The financial regulations require hedge funds and wealthy investors that exceeded the $100 million equity holdings threshold to file a report that shows their positions at the end of every quarter. Even though it isn’t the intention, these filings to a certain extent level the playing field for ordinary investors. The latest round of 13F filings disclosed the funds’ positions on March 31st, about a week after the S&P 500 Index bottomed. We at Insider Monkey have made an extensive database of more than 821 of those established hedge funds and famous value investors’ filings. In this article, we analyze how these elite funds and prominent investors traded Gilead Sciences, Inc. (NASDAQ:GILD) based on those filings.

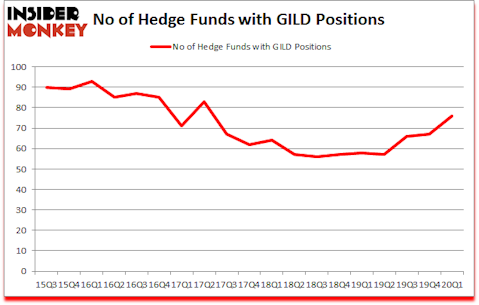

Gilead Sciences, Inc. (NASDAQ:GILD) investors should be aware of an increase in activity from the world’s largest hedge funds lately. Our calculations also showed that GILD isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by more than 44 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in stocks that are in our short portfolio.

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We believe electric vehicles and energy storage are set to become giant markets, and we want to take advantage of the declining lithium prices amid the COVID-19 pandemic. So we asked astrophysicist Neil deGrasse Tyson about Tesla, Elon Musk, and his top stock picks. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. Keeping this in mind we’re going to analyze the key hedge fund action encompassing Gilead Sciences, Inc. (NASDAQ:GILD).

Hedge fund activity in Gilead Sciences, Inc. (NASDAQ:GILD)

Heading into the second quarter of 2020, a total of 76 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 13% from the fourth quarter of 2019. By comparison, 58 hedge funds held shares or bullish call options in GILD a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Renaissance Technologies held the most valuable stake in Gilead Sciences, Inc. (NASDAQ:GILD), which was worth $936.8 million at the end of the third quarter. On the second spot was AQR Capital Management which amassed $433.4 million worth of shares. Ariel Investments, Citadel Investment Group, and Diamond Hill Capital were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Keywise Capital Management allocated the biggest weight to Gilead Sciences, Inc. (NASDAQ:GILD), around 16.7% of its 13F portfolio. Healthcare Value Capital is also relatively very bullish on the stock, dishing out 6.29 percent of its 13F equity portfolio to GILD.

As one would reasonably expect, some big names have been driving this bullishness. Keywise Capital Management, managed by Fang Zheng, established the biggest position in Gilead Sciences, Inc. (NASDAQ:GILD). Keywise Capital Management had $61.6 million invested in the company at the end of the quarter. Glen Kacher’s Light Street Capital also made a $52.2 million investment in the stock during the quarter. The following funds were also among the new GILD investors: Peter Kolchinsky’s RA Capital Management, Louis Bacon’s Moore Global Investments, and George McCabe’s Portolan Capital Management.

Let’s now review hedge fund activity in other stocks similar to Gilead Sciences, Inc. (NASDAQ:GILD). These stocks are Texas Instruments Incorporated (NASDAQ:TXN), BHP Group (NYSE:BHP), Linde plc (NYSE:LIN), and Citigroup Inc. (NYSE:C). This group of stocks’ market caps resemble GILD’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TXN | 46 | 1744576 | -4 |

| BHP | 18 | 460616 | -2 |

| LIN | 53 | 3350656 | 6 |

| C | 86 | 5494249 | -12 |

| Average | 50.75 | 2762524 | -3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 50.75 hedge funds with bullish positions and the average amount invested in these stocks was $2763 million. That figure was $2833 million in GILD’s case. Citigroup Inc. (NYSE:C) is the most popular stock in this table. On the other hand BHP Group (NYSE:BHP) is the least popular one with only 18 bullish hedge fund positions. Gilead Sciences, Inc. (NASDAQ:GILD) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 7.9% in 2020 through May 22nd but beat the market by 15.6 percentage points. Unfortunately GILD wasn’t nearly as popular as these 10 stocks and hedge funds that were betting on GILD were disappointed as the stock returned -1.9% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 10 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Disclosure: None. This article was originally published at Insider Monkey.