The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We at Insider Monkey have plowed through 823 13F filings that hedge funds and well-known value investors are required to file by the SEC. The 13F filings show the funds’ and investors’ portfolio positions as of June 30th, when the S&P 500 Index was trading around the 3100 level. Stocks kept going up since then. In this article we look at how hedge funds traded Under Armour Inc (NYSE:UA) and determine whether the smart money was really smart about this stock.

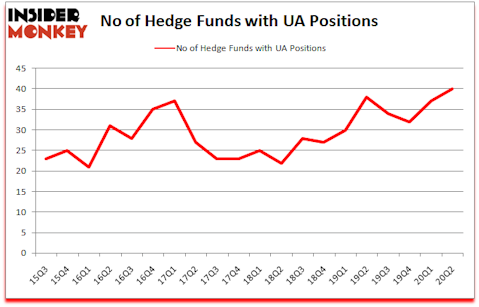

Is Under Armour Inc (NYSE:UA) a healthy stock for your portfolio? Hedge funds were taking an optimistic view. The number of long hedge fund bets inched up by 3 recently. Under Armour Inc (NYSE:UA) was in 40 hedge funds’ portfolios at the end of June. The all time high for this statistics is 38. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. Our calculations also showed that UA isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings and see the video for a quick look at the top 5 stocks). There were 37 hedge funds in our database with UA holdings at the end of March.

Video: Watch our video about the top 5 most popular hedge fund stocks.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that a select group of hedge fund holdings outperformed the S&P 500 ETFs by 56 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 34% through August 17th. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Phill Gross of Adage Capital Management

At Insider Monkey we scour multiple sources to uncover the next great investment idea. For example, Federal Reserve has been creating trillions of dollars electronically to keep the interest rates near zero. We believe this will lead to inflation and boost precious metals prices. So, we are checking out this junior gold mining stock. Legal marijuana is one of the fastest growing industries right now, so we are checking out stock pitches like “the Starbucks of cannabis” to identify the next tenbagger. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We go through lists like the 10 most profitable companies in the world to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. Keeping this in mind we’re going to view the key hedge fund action surrounding Under Armour Inc (NYSE:UA).

What have hedge funds been doing with Under Armour Inc (NYSE:UA)?

At Q2’s end, a total of 40 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 8% from the previous quarter. By comparison, 38 hedge funds held shares or bullish call options in UA a year ago. With the smart money’s sentiment swirling, there exists a few noteworthy hedge fund managers who were upping their stakes considerably (or already accumulated large positions).

The largest stake in Under Armour Inc (NYSE:UA) was held by Adage Capital Management, which reported holding $130.2 million worth of stock at the end of September. It was followed by Adage Capital Management with a $97.3 million position. Other investors bullish on the company included D E Shaw, Alyeska Investment Group, and Two Sigma Advisors. In terms of the portfolio weights assigned to each position Prentice Capital Management allocated the biggest weight to Under Armour Inc (NYSE:UA), around 1.14% of its 13F portfolio. Senator Investment Group is also relatively very bullish on the stock, designating 0.61 percent of its 13F equity portfolio to UA.

Consequently, key hedge funds have jumped into Under Armour Inc (NYSE:UA) headfirst. Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, initiated the most valuable position in Under Armour Inc (NYSE:UA). Arrowstreet Capital had $28.3 million invested in the company at the end of the quarter. Doug Silverman and Alexander Klabin’s Senator Investment Group also initiated a $17.7 million position during the quarter. The following funds were also among the new UA investors: Anand Parekh’s Alyeska Investment Group, John Smith Clark’s Southpoint Capital Advisors, and Simon Sadler’s Segantii Capital.

Let’s also examine hedge fund activity in other stocks similar to Under Armour Inc (NYSE:UA). We will take a look at Starwood Property Trust, Inc. (NYSE:STWD), Norwegian Cruise Line Holdings Ltd (NYSE:NCLH), Youdao, Inc. (NYSE:DAO), Healthequity Inc (NASDAQ:HQY), DXC Technology Company (NYSE:DXC), Jefferies Financial Group Inc. (NYSE:JEF), and Ashland Global Holdings Inc.. (NYSE:ASH). This group of stocks’ market values match UA’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| STWD | 22 | 168439 | -1 |

| NCLH | 28 | 170565 | 8 |

| DAO | 13 | 381255 | 7 |

| HQY | 18 | 164752 | -1 |

| DXC | 40 | 529806 | -1 |

| JEF | 37 | 586275 | 7 |

| ASH | 32 | 976347 | 0 |

| Average | 27.1 | 425348 | 2.7 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 27.1 hedge funds with bullish positions and the average amount invested in these stocks was $425 million. That figure was $559 million in UA’s case. DXC Technology Company (NYSE:DXC) is the most popular stock in this table. On the other hand Youdao, Inc. (NYSE:DAO) is the least popular one with only 13 bullish hedge fund positions. Under Armour Inc (NYSE:UA) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for UA is 88. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 33% in 2020 through the end of August and beat the market by 23.2 percentage points. Unfortunately UA wasn’t nearly as popular as these 10 stocks and hedge funds that were betting on UA were disappointed as the stock returned 0.1% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 10 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Follow Under Armour Inc. (NYSE:UA)

Follow Under Armour Inc. (NYSE:UA)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.