Is UFP Technologies, Inc. (NASDAQ:UFPT) a good bet right now? We like to analyze hedge fund sentiment before doing days of in-depth research. We do so because hedge funds and other elite investors have numerous Ivy League graduates, expert network advisers, and supply chain tipsters working or consulting for them. There is not a shortage of news stories covering failed hedge fund investments and it is a fact that hedge funds’ picks don’t beat the market 100% of the time, but their consensus picks have historically done very well and have outperformed the market after adjusting for risk.

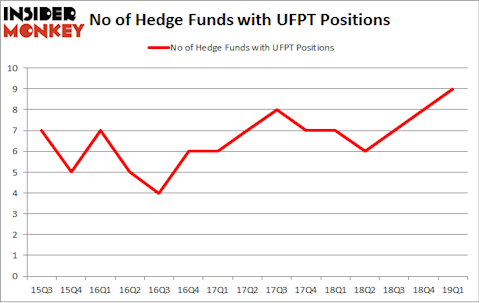

UFP Technologies, Inc. (NASDAQ:UFPT) shareholders have witnessed an increase in support from the world’s most elite money managers in recent months. Our calculations also showed that UFPT isn’t among the 30 most popular stocks among hedge funds.

Today there are tons of gauges market participants use to appraise their holdings. A pair of the best gauges are hedge fund and insider trading sentiment. Our researchers have shown that, historically, those who follow the top picks of the top money managers can outpace the S&P 500 by a very impressive amount (see the details here).

We’re going to check out the latest hedge fund action regarding UFP Technologies, Inc. (NASDAQ:UFPT).

What have hedge funds been doing with UFP Technologies, Inc. (NASDAQ:UFPT)?

At the end of the first quarter, a total of 9 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 13% from the fourth quarter of 2018. On the other hand, there were a total of 7 hedge funds with a bullish position in UFPT a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Cove Street Capital held the most valuable stake in UFP Technologies, Inc. (NASDAQ:UFPT), which was worth $26.9 million at the end of the first quarter. On the second spot was Renaissance Technologies which amassed $19.9 million worth of shares. Moreover, Ancora Advisors, Royce & Associates, and Huber Capital Management were also bullish on UFP Technologies, Inc. (NASDAQ:UFPT), allocating a large percentage of their portfolios to this stock.

With a general bullishness amongst the heavyweights, specific money managers were breaking ground themselves. Millennium Management, managed by Israel Englander, assembled the biggest position in UFP Technologies, Inc. (NASDAQ:UFPT). Millennium Management had $0.2 million invested in the company at the end of the quarter.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as UFP Technologies, Inc. (NASDAQ:UFPT) but similarly valued. These stocks are Calumet Specialty Products Partners, L.P (NASDAQ:CLMT), Telenav Inc (NASDAQ:TNAV), Alpha and Omega Semiconductor Ltd (NASDAQ:AOSL), and Digital Turbine Inc (NASDAQ:APPS). All of these stocks’ market caps resemble UFPT’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CLMT | 4 | 10140 | -1 |

| TNAV | 10 | 75691 | 1 |

| AOSL | 11 | 42571 | 0 |

| APPS | 15 | 17435 | 5 |

| Average | 10 | 36459 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10 hedge funds with bullish positions and the average amount invested in these stocks was $36 million. That figure was $69 million in UFPT’s case. Digital Turbine Inc (NASDAQ:APPS) is the most popular stock in this table. On the other hand Calumet Specialty Products Partners, L.P (NASDAQ:CLMT) is the least popular one with only 4 bullish hedge fund positions. UFP Technologies, Inc. (NASDAQ:UFPT) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. A small number of hedge funds were also right about betting on UFPT as the stock returned 6.9% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.