Does Boston Properties, Inc. (NYSE:BXP) represent a good buying opportunity at the moment? Let’s quickly check the hedge fund interest towards the company. Hedge fund firms constantly search out bright intellectuals and highly-experienced employees and throw away millions of dollars on satellite photos and other research activities, so it is no wonder why they tend to generate millions in profits each year. It is also true that some hedge fund players fail inconceivably on some occasions, but net net their stock picks have been generating superior risk-adjusted returns on average over the years.

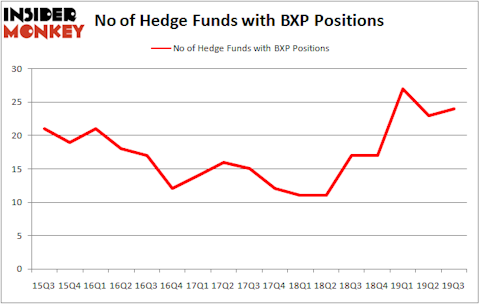

Is Boston Properties, Inc. (NYSE:BXP) the right investment to pursue these days? The smart money is in a bullish mood. The number of bullish hedge fund bets inched up by 1 in recent months. Our calculations also showed that BXP isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings). BXP was in 24 hedge funds’ portfolios at the end of September. There were 23 hedge funds in our database with BXP holdings at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the 21st century investor’s toolkit there are a multitude of tools market participants have at their disposal to evaluate their stock investments. A pair of the most innovative tools are hedge fund and insider trading interest. Our researchers have shown that, historically, those who follow the best picks of the top investment managers can beat the S&P 500 by a very impressive amount (see the details here).

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. Let’s take a gander at the recent hedge fund action surrounding Boston Properties, Inc. (NYSE:BXP).

What does smart money think about Boston Properties, Inc. (NYSE:BXP)?

Heading into the fourth quarter of 2019, a total of 24 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 4% from the previous quarter. By comparison, 17 hedge funds held shares or bullish call options in BXP a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Citadel Investment Group held the most valuable stake in Boston Properties, Inc. (NYSE:BXP), which was worth $140.4 million at the end of the third quarter. On the second spot was D E Shaw which amassed $83.5 million worth of shares. Millennium Management, Renaissance Technologies, and Adage Capital Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Welch Capital Partners allocated the biggest weight to Boston Properties, Inc. (NYSE:BXP), around 2.19% of its portfolio. Stevens Capital Management is also relatively very bullish on the stock, setting aside 0.53 percent of its 13F equity portfolio to BXP.

As industrywide interest jumped, key money managers have been driving this bullishness. Bridgewater Associates, managed by Ray Dalio, created the biggest position in Boston Properties, Inc. (NYSE:BXP). Bridgewater Associates had $8.8 million invested in the company at the end of the quarter. Ken Heebner’s Capital Growth Management also initiated a $3.9 million position during the quarter. The following funds were also among the new BXP investors: Benjamin A. Smith’s Laurion Capital Management, Perella Weinberg Partners, and Michael Platt and William Reeves’s BlueCrest Capital Mgmt..

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Boston Properties, Inc. (NYSE:BXP) but similarly valued. These stocks are Vulcan Materials Company (NYSE:VMC), Hewlett Packard Enterprise Company (NYSE:HPE), Imperial Oil Limited (NYSE:IMO), and Palo Alto Networks Inc (NYSE:PANW). All of these stocks’ market caps resemble BXP’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VMC | 53 | 1965254 | 1 |

| HPE | 27 | 822361 | -1 |

| IMO | 11 | 42957 | -1 |

| PANW | 47 | 2862155 | 2 |

| Average | 34.5 | 1423182 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 34.5 hedge funds with bullish positions and the average amount invested in these stocks was $1423 million. That figure was $448 million in BXP’s case. Vulcan Materials Company (NYSE:VMC) is the most popular stock in this table. On the other hand Imperial Oil Limited (NYSE:IMO) is the least popular one with only 11 bullish hedge fund positions. Boston Properties, Inc. (NYSE:BXP) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. A small number of hedge funds were also right about betting on BXP, though not to the same extent, as the stock returned 6.8% during the first two months of the fourth quarter and outperformed the market.

Disclosure: None. This article was originally published at Insider Monkey.