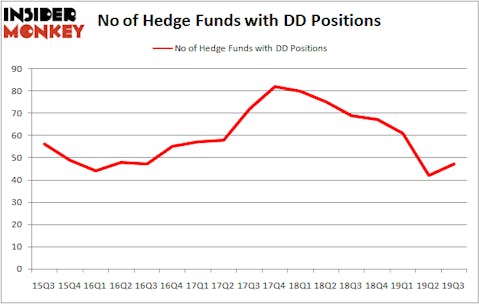

At the end of the third quarter, a total of 47 of the hedge funds tracked by Insider Monkey were long this stock, a change of 12% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards DD over the last 17 quarters. With hedgies’ capital changing hands, there exists an “upper tier” of noteworthy hedge fund managers who were upping their holdings meaningfully (or already accumulated large positions).

The largest stake in DuPont de Nemours, Inc. (NYSE:DD) was held by Maverick Capital, which reported holding $415.2 million worth of stock at the end of September. It was followed by Levin Easterly Partners with a $151.9 million position. Other investors bullish on the company included Citadel Investment Group, D E Shaw, and Adage Capital Management. In terms of the portfolio weights assigned to each position Bodenholm Capital allocated the biggest weight to DuPont de Nemours, Inc. (NYSE:DD), around 13.74% of its portfolio. Maverick Capital is also relatively very bullish on the stock, dishing out 6.1 percent of its 13F equity portfolio to DD.

As industrywide interest jumped, key hedge funds have jumped into DuPont de Nemours, Inc. (NYSE:DD) headfirst. Two Sigma Advisors, managed by John Overdeck and David Siegel, assembled the most outsized position in DuPont de Nemours, Inc. (NYSE:DD). Two Sigma Advisors had $38.5 million invested in the company at the end of the quarter. Clint Carlson’s Carlson Capital also initiated a $30.2 million position during the quarter. The other funds with new positions in the stock are Alexander Mitchell’s Scopus Asset Management, Vince Maddi and Shawn Brennan’s SIR Capital Management, and David Costen Haley’s HBK Investments.

Let’s now review hedge fund activity in other stocks similar to DuPont de Nemours, Inc. (NYSE:DD). We will take a look at Deere & Company (NYSE:DE), Brookfield Asset Management Inc. (NYSE:BAM), General Dynamics Corporation (NYSE:GD), and HDFC Bank Limited (NYSE:HDB). This group of stocks’ market caps are similar to DD’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DE | 40 | 1818266 | 0 |

| BAM | 31 | 1142775 | 9 |

| GD | 40 | 7033615 | 0 |

| HDB | 36 | 2347772 | 9 |

| Average | 36.75 | 3085607 | 4.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 36.75 hedge funds with bullish positions and the average amount invested in these stocks was $3086 million. That figure was $1502 million in DD’s case. Deere & Company (NYSE:DE) is the most popular stock in this table. On the other hand Brookfield Asset Management Inc. (NYSE:BAM) is the least popular one with only 31 bullish hedge fund positions. Compared to these stocks DuPont de Nemours, Inc. (NYSE:DD) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 34.7% in 2019 through November 22nd and outperformed the S&P 500 ETF (SPY) by 8.5 percentage points. Unfortunately DD wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on DD were disappointed as the stock returned -7.7% during the fourth quarter (through 11/22) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market in Q4.

Disclosure: None. This article was originally published at Insider Monkey.