We at Insider Monkey have gone over 738 13F filings that hedge funds and prominent investors are required to file by the SEC The 13F filings show the funds’ and investors’ portfolio positions as of March 31st. In this article, we look at what those funds think of Control4 Corp (NASDAQ:CTRL) based on that data.

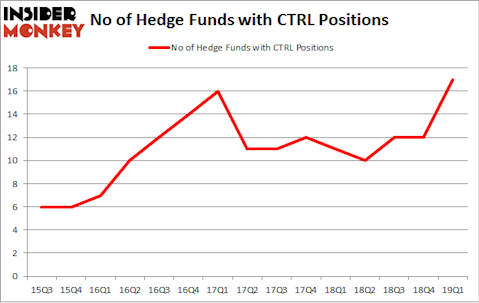

Control4 Corp (NASDAQ:CTRL) was in 17 hedge funds’ portfolios at the end of the first quarter of 2019. CTRL investors should be aware of an increase in enthusiasm from smart money recently. There were 12 hedge funds in our database with CTRL positions at the end of the previous quarter. Overall hedge fund sentiment towards this small-cap stock is at its all time high. This is usually a very bullish signal. We observed this in other stocks like Roku, Uniqure, Avalara, Lindblad Expeditions, and Disney. Roku returned returned 45%, Uniqure and Avalara delivered a 30% gain each, and Disney outperformed the market by 23 percentage points in Q2. Lindblad Expedition investors experienced a relatively modest 15.2% gain during the same period.

In the 21st century investor’s toolkit there are several gauges stock market investors put to use to analyze their holdings. A duo of the less utilized gauges are hedge fund and insider trading signals. Our researchers have shown that, historically, those who follow the best picks of the best fund managers can beat the S&P 500 by a very impressive margin (see the details here).

We’re going to go over the new hedge fund action regarding Control4 Corp (NASDAQ:CTRL).

What have hedge funds been doing with Control4 Corp (NASDAQ:CTRL)?

At Q1’s end, a total of 17 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 42% from the previous quarter. By comparison, 11 hedge funds held shares or bullish call options in CTRL a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Renaissance Technologies, managed by Jim Simons, holds the biggest position in Control4 Corp (NASDAQ:CTRL). Renaissance Technologies has a $10.4 million position in the stock, comprising less than 0.1%% of its 13F portfolio. Coming in second is AQR Capital Management, managed by Cliff Asness, which holds a $4 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Other peers that are bullish include John Overdeck and David Siegel’s Two Sigma Advisors, Ken Griffin’s Citadel Investment Group and Charles Paquelet’s Skylands Capital.

As aggregate interest increased, some big names have jumped into Control4 Corp (NASDAQ:CTRL) headfirst. Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, created the biggest position in Control4 Corp (NASDAQ:CTRL). Arrowstreet Capital had $0.8 million invested in the company at the end of the quarter. Minhua Zhang’s Weld Capital Management also made a $0.6 million investment in the stock during the quarter. The following funds were also among the new CTRL investors: D. E. Shaw’s D E Shaw, Paul Tudor Jones’s Tudor Investment Corp, and Chuck Royce’s Royce & Associates.

Let’s now take a look at hedge fund activity in other stocks similar to Control4 Corp (NASDAQ:CTRL). These stocks are Hi-Crush Partners LP (NYSE:HCLP), Haverty Furniture Companies, Inc. (NYSE:HVT), Adaptimmune Therapeutics plc (NASDAQ:ADAP), and PCM, Inc. (NASDAQ:PCMI). This group of stocks’ market caps resemble CTRL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HCLP | 4 | 1583 | -1 |

| HVT | 11 | 75476 | 1 |

| ADAP | 10 | 152333 | -2 |

| PCMI | 17 | 40529 | 6 |

| Average | 10.5 | 67480 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10.5 hedge funds with bullish positions and the average amount invested in these stocks was $67 million. That figure was $30 million in CTRL’s case. PCM, Inc. (NASDAQ:PCMI) is the most popular stock in this table. On the other hand Hi-Crush Partners LP (NYSE:HCLP) is the least popular one with only 4 bullish hedge fund positions. Control4 Corp (NASDAQ:CTRL) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Hedge funds were also right about betting on CTRL as the stock returned 40.3% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.