It seems that the masses and most of the financial media hate hedge funds and what they do, but why is this hatred of hedge funds so prominent? At the end of the day, these asset management firms do not gamble the hard-earned money of the people who are on the edge of poverty. Truth be told, most hedge fund managers and other smaller players within this industry are very smart and skilled investors. Of course, they may also make wrong bets in some instances, but no one knows what the future holds and how market participants will react to the bountiful news that floods in each day. The Standard and Poor’s 500 Index returned approximately 13.1% in the first 2.5 months of this year (including dividend payments). Conversely, hedge funds’ top 15 large-cap stock picks generated a return of 19.7% during the same 2.5-month period, with 93% of these stock picks outperforming the broader market benchmark. Coincidence? It might happen to be so, but it is unlikely. Our research covering the last 18 years indicates that hedge funds’ stock picks generate superior risk-adjusted returns. That’s why we believe it isn’t a waste of time to check out hedge fund sentiment before you invest in a stock like Tyler Technologies, Inc. (NYSE:TYL).

Is Tyler Technologies, Inc. (NYSE:TYL) an excellent investment today? Prominent investors are becoming more confident. The number of long hedge fund bets inched up by 2 in recent months. Overall hedge fund sentiment towards the stock is at its all time high. This is usually a bullish sign. For example hedge fund sentiment in Xilinx Inc. (XLNX) was also at its all time high at the beginning of this year and the stock returned more than 46% in 2.5 months. We observed similar performances from Twilio, MSCI and Progressive Corporation (PGR); these stocks returned 37%, 29% and 27% respectively. Hedge fund sentiment towards IQVIA Holdings Inc. (IQV), Brookfield Asset Management Inc. (BAM), Atlassian Corporation Plc (TEAM), RCL, MTB, VAR and CRH hit all time highs at the end of December, and all of these stocks returned more than 20% in the first 2.5 months of this year.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to take a gander at the recent hedge fund action encompassing Tyler Technologies, Inc. (NYSE:TYL).

How are hedge funds trading Tyler Technologies, Inc. (NYSE:TYL)?

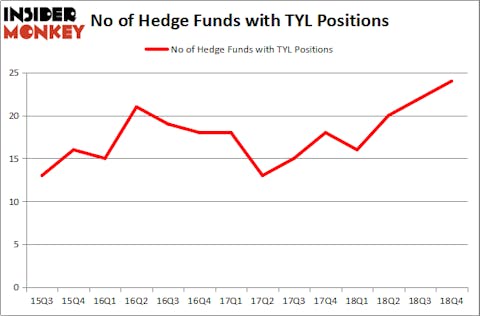

At Q4’s end, a total of 24 of the hedge funds tracked by Insider Monkey were long this stock, a change of 9% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards TYL over the last 14 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were boosting their stakes significantly (or already accumulated large positions).

More specifically, Stockbridge Partners was the largest shareholder of Tyler Technologies, Inc. (NYSE:TYL), with a stake worth $161.9 million reported as of the end of September. Trailing Stockbridge Partners was SQ Advisors, which amassed a stake valued at $150.4 million. Praesidium Investment Management Company, RGM Capital, and Two Creeks Capital Management were also very fond of the stock, giving the stock large weights in their portfolios.

Consequently, some big names have jumped into Tyler Technologies, Inc. (NYSE:TYL) headfirst. Waratah Capital Advisors, managed by Brad Dunkley and Blair Levinsky, established the largest position in Tyler Technologies, Inc. (NYSE:TYL). Waratah Capital Advisors had $21.7 million invested in the company at the end of the quarter. William Hyatt’s Hudson Way Capital Management also initiated a $6.9 million position during the quarter. The other funds with new positions in the stock are Jim Simons’s Renaissance Technologies, D. E. Shaw’s D E Shaw, and Matthew Hulsizer’s PEAK6 Capital Management.

Let’s also examine hedge fund activity in other stocks similar to Tyler Technologies, Inc. (NYSE:TYL). We will take a look at Micro Focus Intl PLC (NYSE:MFGP), SEI Investments Company (NASDAQ:SEIC), Paycom Software Inc (NYSE:PAYC), and Aramark (NYSE:ARMK). All of these stocks’ market caps are similar to TYL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MFGP | 8 | 9232 | -2 |

| SEIC | 25 | 287486 | 1 |

| PAYC | 19 | 148642 | -4 |

| ARMK | 39 | 907568 | 4 |

| Average | 22.75 | 338232 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22.75 hedge funds with bullish positions and the average amount invested in these stocks was $338 million. That figure was $714 million in TYL’s case. Aramark (NYSE:ARMK) is the most popular stock in this table. On the other hand Micro Focus Intl PLC (NYSE:MFGP) is the least popular one with only 8 bullish hedge fund positions. Tyler Technologies, Inc. (NYSE:TYL) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 15 most popular stocks among hedge funds returned 21.3% through April 8th and outperformed the S&P 500 ETF (SPY) by more than 5 percentage points. Unfortunately TYL wasn’t in this group. Hedge funds that bet on TYL were disappointed as the stock returned 13.1% and underperformed the market. If you are interested in investing in large cap stocks, you should check out the top 15 hedge fund stocks as 12 of these outperformed the market.

Disclosure: None. This article was originally published at Insider Monkey.