As we already know from media reports and hedge fund investor letters, hedge funds delivered their best returns in a decade. Most investors who decided to stick with hedge funds after a rough 2018 recouped their losses by the end of the second quarter. We get to see hedge funds’ thoughts towards the market and individual stocks by aggregating their quarterly portfolio movements and reading their investor letters. In this article, we will particularly take a look at what hedge funds think about Veoneer, Inc. (NYSE:VNE).

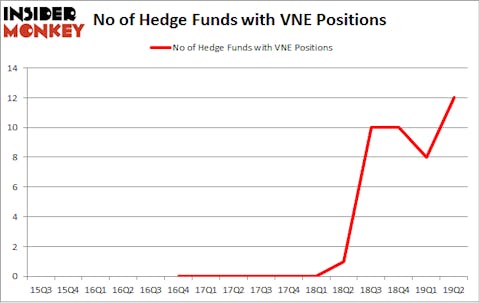

Is Veoneer, Inc. (NYSE:VNE) a buy here? The smart money is getting more bullish. The number of bullish hedge fund bets went up by 4 recently. Our calculations also showed that VNE isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s take a peek at the latest hedge fund action encompassing Veoneer, Inc. (NYSE:VNE).

What does smart money think about Veoneer, Inc. (NYSE:VNE)?

Heading into the third quarter of 2019, a total of 12 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 50% from the first quarter of 2019. The graph below displays the number of hedge funds with bullish position in VNE over the last 16 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Christer Gardell and Lars Forberg’s Cevian Capital has the number one position in Veoneer, Inc. (NYSE:VNE), worth close to $138.9 million, corresponding to 25.6% of its total 13F portfolio. Coming in second is Citadel Investment Group, managed by Ken Griffin, which holds a $42.8 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Some other hedge funds and institutional investors that hold long positions contain Israel Englander’s Millennium Management, Joseph Samuels’s Islet Management and Joshua Nash’s Ulysses Management.

As aggregate interest increased, some big names were breaking ground themselves. Islet Management, managed by Joseph Samuels, created the most valuable position in Veoneer, Inc. (NYSE:VNE). Islet Management had $6.5 million invested in the company at the end of the quarter. D. E. Shaw’s D E Shaw also made a $0.9 million investment in the stock during the quarter. The other funds with brand new VNE positions are OZ Management, Ken Griffin’s Citadel Investment Group, and Clint Carlson’s Carlson Capital.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Veoneer, Inc. (NYSE:VNE) but similarly valued. These stocks are Compass Minerals International, Inc. (NYSE:CMP), FGL Holdings (NYSE:FG), SPS Commerce, Inc. (NASDAQ:SPSC), and LivePerson, Inc. (NASDAQ:LPSN). This group of stocks’ market valuations resemble VNE’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CMP | 16 | 81209 | 3 |

| FG | 24 | 200982 | 1 |

| SPSC | 18 | 170860 | -1 |

| LPSN | 17 | 174378 | -4 |

| Average | 18.75 | 156857 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.75 hedge funds with bullish positions and the average amount invested in these stocks was $157 million. That figure was $204 million in VNE’s case. FGL Holdings (NYSE:FG) is the most popular stock in this table. On the other hand Compass Minerals International, Inc. (NYSE:CMP) is the least popular one with only 16 bullish hedge fund positions. Compared to these stocks Veoneer, Inc. (NYSE:VNE) is even less popular than CMP. Hedge funds dodged a bullet by taking a bearish stance towards VNE. Our calculations showed that the top 20 most popular hedge fund stocks returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately VNE wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); VNE investors were disappointed as the stock returned -13.4% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far in 2019.

Disclosure: None. This article was originally published at Insider Monkey.