As we already know from media reports and hedge fund investor letters, hedge funds delivered their best returns in a decade. Most investors who decided to stick with hedge funds after a rough 2018 recouped their losses by the end of the third quarter. We get to see hedge funds’ thoughts towards the market and individual stocks by aggregating their quarterly portfolio movements and reading their investor letters. In this article, we will particularly take a look at what hedge funds think about SYNNEX Corporation (NYSE:SNX).

SYNNEX Corporation (NYSE:SNX) has experienced an increase in support from the world’s most elite money managers in recent months. Our calculations also showed that SNX isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the eyes of most stock holders, hedge funds are viewed as worthless, outdated financial tools of the past. While there are over 8000 funds with their doors open at the moment, Our researchers hone in on the masters of this club, about 750 funds. It is estimated that this group of investors watch over the lion’s share of all hedge funds’ total asset base, and by following their finest stock picks, Insider Monkey has identified several investment strategies that have historically outrun the market. Insider Monkey’s flagship short hedge fund strategy outrun the S&P 500 short ETFs by around 20 percentage points annually since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Matthew Hulsizer of PEAK6 Capital

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. Let’s view the latest hedge fund action surrounding SYNNEX Corporation (NYSE:SNX).

How are hedge funds trading SYNNEX Corporation (NYSE:SNX)?

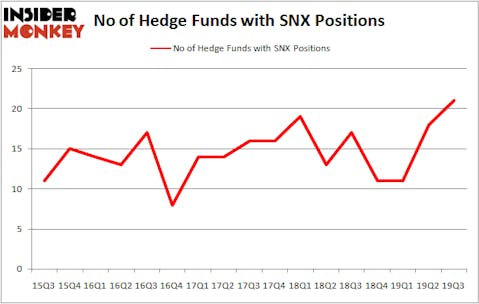

Heading into the fourth quarter of 2019, a total of 21 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 17% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards SNX over the last 17 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were upping their holdings meaningfully (or already accumulated large positions).

The largest stake in SYNNEX Corporation (NYSE:SNX) was held by Citadel Investment Group, which reported holding $99.6 million worth of stock at the end of September. It was followed by Renaissance Technologies with a $35.1 million position. Other investors bullish on the company included Millennium Management, Alyeska Investment Group, and AQR Capital Management. In terms of the portfolio weights assigned to each position Brant Point Investment Management allocated the biggest weight to SYNNEX Corporation (NYSE:SNX), around 0.54% of its 13F portfolio. Zebra Capital Management is also relatively very bullish on the stock, setting aside 0.36 percent of its 13F equity portfolio to SNX.

With a general bullishness amongst the heavyweights, key money managers were breaking ground themselves. Marshall Wace, managed by Paul Marshall and Ian Wace, assembled the most valuable position in SYNNEX Corporation (NYSE:SNX). Marshall Wace had $9.1 million invested in the company at the end of the quarter. Matthew Hulsizer’s PEAK6 Capital Management also initiated a $4.1 million position during the quarter. The other funds with brand new SNX positions are Ira Unschuld’s Brant Point Investment Management, John Overdeck and David Siegel’s Two Sigma Advisors, and Mike Vranos’s Ellington.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as SYNNEX Corporation (NYSE:SNX) but similarly valued. We will take a look at AGCO Corporation (NYSE:AGCO), Kinross Gold Corporation (NYSE:KGC), Toll Brothers Inc (NYSE:TOL), and CACI International Inc (NYSE:CACI). This group of stocks’ market valuations match SNX’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AGCO | 24 | 243089 | -1 |

| KGC | 26 | 436214 | 8 |

| TOL | 22 | 483101 | 2 |

| CACI | 25 | 522212 | -4 |

| Average | 24.25 | 421154 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24.25 hedge funds with bullish positions and the average amount invested in these stocks was $421 million. That figure was $225 million in SNX’s case. Kinross Gold Corporation (NYSE:KGC) is the most popular stock in this table. On the other hand Toll Brothers Inc (NYSE:TOL) is the least popular one with only 22 bullish hedge fund positions. Compared to these stocks SYNNEX Corporation (NYSE:SNX) is even less popular than TOL. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. A small number of hedge funds were also right about betting on SNX, though not to the same extent, as the stock returned 9.1% during the fourth quarter (through 11/30) and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.