Before putting in our own effort and resources into finding a good investment, we can quickly utilize hedge fund expertise to give us a quick glimpse of whether that stock could make for a good addition to our portfolios. The odds are not exactly stacked in investors’ favor when it comes to beating the market, as evidenced by the fact that less than 49% of the stocks in the S&P 500 did so during the third quarter. The stats were even worse in recent years when most of the advances in the market were due to large gains by FAANG stocks. However, one bright side for individual investors was the strong performance of hedge funds’ top consensus picks. This year hedge funds’ top 20 stock picks outperformed the S&P 500 Index by 4 percentage points through September 30th. Thus, we can see that the tireless research and efforts of hedge funds to identify winning stocks can work to our advantage when we know how to use the data. While not all of their picks will be winners, our odds are much better following their best stock picks than trying to go it alone.

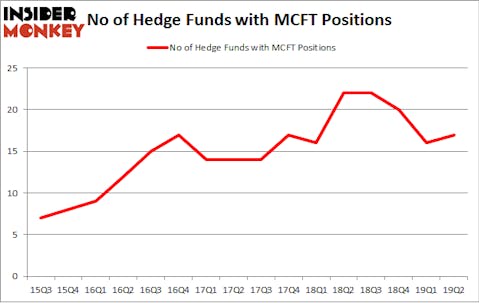

MasterCraft Boat Holdings, Inc. (NASDAQ:MCFT) has experienced an increase in enthusiasm from smart money in recent months. MCFT was in 17 hedge funds’ portfolios at the end of the second quarter of 2019. There were 16 hedge funds in our database with MCFT positions at the end of the previous quarter. Our calculations also showed that MCFT isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

According to most investors, hedge funds are seen as worthless, outdated investment vehicles of yesteryear. While there are greater than 8000 funds trading today, Our experts look at the top tier of this club, approximately 750 funds. These investment experts have their hands on the lion’s share of the hedge fund industry’s total capital, and by keeping an eye on their best equity investments, Insider Monkey has uncovered various investment strategies that have historically outperformed the S&P 500 index. Insider Monkey’s flagship hedge fund strategy defeated the S&P 500 index by around 5 percentage points per year since its inception in May 2014. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 25.7% since February 2017 (through September 30th) even though the market was up more than 33% during the same period. We just shared a list of 10 short targets in our latest quarterly update .

Unlike other investors who track every movement of the 25 largest hedge funds, our long-short investment strategy relies on hedge fund buy/sell signals given by the 100 best performing hedge funds. Let’s take a look at the key hedge fund action encompassing MasterCraft Boat Holdings, Inc. (NASDAQ:MCFT).

What have hedge funds been doing with MasterCraft Boat Holdings, Inc. (NASDAQ:MCFT)?

At Q2’s end, a total of 17 of the hedge funds tracked by Insider Monkey were long this stock, a change of 6% from the first quarter of 2019. The graph below displays the number of hedge funds with bullish position in MCFT over the last 16 quarters. With the smart money’s capital changing hands, there exists an “upper tier” of notable hedge fund managers who were boosting their stakes significantly (or already accumulated large positions).

The largest stake in MasterCraft Boat Holdings, Inc. (NASDAQ:MCFT) was held by Divisar Capital, which reported holding $17.4 million worth of stock at the end of March. It was followed by Renaissance Technologies with a $16.9 million position. Other investors bullish on the company included Royce & Associates, Citadel Investment Group, and GLG Partners.

Consequently, specific money managers were breaking ground themselves. Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, initiated the biggest position in MasterCraft Boat Holdings, Inc. (NASDAQ:MCFT). Arrowstreet Capital had $2.8 million invested in the company at the end of the quarter. Israel Englander’s Millennium Management also made a $2.8 million investment in the stock during the quarter. The other funds with new positions in the stock are Paul Marshall and Ian Wace’s Marshall Wace LLP and Matthew Hulsizer’s PEAK6 Capital Management.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as MasterCraft Boat Holdings, Inc. (NASDAQ:MCFT) but similarly valued. We will take a look at Option Care Health, Inc. (NASDAQ:BIOS), CalAmp Corp. (NASDAQ:CAMP), Gogo Inc (NASDAQ:GOGO), and Southern National Bancorp of Virginia, Inc. (NASDAQ:SONA). This group of stocks’ market values resemble MCFT’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BIOS | 15 | 65590 | -1 |

| CAMP | 16 | 99878 | 1 |

| GOGO | 15 | 65503 | 3 |

| SONA | 7 | 21014 | -1 |

| Average | 13.25 | 62996 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.25 hedge funds with bullish positions and the average amount invested in these stocks was $63 million. That figure was $92 million in MCFT’s case. CalAmp Corp. (NASDAQ:CAMP) is the most popular stock in this table. On the other hand Southern National Bancorp of Virginia, Inc. (NASDAQ:SONA) is the least popular one with only 7 bullish hedge fund positions. Compared to these stocks MasterCraft Boat Holdings, Inc. (NASDAQ:MCFT) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately MCFT wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on MCFT were disappointed as the stock returned -23.8% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market in Q3.

Disclosure: None. This article was originally published at Insider Monkey.