“Since 2006, value stocks (IVE vs IVW) have underperformed 11 of the 13 calendar years and when they beat growth, it wasn’t by much. Cumulatively, through this week, it has been a 122% differential (up 52% for value vs up 174% for growth). This appears to be the longest and most severe drought for value investors since data collection began. It will go our way eventually as there are too many people paying far too much for today’s darlings, both public and private. Further, the ten-year yield of 2.5% (pre-tax) isn’t attractive nor is real estate. We believe the value part of the global equity market is the only place to earn solid risk adjusted returns and we believe those returns will be higher than normal,” said Vilas Fund in its Q1 investor letter. We aren’t sure whether value stocks outperform growth, but we follow hedge fund investor letters to understand where the markets and stocks might be going. This article will lay out and discuss the hedge fund and institutional investor sentiment towards Stitch Fix, Inc. (NASDAQ:SFIX).

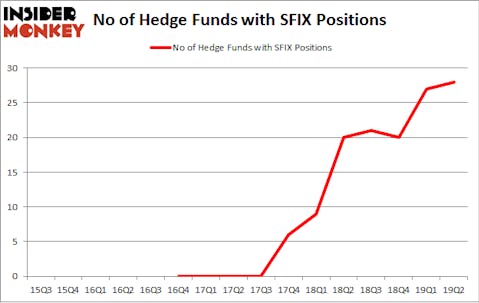

Stitch Fix, Inc. (NASDAQ:SFIX) was in 28 hedge funds’ portfolios at the end of June. SFIX shareholders have witnessed an increase in hedge fund interest recently. There were 27 hedge funds in our database with SFIX positions at the end of the previous quarter. Our calculations also showed that SFIX isn’t among the 30 most popular stocks among hedge funds (view the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

According to most stock holders, hedge funds are assumed to be underperforming, outdated financial tools of years past. While there are greater than 8000 funds in operation at present, Our experts choose to focus on the elite of this group, around 750 funds. These investment experts command most of the hedge fund industry’s total asset base, and by keeping track of their unrivaled stock picks, Insider Monkey has come up with various investment strategies that have historically defeated the S&P 500 index. Insider Monkey’s flagship hedge fund strategy beat the S&P 500 index by around 5 percentage points a year since its inception in May 2014. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 25.7% since February 2017 (through September 30th) even though the market was up more than 33% during the same period. We just shared a list of 10 short targets in our latest quarterly update .

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s check out the new hedge fund action surrounding Stitch Fix, Inc. (NASDAQ:SFIX).

How have hedgies been trading Stitch Fix, Inc. (NASDAQ:SFIX)?

At the end of the second quarter, a total of 28 of the hedge funds tracked by Insider Monkey were long this stock, a change of 4% from the previous quarter. By comparison, 20 hedge funds held shares or bullish call options in SFIX a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Steadfast Capital Management was the largest shareholder of Stitch Fix, Inc. (NASDAQ:SFIX), with a stake worth $71.5 million reported as of the end of March. Trailing Steadfast Capital Management was Park West Asset Management, which amassed a stake valued at $30.4 million. Miller Value Partners, Woodson Capital Management, and Two Sigma Advisors were also very fond of the stock, giving the stock large weights in their portfolios.

As one would reasonably expect, some big names have been driving this bullishness. Miller Value Partners, managed by Bill Miller, initiated the largest position in Stitch Fix, Inc. (NASDAQ:SFIX). Miller Value Partners had $28 million invested in the company at the end of the quarter. James Woodson Davis’s Woodson Capital Management also initiated a $25.9 million position during the quarter. The other funds with new positions in the stock are Bijan Modanlou, Joseph Bou-Saba, and Jayaveera Kodali’s Alta Park Capital, Principal Global Investors’s Columbus Circle Investors, and Dipak Patel’s Alight Capital.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Stitch Fix, Inc. (NASDAQ:SFIX) but similarly valued. We will take a look at Fox Factory Holding Corp (NASDAQ:FOXF), The Descartes Systems Group Inc (NASDAQ:DSGX), Black Stone Minerals LP (NYSE:BSM), and Neogen Corporation (NASDAQ:NEOG). This group of stocks’ market values match SFIX’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FOXF | 11 | 28084 | -3 |

| DSGX | 11 | 121216 | 1 |

| BSM | 7 | 11439 | 2 |

| NEOG | 12 | 28955 | 0 |

| Average | 10.25 | 47424 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10.25 hedge funds with bullish positions and the average amount invested in these stocks was $47 million. That figure was $262 million in SFIX’s case. Neogen Corporation (NASDAQ:NEOG) is the most popular stock in this table. On the other hand Black Stone Minerals LP (NYSE:BSM) is the least popular one with only 7 bullish hedge fund positions. Compared to these stocks Stitch Fix, Inc. (NASDAQ:SFIX) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately SFIX wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on SFIX were disappointed as the stock returned -39.8% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market in Q3.

Disclosure: None. This article was originally published at Insider Monkey.