How do you pick the next stock to invest in? One way would be to spend days of research browsing through thousands of publicly traded companies. However, an easier way is to look at the stocks that smart money investors are collectively bullish on. Hedge funds and other institutional investors usually invest large amounts of capital and have to conduct due diligence while choosing their next pick. They don’t always get it right, but, on average, their stock picks historically generated strong returns after adjusting for known risk factors. With this in mind, let’s take a look at the recent hedge fund activity surrounding The Mosaic Company (NYSE:MOS).

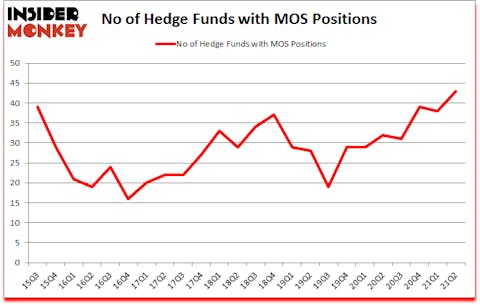

The Mosaic Company (NYSE:MOS) shareholders have witnessed an increase in activity from the world’s largest hedge funds in recent months. The Mosaic Company (NYSE:MOS) was in 43 hedge funds’ portfolios at the end of the second quarter of 2021. The all time high for this statistic was previously 39. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. There were 38 hedge funds in our database with MOS positions at the end of the first quarter. Our calculations also showed that MOS isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings).

In the 21st century investor’s toolkit there are tons of indicators shareholders put to use to value stocks. Some of the most underrated indicators are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best investment managers can outclass the S&P 500 by a healthy margin (see the details here). Also, our monthly newsletter’s portfolio of long stock picks returned 185.4% since March 2017 (through August 2021) and beat the S&P 500 Index by more than 79 percentage points. You can download a sample issue of this newsletter on our website .

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, artificial intelligence is one of the fastest-growing industries right now, so we are checking out stock pitches like this emerging AI stock. We go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. Now we’re going to check out the fresh hedge fund action encompassing The Mosaic Company (NYSE:MOS).

Do Hedge Funds Think MOS Is A Good Stock To Buy Now?

At second quarter’s end, a total of 43 of the hedge funds tracked by Insider Monkey were long this stock, a change of 13% from the first quarter of 2020. Below, you can check out the change in hedge fund sentiment towards MOS over the last 24 quarters. With the smart money’s sentiment swirling, there exists a select group of notable hedge fund managers who were adding to their stakes meaningfully (or already accumulated large positions).

Among these funds, Platinum Asset Management held the most valuable stake in The Mosaic Company (NYSE:MOS), which was worth $110.3 million at the end of the second quarter. On the second spot was Slate Path Capital which amassed $105.6 million worth of shares. Adage Capital Management, Appaloosa Management LP, and AQR Capital Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Brightline Capital allocated the biggest weight to The Mosaic Company (NYSE:MOS), around 8.81% of its 13F portfolio. Slate Path Capital is also relatively very bullish on the stock, setting aside 5.9 percent of its 13F equity portfolio to MOS.

As one would reasonably expect, some big names have been driving this bullishness. Point72 Asset Management, managed by Steve Cohen, initiated the most outsized call position in The Mosaic Company (NYSE:MOS). Point72 Asset Management had $25.5 million invested in the company at the end of the quarter. David Brown’s Hawk Ridge Management also made a $25 million investment in the stock during the quarter. The following funds were also among the new MOS investors: Simon Sadler’s Segantii Capital, Ryan Tolkin (CIO)’s Schonfeld Strategic Advisors, and Steve Cohen’s Point72 Asset Management.

Let’s check out hedge fund activity in other stocks similar to The Mosaic Company (NYSE:MOS). These stocks are Companhia Siderurgica Nacional (NYSE:SID), Snap-on Incorporated (NYSE:SNA), McAfee Corp. (NASDAQ:MCFE), Host Hotels and Resorts Inc (NASDAQ:HST), Williams-Sonoma, Inc. (NYSE:WSM), Weibo Corp (NASDAQ:WB), and Lincoln National Corporation (NYSE:LNC). This group of stocks’ market values resemble MOS’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SID | 12 | 71048 | 2 |

| SNA | 31 | 499550 | 13 |

| MCFE | 18 | 125600 | 1 |

| HST | 24 | 346526 | -1 |

| WSM | 34 | 803274 | 5 |

| WB | 14 | 128195 | 2 |

| LNC | 30 | 678736 | -6 |

| Average | 23.3 | 378990 | 2.3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23.3 hedge funds with bullish positions and the average amount invested in these stocks was $379 million. That figure was $809 million in MOS’s case. Williams-Sonoma, Inc. (NYSE:WSM) is the most popular stock in this table. On the other hand Companhia Siderurgica Nacional (NYSE:SID) is the least popular one with only 12 bullish hedge fund positions. Compared to these stocks The Mosaic Company (NYSE:MOS) is more popular among hedge funds. Our overall hedge fund sentiment score for MOS is 90. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks returned 22.9% in 2021 through October 1st but still managed to beat the market by 5.6 percentage points. Hedge funds were also right about betting on MOS as the stock returned 18.7% since the end of June (through 10/1) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Follow Mosaic Co (NYSE:MOS)

Follow Mosaic Co (NYSE:MOS)

Receive real-time insider trading and news alerts

Suggested Articles:

- 10 Best Affordable Dividend Stocks to Buy

- 15 Largest Beverage Companies by Market Cap

- 10 Best Oil Stocks to Buy Amid Post-COVID Demand Boom and Price Volatility

Disclosure: None. This article was originally published at Insider Monkey.