A market surge in the first quarter, spurred by easing global macroeconomic concerns and Powell’s pivot ended up having a positive impact on the markets and many hedge funds as a result. The stocks of smaller companies which were especially hard hit during the fourth quarter slightly outperformed the market during the first quarter. Unfortunately, Trump is unpredictable and volatility returned in the second quarter and smaller-cap stocks went back to selling off. We finished compiling the latest 13F filings to get an idea about what hedge funds are thinking about the overall market as well as individual stocks. In this article we will study the hedge fund sentiment to see how those concerns affected their ownership of The E.W. Scripps Company (NASDAQ:SSP) during the quarter.

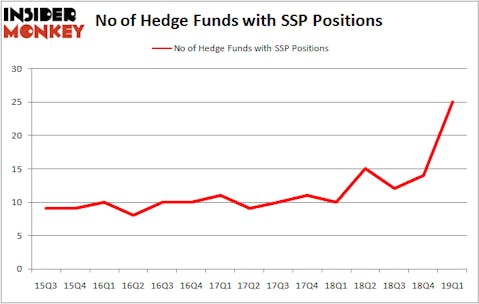

Is The E.W. Scripps Company (NASDAQ:SSP) a bargain? Hedge funds are in a bullish mood. The number of bullish hedge fund bets increased by 11 recently. Our calculations also showed that SSP isn’t among the 30 most popular stocks among hedge funds. SSP was in 25 hedge funds’ portfolios at the end of the first quarter of 2019. There were 14 hedge funds in our database with SSP positions at the end of the previous quarter.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to take a glance at the recent hedge fund action surrounding The E.W. Scripps Company (NASDAQ:SSP).

How have hedgies been trading The E.W. Scripps Company (NASDAQ:SSP)?

Heading into the second quarter of 2019, a total of 25 of the hedge funds tracked by Insider Monkey were long this stock, a change of 79% from the previous quarter. On the other hand, there were a total of 10 hedge funds with a bullish position in SSP a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, GAMCO Investors was the largest shareholder of The E.W. Scripps Company (NASDAQ:SSP), with a stake worth $138.7 million reported as of the end of March. Trailing GAMCO Investors was Cove Street Capital, which amassed a stake valued at $19.6 million. Minerva Advisors, Renaissance Technologies, and Millennium Management were also very fond of the stock, giving the stock large weights in their portfolios.

As one would reasonably expect, key money managers have been driving this bullishness. Minerva Advisors, managed by David P. Cohen, assembled the largest position in The E.W. Scripps Company (NASDAQ:SSP). Minerva Advisors had $13.1 million invested in the company at the end of the quarter. Jamie Zimmerman’s Litespeed Management also made a $9.2 million investment in the stock during the quarter. The other funds with brand new SSP positions are David Costen Haley’s HBK Investments, Paul Marshall and Ian Wace’s Marshall Wace LLP, and Minhua Zhang’s Weld Capital Management.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as The E.W. Scripps Company (NASDAQ:SSP) but similarly valued. We will take a look at Myovant Sciences Ltd. (NYSE:MYOV), Chesapeake Lodging Trust (NYSE:CHSP), Instructure, Inc. (NYSE:INST), and Kaiser Aluminum Corp. (NASDAQ:KALU). This group of stocks’ market valuations are similar to SSP’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MYOV | 6 | 125510 | 1 |

| CHSP | 12 | 23167 | 0 |

| INST | 24 | 454616 | 2 |

| KALU | 19 | 134499 | 5 |

| Average | 15.25 | 184448 | 2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.25 hedge funds with bullish positions and the average amount invested in these stocks was $184 million. That figure was $229 million in SSP’s case. Instructure, Inc. (NYSE:INST) is the most popular stock in this table. On the other hand Myovant Sciences Ltd. (NYSE:MYOV) is the least popular one with only 6 bullish hedge fund positions. Compared to these stocks The E.W. Scripps Company (NASDAQ:SSP) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately SSP wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on SSP were disappointed as the stock returned -25.9% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market in Q2.

Disclosure: None. This article was originally published at Insider Monkey.