Hedge funds are not perfect. They have their bad picks just like everyone else. Facebook, a stock hedge funds have loved dearly, lost nearly 40% of its value at one point in 2018. Although hedge funds are not perfect, their consensus picks do deliver solid returns, however. Our data show the top 20 S&P 500 stocks among hedge funds beat the S&P 500 Index by more than 6 percentage points so far in 2019. Because hedge funds have a lot of resources and their consensus picks do well, we pay attention to what they think. In this article, we analyze what the elite funds think of Tactile Systems Technology, Inc. (NASDAQ:TCMD).

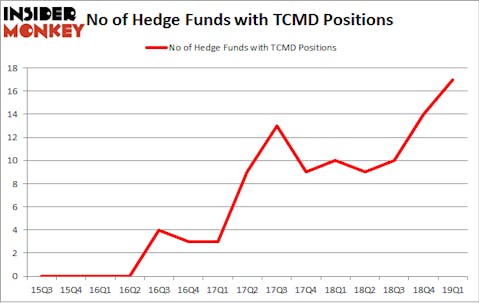

Is Tactile Systems Technology, Inc. (NASDAQ:TCMD) a bargain? Money managers are becoming hopeful. The number of bullish hedge fund bets improved by 3 lately. Our calculations also showed that tcmd isn’t among the 30 most popular stocks among hedge funds. TCMD was in 17 hedge funds’ portfolios at the end of the first quarter of 2019. There were 14 hedge funds in our database with TCMD positions at the end of the previous quarter.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Paul Marshall of Marshall Wace

We’re going to go over the fresh hedge fund action regarding Tactile Systems Technology, Inc. (NASDAQ:TCMD).

Hedge fund activity in Tactile Systems Technology, Inc. (NASDAQ:TCMD)

At the end of the first quarter, a total of 17 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 21% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards TCMD over the last 15 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Paul Marshall and Ian Wace’s Marshall Wace LLP has the biggest position in Tactile Systems Technology, Inc. (NASDAQ:TCMD), worth close to $17.4 million, comprising 0.2% of its total 13F portfolio. On Marshall Wace LLP’s heels is Richard Driehaus of Driehaus Capital, with a $16.7 million position; the fund has 0.6% of its 13F portfolio invested in the stock. Remaining hedge funds and institutional investors with similar optimism consist of D. E. Shaw’s D E Shaw, Ken Griffin’s Citadel Investment Group and Jim Simons’s Renaissance Technologies.

Now, key money managers were breaking ground themselves. PEAK6 Capital Management, managed by Matthew Hulsizer, assembled the largest call position in Tactile Systems Technology, Inc. (NASDAQ:TCMD). PEAK6 Capital Management had $3.7 million invested in the company at the end of the quarter. Matthew Hulsizer’s PEAK6 Capital Management also initiated a $0.8 million position during the quarter. The other funds with new positions in the stock are Paul Tudor Jones’s Tudor Investment Corp, Israel Englander’s Millennium Management, and John Overdeck and David Siegel’s Two Sigma Advisors.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Tactile Systems Technology, Inc. (NASDAQ:TCMD) but similarly valued. We will take a look at Intersect ENT Inc (NASDAQ:XENT), Atkore International Group Inc. (NYSE:ATKR), Carbon Black, Inc. (NASDAQ:CBLK), and Epizyme Inc (NASDAQ:EPZM). This group of stocks’ market caps match TCMD’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| XENT | 23 | 263913 | 3 |

| ATKR | 19 | 104262 | 2 |

| CBLK | 19 | 59849 | 2 |

| EPZM | 19 | 353318 | 1 |

| Average | 20 | 195336 | 2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20 hedge funds with bullish positions and the average amount invested in these stocks was $195 million. That figure was $80 million in TCMD’s case. Intersect ENT Inc (NASDAQ:XENT) is the most popular stock in this table. On the other hand Atkore International Group Inc. (NYSE:ATKR) is the least popular one with only 19 bullish hedge fund positions. Compared to these stocks Tactile Systems Technology, Inc. (NASDAQ:TCMD) is even less popular than ATKR. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. A small number of hedge funds were also right about betting on TCMD, though not to the same extent, as the stock returned 6% during the same time frame and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.