In this article we will check out the progression of hedge fund sentiment towards Zovio Inc. (NASDAQ:ZVO) and determine whether it is a good investment right now. We at Insider Monkey like to examine what billionaires and hedge funds think of a company before spending days of research on it. Given their 2 and 20 payment structure, hedge funds have more incentives and resources than the average investor. The funds have access to expert networks and get tips from industry insiders. They also employ numerous Ivy League graduates and MBAs. Like everyone else, hedge funds perform miserably at times, but their consensus picks have historically outperformed the market after risk adjustments.

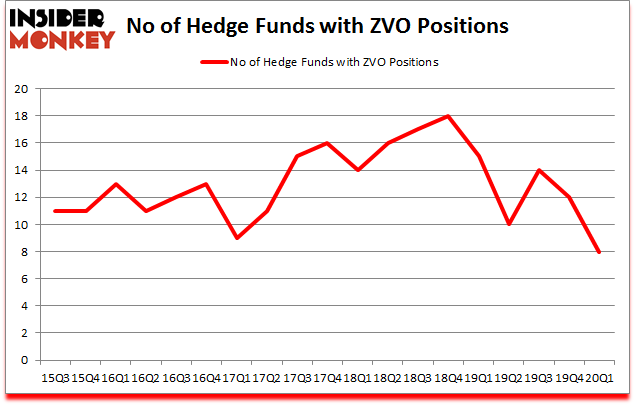

Zovio Inc. (NASDAQ:ZVO) has experienced a decrease in support from the world’s most elite money managers in recent months. ZVO was in 8 hedge funds’ portfolios at the end of the first quarter of 2020. There were 12 hedge funds in our database with ZVO holdings at the end of the previous quarter. Our calculations also showed that ZVO isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

In the eyes of most traders, hedge funds are viewed as worthless, old investment tools of years past. While there are greater than 8000 funds with their doors open today, Our researchers hone in on the bigwigs of this group, around 850 funds. These investment experts direct most of the hedge fund industry’s total capital, and by paying attention to their inimitable picks, Insider Monkey has figured out a number of investment strategies that have historically outstripped the S&P 500 index. Insider Monkey’s flagship short hedge fund strategy surpassed the S&P 500 short ETFs by around 20 percentage points per year since its inception in March 2017. Our portfolio of short stocks lost 36% since February 2017 (through May 18th) even though the market was up 30% during the same period. We just shared a list of 8 short targets in our latest quarterly update .

Roger Ibbotson of Zebra Capital Management

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, We take a look at lists like the 10 most profitable companies in the world to identify the compounders that are likely to deliver double digit returns. We interview hedge fund managers and ask them about their best ideas. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. For example we are checking out stocks recommended/scorned by legendary Bill Miller. Our best call in 2020 was shorting the market when the S&P 500 was trading at 3150 in February after realizing the coronavirus pandemic’s significance before most investors. Keeping this in mind we’re going to take a glance at the new hedge fund action regarding Zovio Inc. (NASDAQ:ZVO).

What does smart money think about Zovio Inc. (NASDAQ:ZVO)?

Heading into the second quarter of 2020, a total of 8 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -33% from the fourth quarter of 2019. By comparison, 15 hedge funds held shares or bullish call options in ZVO a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Nantahala Capital Management held the most valuable stake in Zovio Inc. (NASDAQ:ZVO), which was worth $4.4 million at the end of the third quarter. On the second spot was Prescott Group Capital Management which amassed $3.4 million worth of shares. Renaissance Technologies, D E Shaw, and Two Sigma Advisors were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Prescott Group Capital Management allocated the biggest weight to Zovio Inc. (NASDAQ:ZVO), around 1.68% of its 13F portfolio. Nantahala Capital Management is also relatively very bullish on the stock, setting aside 0.16 percent of its 13F equity portfolio to ZVO.

Because Zovio Inc. (NASDAQ:ZVO) has witnessed a decline in interest from the aggregate hedge fund industry, it’s safe to say that there were a few hedge funds that decided to sell off their positions entirely by the end of the first quarter. Interestingly, Brian Gustavson and Andrew Haley’s 1060 Capital Management sold off the biggest position of all the hedgies monitored by Insider Monkey, comprising close to $1.2 million in stock, and Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital was right behind this move, as the fund dumped about $0.4 million worth. These moves are intriguing to say the least, as aggregate hedge fund interest was cut by 4 funds by the end of the first quarter.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Zovio Inc. (NASDAQ:ZVO) but similarly valued. We will take a look at Perma-Pipe International Holdings, Inc. (NASDAQ:PPIH), Bellerophon Therapeutics, Inc. (NASDAQ:BLPH), Kentucky First Federal Bancorp (NASDAQ:KFFB), and Outlook Therapeutics, Inc. (NASDAQ:OTLK). This group of stocks’ market valuations are similar to ZVO’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PPIH | 2 | 5111 | -1 |

| BLPH | 4 | 8729 | 2 |

| KFFB | 1 | 410 | 0 |

| OTLK | 6 | 3049 | 0 |

| Average | 3.25 | 4325 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 3.25 hedge funds with bullish positions and the average amount invested in these stocks was $4 million. That figure was $13 million in ZVO’s case. Outlook Therapeutics, Inc. (NASDAQ:OTLK) is the most popular stock in this table. On the other hand Kentucky First Federal Bancorp (NASDAQ:KFFB) is the least popular one with only 1 bullish hedge fund positions. Compared to these stocks Zovio Inc. (NASDAQ:ZVO) is more popular among hedge funds. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks returned 12.2% in 2020 through June 17th but still managed to beat the market by 14.8 percentage points. Hedge funds were also right about betting on ZVO as the stock returned 57% so far in Q2 (through June 17th) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Follow Zovio Inc (NASDAQ:ZVO)

Follow Zovio Inc (NASDAQ:ZVO)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.