There are several ways to beat the market, and investing in small cap stocks has historically been one of them. We like to improve the odds of beating the market further by examining what famous hedge fund operators such as Carl Icahn and George Soros think. Those hedge fund operators make billions of dollars each year by hiring the best and the brightest to do research on stocks, including small cap stocks that big brokerage houses simply don’t cover. Because of Carl Icahn and other elite funds’ exemplary historical records, we pay attention to their small cap picks. In this article, we use hedge fund filing data to analyze Nomad Foods Limited (NYSE:NOMD).

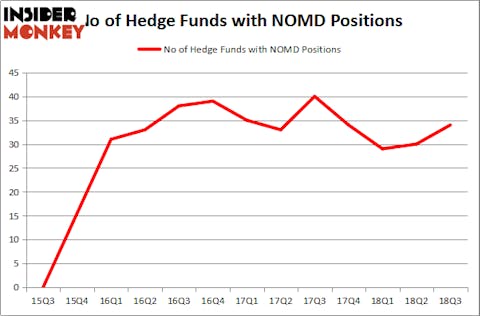

Nomad Foods Limited (NYSE:NOMD) was owned by 34 of the hedge funds tracked by our system on September 30, rising by 13% in Q3. That also represented the second consecutive quarter of net hedge fund buying after two quarters of selling. Jay Petschek and Steven Major’s Corsair Capital Management owned a $9.39 million position in NOMD at the end of September and likes how the company has diversified its product offerings through acquisitions.

“Nomad Foods (“NOMD”) rose 22% in the quarter as a “beat and raise” Q1 earnings report along with the continued execution of its accretive M&A strategy pushed the stock higher. In early Q2, NOMD announced strong Q1 results with organic growth of 2.9% and adjusted EPS growth of 40% year on year, resulting in management taking up the bottom end of its Fiscal Year 2018 guidance. Then, in early June, NOMD announced the acquisition of Aunt Bessie’s Ltd. for €240MM. Aunt Bessie’s is a leader in the UK frozen puddings and potatoes market, which will help diversify NOMD’s product and geographic exposure. The deal is expected to be immediately accretive and was financed with cash as well as a term loan that priced better than initially expected. In short, NOMD, which we had written up in our Q4 2016 letter, has succeeded in repositioning itself for above-market growth by redoubling its effort in its core categories and by executing on its frozen food M&A strategy. NOMD closed the quarter at $19.19,” Corsair Capital Management wrote in the fund’s Q2 investor letter.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 17.4% year to date and outperformed the market by more than 14 percentage points this year. This strategy also outperformed the market by 3 percentage points in the fourth quarter despite the market volatility (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Hedge fund activity in Nomad Foods Limited (NYSE:NOMD)

Heading into the fourth quarter of 2018, a total of 34 of the hedge funds tracked by Insider Monkey were bullish on this stock, a 13% increase from the second quarter of 2018. By comparison, the same amount of hedge funds held shares or bullish call options in NOMD heading into this year. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, GMT Capital held the most valuable stake in Nomad Foods Limited (NYSE:NOMD), which was worth $53.8 million at the end of the third quarter. On the second spot was Citadel Investment Group which amassed $33.6 million worth of shares. Moreover, Millennium Management, Wallace Capital Management, and Ancora Advisors were also bullish on Nomad Foods Limited (NYSE:NOMD), allocating a large percentage of their portfolios to this stock.

As one would reasonably expect, key money managers have jumped into Nomad Foods Limited (NYSE:NOMD) headfirst. Balyasny Asset Management, managed by Dmitry Balyasny, initiated the most outsized position in Nomad Foods Limited (NYSE:NOMD). Balyasny Asset Management had $7.6 million invested in the company at the end of the quarter. Paul Marshall and Ian Wace’s Marshall Wace LLP also initiated a $3.2 million position during the quarter. The following funds were also among the new NOMD investors: Robert B. Gillam’s McKinley Capital Management, Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital, and Matthew Hulsizer’s PEAK6 Capital Management.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Nomad Foods Limited (NYSE:NOMD) but similarly valued. These stocks are Energizer Holdings, Inc. (NYSE:ENR), Generac Holdings Inc. (NYSE:GNRC), PolyOne Corporation (NYSE:POL), and CNO Financial Group Inc (NYSE:CNO). This group of stocks’ market values resemble NOMD’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ENR | 26 | 271771 | 6 |

| GNRC | 24 | 167244 | 7 |

| POL | 15 | 58503 | 0 |

| CNO | 14 | 143832 | -3 |

As you can see these stocks had an average of 20 hedge funds with bullish positions and the average amount invested in these stocks was $160 million. That figure was $327 million in NOMD’s case. Energizer Holdings, Inc. (NYSE:ENR) is the most popular stock in this table. On the other hand CNO Financial Group Inc (NYSE:CNO) is the least popular one with only 14 bullish hedge fund positions. Compared to these stocks Nomad Foods Limited (NYSE:NOMD) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.