Reputable billionaire investors such as Jim Simons, Cliff Asness and David Tepper generate exorbitant profits for their wealthy accredited investors (a minimum of $1 million in investable assets would be required to invest in a hedge fund and most successful hedge funds won’t accept your savings unless you commit at least $5 million) by pinpointing winning small-cap stocks. There is little or no publicly-available information at all on some of these small companies, which makes it hard for an individual investor to pin down a winner within the small-cap space. However, hedge funds and other big asset managers can do the due diligence and analysis for you instead, thanks to their highly-skilled research teams and vast resources to conduct an appropriate evaluation process. Looking for potential winners within the small-cap galaxy of stocks? We believe following the smart money is a good starting point.

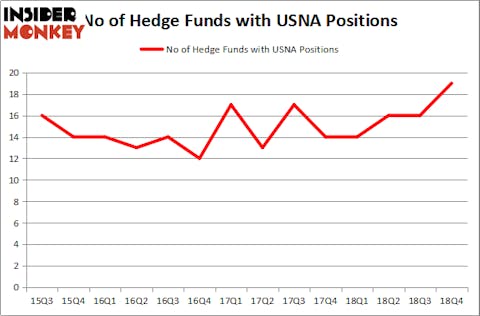

USANA Health Sciences, Inc. (NYSE:USNA) was in 19 hedge funds’ portfolios at the end of December. USNA investors should pay attention to an increase in hedge fund interest lately. There were 16 hedge funds in our database with USNA positions at the end of the previous quarter. Our calculations also showed that USNA isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s take a look at the key hedge fund action encompassing USANA Health Sciences, Inc. (NYSE:USNA).

How are hedge funds trading USANA Health Sciences, Inc. (NYSE:USNA)?

At the end of the fourth quarter, a total of 19 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 19% from the previous quarter. The graph below displays the number of hedge funds with bullish position in USNA over the last 14 quarters. With the smart money’s sentiment swirling, there exists a select group of notable hedge fund managers who were increasing their holdings substantially (or already accumulated large positions).

More specifically, Renaissance Technologies was the largest shareholder of USANA Health Sciences, Inc. (NYSE:USNA), with a stake worth $221.5 million reported as of the end of December. Trailing Renaissance Technologies was Arrowstreet Capital, which amassed a stake valued at $38.6 million. AQR Capital Management, Millennium Management, and D E Shaw were also very fond of the stock, giving the stock large weights in their portfolios.

Now, key hedge funds have jumped into USANA Health Sciences, Inc. (NYSE:USNA) headfirst. Weld Capital Management, managed by Minhua Zhang, created the most outsized position in USANA Health Sciences, Inc. (NYSE:USNA). Weld Capital Management had $1.2 million invested in the company at the end of the quarter. Brandon Haley’s Holocene Advisors also initiated a $0.3 million position during the quarter. The only other fund with a new position in the stock is Hoon Kim’s Quantinno Capital.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as USANA Health Sciences, Inc. (NYSE:USNA) but similarly valued. These stocks are Stamps.com Inc. (NASDAQ:STMP), LendingTree, Inc (NASDAQ:TREE), Bank of Hawaii Corporation (NYSE:BOH), and Eldorado Resorts Inc (NASDAQ:ERI). This group of stocks’ market values resemble USNA’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| STMP | 33 | 360166 | -5 |

| TREE | 21 | 73640 | 3 |

| BOH | 13 | 102340 | 1 |

| ERI | 29 | 492002 | 5 |

| Average | 24 | 257037 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24 hedge funds with bullish positions and the average amount invested in these stocks was $257 million. That figure was $360 million in USNA’s case. Stamps.com Inc. (NASDAQ:STMP) is the most popular stock in this table. On the other hand Bank of Hawaii Corporation (NYSE:BOH) is the least popular one with only 13 bullish hedge fund positions. USANA Health Sciences, Inc. (NYSE:USNA) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately USNA wasn’t nearly as popular as these 15 stock (hedge fund sentiment was quite bearish); USNA investors were disappointed as the stock returned -30.5% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.