In this article we will take a look at whether hedge funds think T-Mobile US, Inc. (NASDAQ:TMUS) is a good investment right now. We check hedge fund and billionaire investor sentiment before delving into hours of research. Hedge funds spend millions of dollars on Ivy League graduates, unconventional data sources, expert networks, and get tips from investment bankers and industry insiders. Sure they sometimes fail miserably, but their consensus stock picks historically outperformed the market after adjusting for known risk factors.

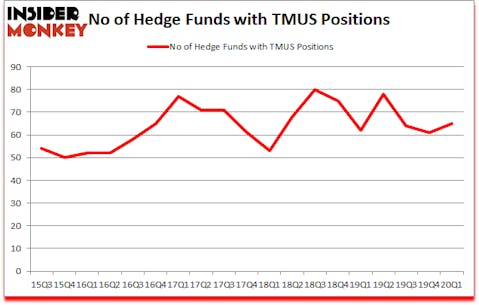

T-Mobile US, Inc. (NASDAQ:TMUS) investors should be aware of an increase in hedge fund interest recently. Our calculations also showed that TMUS isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

In the 21st century investor’s toolkit there are several methods stock market investors use to evaluate stocks. Some of the less known methods are hedge fund and insider trading activity. We have shown that, historically, those who follow the top picks of the top hedge fund managers can outperform their index-focused peers by a superb margin (see the details here).

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, Europe is set to become the world’s largest cannabis market, so we checked out this European marijuana stock pitch. Also, we are still not out of the woods in terms of the coronavirus pandemic. So, we checked out this analyst’s “corona catalyst plays“. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when the S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. With all of this in mind let’s go over the recent hedge fund action regarding T-Mobile US, Inc. (NASDAQ:TMUS).

Hedge fund activity in T-Mobile US, Inc. (NASDAQ:TMUS)

Heading into the second quarter of 2020, a total of 65 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 7% from one quarter earlier. By comparison, 62 hedge funds held shares or bullish call options in TMUS a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in T-Mobile US, Inc. (NASDAQ:TMUS) was held by Citadel Investment Group, which reported holding $273.8 million worth of stock at the end of September. It was followed by Jericho Capital Asset Management with a $110.8 million position. Other investors bullish on the company included Viking Global, Pentwater Capital Management, and Fir Tree. In terms of the portfolio weights assigned to each position Tekne Capital Management allocated the biggest weight to T-Mobile US, Inc. (NASDAQ:TMUS), around 15.79% of its 13F portfolio. Jericho Capital Asset Management is also relatively very bullish on the stock, setting aside 8.91 percent of its 13F equity portfolio to TMUS.

With a general bullishness amongst the heavyweights, key hedge funds were leading the bulls’ herd. Jericho Capital Asset Management, managed by Josh Resnick, initiated the most outsized position in T-Mobile US, Inc. (NASDAQ:TMUS). Jericho Capital Asset Management had $110.8 million invested in the company at the end of the quarter. Andreas Halvorsen’s Viking Global also initiated a $105.2 million position during the quarter. The following funds were also among the new TMUS investors: Jeffrey Altman’s Owl Creek Asset Management, Andrew Immerman and Jeremy Schiffman’s Palestra Capital Management, and Brandon Haley’s Holocene Advisors.

Let’s also examine hedge fund activity in other stocks similar to T-Mobile US, Inc. (NASDAQ:TMUS). These stocks are Altria Group Inc (NYSE:MO), Mondelez International Inc (NASDAQ:MDLZ), HDFC Bank Limited (NYSE:HDB), and General Electric Company (NYSE:GE). This group of stocks’ market valuations are similar to TMUS’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MO | 46 | 1439983 | -8 |

| MDLZ | 54 | 2218156 | 4 |

| HDB | 38 | 1852582 | -1 |

| GE | 58 | 3531845 | -2 |

| Average | 49 | 2260642 | -1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 49 hedge funds with bullish positions and the average amount invested in these stocks was $2261 million. That figure was $1646 million in TMUS’s case. General Electric Company (NYSE:GE) is the most popular stock in this table. On the other hand HDFC Bank Limited (NYSE:HDB) is the least popular one with only 38 bullish hedge fund positions. Compared to these stocks T-Mobile US, Inc. (NASDAQ:TMUS) is more popular among hedge funds. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 7.9% in 2020 through May 22nd and still beat the market by 15.6 percentage points. Unfortunately TMUS wasn’t nearly as popular as these 10 stocks and hedge funds that were betting on TMUS were disappointed as the stock returned 14.2% during the second quarter (through May 22nd) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 10 most popular stocks among hedge funds as most of these stocks already outperformed the market in 2020.

Disclosure: None. This article was originally published at Insider Monkey.