We hate to say this but, we told you so. On February 27th we published an article with the title Recession is Imminent: We Need A Travel Ban NOW and predicted a US recession when the S&P 500 Index was trading at the 3150 level. We also told you to short the market and buy long-term Treasury bonds. Our article also called for a total international travel ban. While we were warning you, President Trump minimized the threat and failed to act promptly. As a result of his inaction, we will now experience a deeper recession.

In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. Although the masses and most of the financial media blame hedge funds for their exorbitant fee structure and disappointing performance, these investors have proved to have great stock picking abilities over the years (that’s why their assets under management continue to swell). We believe hedge fund sentiment should serve as a crucial tool of an individual investor’s stock selection process, as it may offer great insights of how the brightest minds of the finance industry feel about specific stocks. After all, these people have access to smartest analysts and expensive data/information sources that individual investors can’t match. So should one consider investing in Veeva Systems Inc (NYSE:VEEV)? The smart money sentiment can provide an answer to this question.

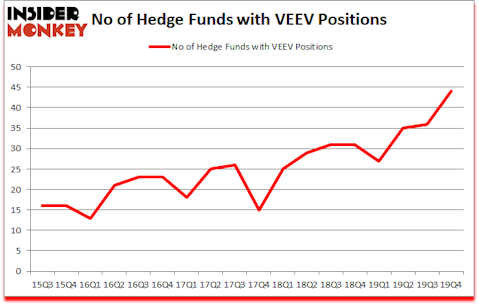

Veeva Systems Inc (NYSE:VEEV) investors should pay attention to an increase in hedge fund sentiment of late. Our calculations also showed that VEEV isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video below for Q3 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

At the moment there are dozens of gauges investors use to analyze their holdings. A pair of the less known gauges are hedge fund and insider trading interest. Our researchers have shown that, historically, those who follow the top picks of the elite fund managers can outpace the market by a solid margin (see the details here).

We leave no stone unturned when looking for the next great investment idea. For example we recently identified a stock that trades 25% below the net cash on its balance sheet. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences, and go through short-term trade recommendations like this one. We even check out the recommendations of services with hard to believe track records. Our best call in 2020 was shorting the market when S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. Keeping this in mind let’s take a gander at the new hedge fund action surrounding Veeva Systems Inc (NYSE:VEEV).

How have hedgies been trading Veeva Systems Inc (NYSE:VEEV)?

Heading into the first quarter of 2020, a total of 44 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 22% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards VEEV over the last 18 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Veeva Systems Inc (NYSE:VEEV) was held by Arrowstreet Capital, which reported holding $192.6 million worth of stock at the end of September. It was followed by Two Sigma Advisors with a $112 million position. Other investors bullish on the company included D E Shaw, Renaissance Technologies, and GLG Partners. In terms of the portfolio weights assigned to each position Diker Management allocated the biggest weight to Veeva Systems Inc (NYSE:VEEV), around 3.14% of its 13F portfolio. Navellier & Associates is also relatively very bullish on the stock, designating 2.19 percent of its 13F equity portfolio to VEEV.

As one would reasonably expect, key hedge funds were leading the bulls’ herd. PEAK6 Capital Management, managed by Matthew Hulsizer, assembled the most valuable position in Veeva Systems Inc (NYSE:VEEV). PEAK6 Capital Management had $9.8 million invested in the company at the end of the quarter. Mark Wolfson and Jamie Alexander’s Jasper Ridge Partners also initiated a $9.6 million position during the quarter. The other funds with brand new VEEV positions are Mark N. Diker’s Diker Management, Parvinder Thiara’s Athanor Capital, and Robert B. Gillam’s McKinley Capital Management.

Let’s also examine hedge fund activity in other stocks similar to Veeva Systems Inc (NYSE:VEEV). We will take a look at Brown-Forman Corporation (NYSE:BF), Nokia Corporation (NYSE:NOK), Skyworks Solutions Inc (NASDAQ:SWKS), and CDW Corporation (NASDAQ:CDW). This group of stocks’ market values are closest to VEEV’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BF | 23 | 609563 | 1 |

| NOK | 16 | 227900 | -8 |

| SWKS | 43 | 1178499 | 17 |

| CDW | 30 | 1085374 | 0 |

| Average | 28 | 775334 | 2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 28 hedge funds with bullish positions and the average amount invested in these stocks was $775 million. That figure was $766 million in VEEV’s case. Skyworks Solutions Inc (NASDAQ:SWKS) is the most popular stock in this table. On the other hand Nokia Corporation (NYSE:NOK) is the least popular one with only 16 bullish hedge fund positions. Compared to these stocks Veeva Systems Inc (NYSE:VEEV) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks lost 22.3% in 2020 through March 16th but still managed to beat the market by 3.2 percentage points. Hedge funds were also right about betting on VEEV as the stock returned -14% so far in Q1 (through March 16th) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.