We at Insider Monkey have gone over 821 13F filings that hedge funds and prominent investors are required to file by the SEC The 13F filings show the funds’ and investors’ portfolio positions as of March 31st, near the height of the coronavirus market crash. In this article, we look at what those funds think of Houghton Mifflin Harcourt Co (NASDAQ:HMHC) based on that data.

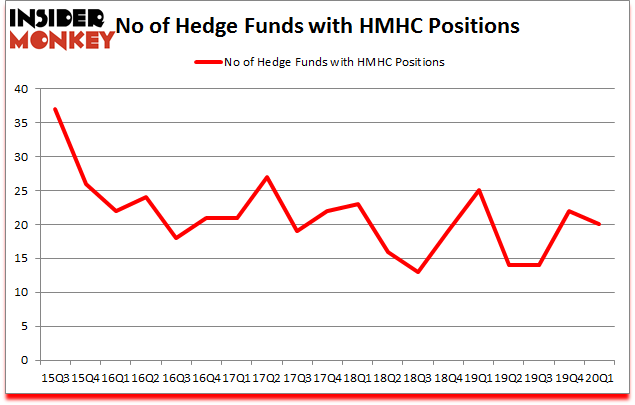

Houghton Mifflin Harcourt Co (NASDAQ:HMHC) was in 20 hedge funds’ portfolios at the end of the first quarter of 2020. HMHC has experienced a decrease in hedge fund interest of late. There were 22 hedge funds in our database with HMHC positions at the end of the previous quarter. Our calculations also showed that HMHC isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 101% since March 2017 and outperformed the S&P 500 ETFs by more than 58 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Noam Gottesman of GLG Partners

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We take a look at lists like the 10 most profitable companies in the world to identify the compounders that are likely to deliver double digit returns. We interview hedge fund managers and ask them about their best ideas. If you want to find out the best healthcare stock to buy right now, you can watch our latest hedge fund manager interview here. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when the S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. With all of this in mind we’re going to check out the recent hedge fund action surrounding Houghton Mifflin Harcourt Co (NASDAQ:HMHC).

How have hedgies been trading Houghton Mifflin Harcourt Co (NASDAQ:HMHC)?

At the end of the first quarter, a total of 20 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -9% from one quarter earlier. By comparison, 25 hedge funds held shares or bullish call options in HMHC a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Houghton Mifflin Harcourt Co (NASDAQ:HMHC) was held by Anchorage Advisors, which reported holding $36.6 million worth of stock at the end of September. It was followed by Water Street Capital with a $11.1 million position. Other investors bullish on the company included Freshford Capital Management, Corsair Capital Management, and Nishkama Capital. In terms of the portfolio weights assigned to each position Gratia Capital allocated the biggest weight to Houghton Mifflin Harcourt Co (NASDAQ:HMHC), around 5.47% of its 13F portfolio. Nishkama Capital is also relatively very bullish on the stock, setting aside 3.09 percent of its 13F equity portfolio to HMHC.

Because Houghton Mifflin Harcourt Co (NASDAQ:HMHC) has witnessed falling interest from hedge fund managers, logic holds that there exists a select few money managers who sold off their entire stakes by the end of the first quarter. Interestingly, Jon Bauer’s Contrarian Capital sold off the biggest position of all the hedgies monitored by Insider Monkey, worth about $3 million in stock, and Peter Algert and Kevin Coldiron’s Algert Coldiron Investors was right behind this move, as the fund sold off about $0.4 million worth. These bearish behaviors are interesting, as total hedge fund interest fell by 2 funds by the end of the first quarter.

Let’s check out hedge fund activity in other stocks similar to Houghton Mifflin Harcourt Co (NASDAQ:HMHC). We will take a look at PAR Technology Corporation (NYSE:PAR), RGC Resources, Inc. (NASDAQ:RGCO), Golar LNG Partners LP (NASDAQ:GMLP), and Sunlands Technology Group (NYSE:STG). This group of stocks’ market values are similar to HMHC’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PAR | 8 | 65546 | -4 |

| RGCO | 1 | 1820 | 0 |

| GMLP | 7 | 22587 | 0 |

| STG | 2 | 445 | 0 |

| Average | 4.5 | 22600 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 4.5 hedge funds with bullish positions and the average amount invested in these stocks was $23 million. That figure was $68 million in HMHC’s case. PAR Technology Corporation (NYSE:PAR) is the most popular stock in this table. On the other hand RGC Resources, Inc. (NASDAQ:RGCO) is the least popular one with only 1 bullish hedge fund positions. Compared to these stocks Houghton Mifflin Harcourt Co (NASDAQ:HMHC) is more popular among hedge funds. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 12.2% in 2020 through June 17th and still beat the market by 14.8 percentage points. Unfortunately HMHC wasn’t nearly as popular as these 10 stocks and hedge funds that were betting on HMHC were disappointed as the stock returned 5.9% during the second quarter (through June 17th) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 10 most popular stocks among hedge funds as most of these stocks already outperformed the market in 2020.

Follow Houghton Mifflin Harcourt Co (NASDAQ:HMHC)

Follow Houghton Mifflin Harcourt Co (NASDAQ:HMHC)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.