We at Insider Monkey have gone over 821 13F filings that hedge funds and prominent investors are required to file by the SEC The 13F filings show the funds’ and investors’ portfolio positions as of March 31st, near the height of the coronavirus market crash. In this article, we look at what those funds think of LexinFintech Holdings Ltd. (NASDAQ:LX) based on that data.

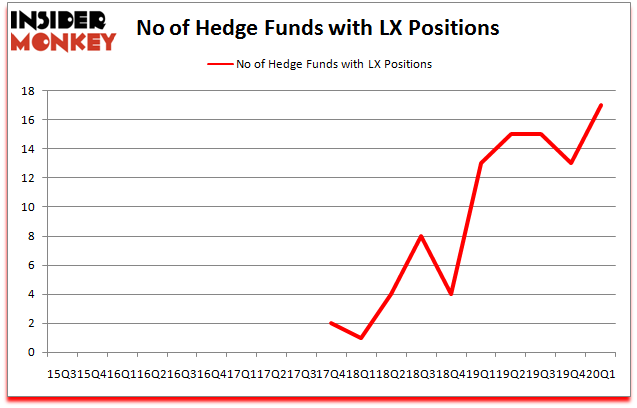

LexinFintech Holdings Ltd. (NASDAQ:LX) was in 17 hedge funds’ portfolios at the end of the first quarter of 2020. LX investors should pay attention to an increase in enthusiasm from smart money in recent months. There were 13 hedge funds in our database with LX positions at the end of the previous quarter. Our calculations also showed that LX isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

At the moment there are a multitude of formulas stock traders have at their disposal to assess stocks. A couple of the less known formulas are hedge fund and insider trading interest. Our researchers have shown that, historically, those who follow the top picks of the top hedge fund managers can outclass their index-focused peers by a significant margin (see the details here).

Jim Simons Founder of Renaissance Technologies

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We interview hedge fund managers and ask them about their best ideas. If you want to find out the best healthcare stock to buy right now, you can watch our latest hedge fund manager interview here. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when the S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. Keeping this in mind we’re going to check out the new hedge fund action surrounding LexinFintech Holdings Ltd. (NASDAQ:LX).

Hedge fund activity in LexinFintech Holdings Ltd. (NASDAQ:LX)

At the end of the first quarter, a total of 17 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 31% from the fourth quarter of 2019. On the other hand, there were a total of 13 hedge funds with a bullish position in LX a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Nitin Saigal and Dan Jacobs’s Kora Management has the largest position in LexinFintech Holdings Ltd. (NASDAQ:LX), worth close to $8 million, amounting to 1.8% of its total 13F portfolio. On Kora Management’s heels of Renaissance Technologies, with a $7.6 million position; less than 0.1%% of its 13F portfolio is allocated to the stock. Some other peers with similar optimism contain David Halpert’s Prince Street Capital Management, Seth Fischer’s Oasis Management and David Greenspan’s Slate Path Capital. In terms of the portfolio weights assigned to each position Prince Street Capital Management allocated the biggest weight to LexinFintech Holdings Ltd. (NASDAQ:LX), around 5.64% of its 13F portfolio. Oasis Management is also relatively very bullish on the stock, setting aside 3.74 percent of its 13F equity portfolio to LX.

As aggregate interest increased, some big names have been driving this bullishness. Oasis Management, managed by Seth Fischer, assembled the most valuable position in LexinFintech Holdings Ltd. (NASDAQ:LX). Oasis Management had $4.4 million invested in the company at the end of the quarter. Kevin Mok’s Hidden Lake Asset Management also made a $0.7 million investment in the stock during the quarter. The following funds were also among the new LX investors: Greg Eisner’s Engineers Gate Manager, Ryan Tolkin (CIO)’s Schonfeld Strategic Advisors, and Jinghua Yan’s TwinBeech Capital.

Let’s go over hedge fund activity in other stocks similar to LexinFintech Holdings Ltd. (NASDAQ:LX). These stocks are Pluralsight, Inc. (NASDAQ:PS), Prospect Capital Corporation (NASDAQ:PSEC), Epizyme Inc (NASDAQ:EPZM), and Badger Meter, Inc. (NYSE:BMI). This group of stocks’ market values resemble LX’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PS | 18 | 77707 | 0 |

| PSEC | 8 | 16564 | -7 |

| EPZM | 22 | 351530 | 4 |

| BMI | 20 | 125239 | 0 |

| Average | 17 | 142760 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17 hedge funds with bullish positions and the average amount invested in these stocks was $143 million. That figure was $40 million in LX’s case. Epizyme Inc (NASDAQ:EPZM) is the most popular stock in this table. On the other hand Prospect Capital Corporation (NASDAQ:PSEC) is the least popular one with only 8 bullish hedge fund positions. LexinFintech Holdings Ltd. (NASDAQ:LX) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 13.4% in 2020 through June 22nd and still beat the market by 15.9 percentage points. A small number of hedge funds were also right about betting on LX as the stock returned 27.2% during the second quarter and outperformed the market by an even larger margin.

Follow Lexinfintech Holdings Ltd. (NASDAQ:LX)

Follow Lexinfintech Holdings Ltd. (NASDAQ:LX)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.