Investing in small cap stocks has historically been a way to outperform the market, as small cap companies typically grow faster on average than the blue chips. That outperformance comes with a price, however, as there are occasional periods of higher volatility. The last 12 months is one of those periods, as the Russell 2000 ETF (IWM) has underperformed the larger S&P 500 ETF (SPY) by more than 10 percentage points. Given that the funds we track tend to have a disproportionate amount of their portfolios in smaller cap stocks, they have seen some volatility in their portfolios too. Actually their moves are potentially one of the factors that contributed to this volatility. In this article, we use our extensive database of hedge fund holdings to find out what the smart money thinks of Tilray, Inc. (NASDAQ:TLRY).

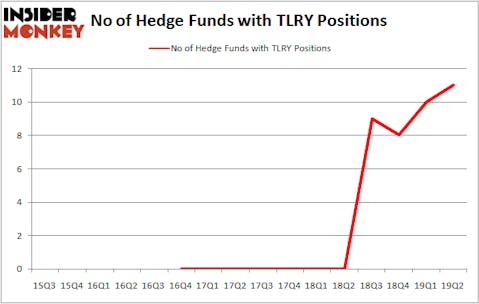

Is Tilray, Inc. (NASDAQ:TLRY) a healthy stock for your portfolio? The best stock pickers are getting more bullish. The number of long hedge fund bets inched up by 1 lately. Our calculations also showed that TLRY isn’t among the 30 most popular stocks among hedge funds (view the video below). TLRY was in 11 hedge funds’ portfolios at the end of the second quarter of 2019. There were 10 hedge funds in our database with TLRY positions at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Today there are a large number of tools investors employ to evaluate publicly traded companies. A couple of the most under-the-radar tools are hedge fund and insider trading moves. Our experts have shown that, historically, those who follow the best picks of the best fund managers can trounce their index-focused peers by a superb amount (see the details here).

We’re going to take a look at the new hedge fund action encompassing Tilray, Inc. (NASDAQ:TLRY).

How are hedge funds trading Tilray, Inc. (NASDAQ:TLRY)?

Heading into the third quarter of 2019, a total of 11 of the hedge funds tracked by Insider Monkey were long this stock, a change of 10% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards TLRY over the last 16 quarters. With the smart money’s capital changing hands, there exists an “upper tier” of noteworthy hedge fund managers who were adding to their stakes considerably (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Ken Griffin’s Citadel Investment Group has the largest call position in Tilray, Inc. (NASDAQ:TLRY), worth close to $44.7 million, corresponding to less than 0.1%% of its total 13F portfolio. The second most bullish fund manager is Shashin Shah of Think Investments, with a $7 million position; the fund has 2.4% of its 13F portfolio invested in the stock. Other peers with similar optimism comprise Noah Levy and Eugene Dozortsev’s Newtyn Management, Warren Lammert’s Granite Point Capital and William C. Martin’s Raging Capital Management.

Consequently, specific money managers were leading the bulls’ herd. Think Investments, managed by Shashin Shah, initiated the most valuable position in Tilray, Inc. (NASDAQ:TLRY). Think Investments had $7 million invested in the company at the end of the quarter. John Smith Clark’s Southpoint Capital Advisors also made a $1.6 million investment in the stock during the quarter. The following funds were also among the new TLRY investors: D. E. Shaw’s D E Shaw, Dmitry Balyasny’s Balyasny Asset Management, and Steve Cohen’s Point72 Asset Management.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Tilray, Inc. (NASDAQ:TLRY) but similarly valued. These stocks are Luckin Coffee Inc. (NASDAQ:LK), WPX Energy Inc (NYSE:WPX), Horizon Therapeutics Public Limited Company (NASDAQ:HZNP), and Air Lease Corp (NYSE:AL). All of these stocks’ market caps resemble TLRY’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LK | 31 | 378737 | 31 |

| WPX | 40 | 726310 | -2 |

| HZNP | 34 | 1221612 | -7 |

| AL | 18 | 320553 | -5 |

| Average | 30.75 | 661803 | 4.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 30.75 hedge funds with bullish positions and the average amount invested in these stocks was $662 million. That figure was $26 million in TLRY’s case. WPX Energy Inc (NYSE:WPX) is the most popular stock in this table. On the other hand Air Lease Corp (NYSE:AL) is the least popular one with only 18 bullish hedge fund positions. Compared to these stocks Tilray, Inc. (NASDAQ:TLRY) is even less popular than AL. Hedge funds dodged a bullet by taking a bearish stance towards TLRY. Our calculations showed that the top 20 most popular hedge fund stocks returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately TLRY wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); TLRY investors were disappointed as the stock returned -46.9% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far in 2019.

Disclosure: None. This article was originally published at Insider Monkey.