Coronavirus is probably the #1 concern in investors’ minds right now. It should be. We estimate that COVID-19 will kill around 5 million people worldwide and there is a 3.3% probability that Donald Trump will die from the new coronavirus (read the details). In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. The 800+ hedge funds and famous money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the fourth quarter, which unveil their equity positions as of December 31. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund portfolios. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards The Charles Schwab Corporation (NYSE:SCHW).

The Charles Schwab Corporation (NYSE:SCHW) has seen an increase in activity from the world’s largest hedge funds recently. Our calculations also showed that SCHW isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video below for Q3 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 72.9% since March 2017 and outperformed the S&P 500 ETFs by more than 41 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Ricky Sandler of Eminence Capital

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences, and and go through short-term trade recommendations like this one. We even check out the recommendations of services with hard to believe track records. In January, we recommended a long position in one of the most shorted stocks in the market, and that stock returned more than 50% despite the large losses in the market since our recommendation. With all of this in mind let’s analyze the recent hedge fund action regarding The Charles Schwab Corporation (NYSE:SCHW).

How are hedge funds trading The Charles Schwab Corporation (NYSE:SCHW)?

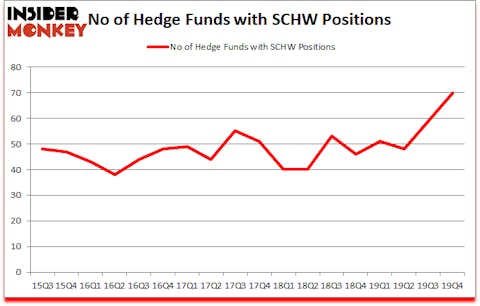

Heading into the first quarter of 2020, a total of 70 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 19% from the third quarter of 2019. The graph below displays the number of hedge funds with bullish position in SCHW over the last 18 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists a select group of notable hedge fund managers who were upping their stakes meaningfully (or already accumulated large positions).

More specifically, Generation Investment Management was the largest shareholder of The Charles Schwab Corporation (NYSE:SCHW), with a stake worth $1414.4 million reported as of the end of September. Trailing Generation Investment Management was Route One Investment Company, which amassed a stake valued at $637 million. Eminence Capital, Diamond Hill Capital, and Citadel Investment Group were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Route One Investment Company allocated the biggest weight to The Charles Schwab Corporation (NYSE:SCHW), around 17.99% of its 13F portfolio. Triple Frond Partners is also relatively very bullish on the stock, designating 10.85 percent of its 13F equity portfolio to SCHW.

Consequently, key money managers have been driving this bullishness. Third Point, managed by Dan Loeb, established the most valuable position in The Charles Schwab Corporation (NYSE:SCHW). Third Point had $47.6 million invested in the company at the end of the quarter. Ravi Chopra’s Azora Capital also made a $46.2 million investment in the stock during the quarter. The other funds with brand new SCHW positions are Zach Schreiber’s Point State Capital, Renaissance Technologies, and Richard Merage’s MIG Capital.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as The Charles Schwab Corporation (NYSE:SCHW) but similarly valued. These stocks are Brookfield Asset Management Inc. (NYSE:BAM), Micron Technology, Inc. (NASDAQ:MU), Westpac Banking Corporation (NYSE:WBK), and Crown Castle International Corp. (NYSE:CCI). This group of stocks’ market caps resemble SCHW’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BAM | 34 | 1282206 | 2 |

| MU | 89 | 4565616 | 17 |

| WBK | 7 | 49339 | 3 |

| CCI | 38 | 1723851 | -3 |

| Average | 42 | 1905253 | 4.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 42 hedge funds with bullish positions and the average amount invested in these stocks was $1905 million. That figure was $4021 million in SCHW’s case. Micron Technology, Inc. (NASDAQ:MU) is the most popular stock in this table. On the other hand Westpac Banking Corporation (NYSE:WBK) is the least popular one with only 7 bullish hedge fund positions. The Charles Schwab Corporation (NYSE:SCHW) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks also gained 0.1% in 2020 through March 2nd and beat the market by 4.1 percentage points. Unfortunately SCHW wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on SCHW were disappointed as the stock returned -11.4% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Disclosure: None. This article was originally published at Insider Monkey.