“I have been following Dr. Inan Dogan since this outbreak, and he is a phenomenally intelligent researcher. One month ago, Dr. Dogan’s prediction that the total U.S. death toll would be 20,000+ by April 15th was deemed “radical”. His Recession is Imminent article in February was very timely. Now he believes we could quickly end lockdowns in NYC after some simple testing. A must read” were the words used by our readers to describe our latest article.

In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going even though the mainstream financial media journalists don’t agree with this approach. The financial regulations require hedge funds and wealthy investors that exceeded the $100 million equity holdings threshold to file a report that shows their positions at the end of every quarter. Even though it isn’t the intention, these filings to a certain extent level the playing field for ordinary investors. The latest round of 13F filings disclosed the funds’ positions on December 31st. We at Insider Monkey have made an extensive database of more than 835 of those established hedge funds and famous value investors’ filings. In this article, we analyze how these elite funds and prominent investors traded Apple Inc. (NASDAQ:AAPL) based on those filings.

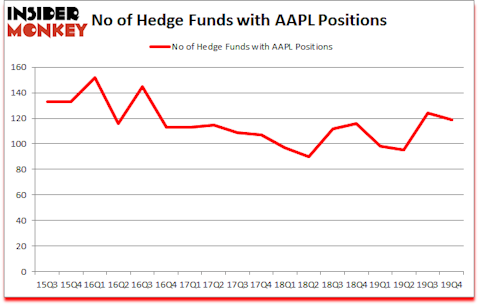

Is Apple Inc. (NASDAQ:AAPL) a healthy stock for your portfolio? Prominent investors are still very bullish about Apple. Our calculations also showed that AAPL ranked 11th among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video at the end of this article for Q3 rankings). AAPL was in 119 hedge funds’ portfolios at the end of the fourth quarter of 2019. There were 124 hedge funds in our database with AAPL positions at the end of the previous quarter.

If you listen to the mainstream financial media, you should avoid stock picking and invest in low-cost index funds. This is indeed what you should do if you want to generate average returns. Mainstream financial media journalists try to make you believe that it isn’t possible to pick winners and losers, and you should ignore the stock picks of hedge fund managers. You may remember reading an article in the WSJ that said “random dart throwing monkeys beat hedge fund stars”. What they fail to tell you is that the top 5 hedge fund stocks returned more than 30% since the end of 2018 and beat the S&P 500 Index by nearly 25 percentage points. You can’t explain this kind of outperformance by luck or coincidence. WSJ will need an army of monkeys to throw darts and tens of thousands of attempts to match these returns.

We leave no stone unturned when looking for the next great investment idea. For example, this trader is claiming triple digit returns, so we check out his latest trade recommendations We are probably at the peak of the COVID-19 pandemic, so we check out this biotech investor’s coronavirus picks. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences (by the way watch this video if you want to hear one of the best healthcare hedge fund manager’s coronavirus analysis). Our best call in 2020 was shorting the market when S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. Now let’s take a glance at the latest hedge fund action regarding Apple Inc. (NASDAQ:AAPL).

What does smart money think about Apple Inc. (NASDAQ:AAPL)?

At the end of the fourth quarter, a total of 119 of the hedge funds tracked by Insider Monkey were long this stock, a change of -4% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in AAPL over the last 18 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were upping their holdings significantly (or already accumulated large positions).

The largest stake in Apple Inc. (NASDAQ:AAPL) was held by Berkshire Hathaway, which reported holding $71989.9 million worth of stock at the end of September. It was followed by Fisher Asset Management with a $4121 million position. Other investors bullish on the company included Citadel Investment Group, AQR Capital Management, and Adage Capital Management. In terms of the portfolio weights assigned to each position Berkshire Hathaway allocated the biggest weight to Apple Inc. (NASDAQ:AAPL), around 29.74% of its 13F portfolio. Tairen Capital is also relatively very bullish on the stock, dishing out 11.01 percent of its 13F equity portfolio to AAPL.

Because Apple Inc. (NASDAQ:AAPL) has faced declining sentiment from the entirety of the hedge funds we track, it’s safe to say that there were a few funds who sold off their full holdings heading into Q4. Interestingly, Michael Kharitonov and Jon David McAuliffe’s Voleon Capital cut the largest position of the “upper crust” of funds monitored by Insider Monkey, totaling close to $77.9 million in stock. Lei Zhang’s fund, Hillhouse Capital Management, also dumped its stock, about $28.6 million worth. These transactions are interesting, as total hedge fund interest dropped by 5 funds heading into Q4.

Let’s check out hedge fund activity in other stocks similar to Apple Inc. (NASDAQ:AAPL). These stocks are Microsoft Corporation (NASDAQ:MSFT), Alphabet Inc (NASDAQ:GOOGL), Alphabet Inc (NASDAQ:GOOG), and Amazon.com, Inc. (NASDAQ:AMZN). This group of stocks’ market valuations are similar to AAPL’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MSFT | 189 | 27422676 | -2 |

| GOOGL | 163 | 13078124 | 5 |

| GOOG | 148 | 16215698 | 0 |

| AMZN | 202 | 28001232 | 21 |

| Average | 175.5 | 21179433 | 6 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 175.5 hedge funds with bullish positions and the average amount invested in these stocks was $21179 million. That figure was $83475 million in AAPL’s case. Amazon.com, Inc. (NASDAQ:AMZN) is the most popular stock in this table. On the other hand Alphabet Inc (NASDAQ:GOOG) is the least popular one with only 148 bullish hedge fund positions. Compared to these stocks Apple Inc. (NASDAQ:AAPL) is even less popular than GOOG. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks lost 1.0% in 2020 through April 20th but managed to beat the market by 11 percentage points. A small number of hedge funds were also right about betting on AAPL, though not to the same extent, as the stock returned -5.5% during the same time period and outperformed the market as well.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.