Coronavirus is probably the #1 concern in investors’ minds right now. It should be. On February 27th we publish an article with the title “Recession is Imminent: We Need A Travel Ban NOW”. We predicted that a US recession is imminent and US stocks will go down by at least 20% in the next 3-6 months. We also told you to short the market ETFs and buy long-term bonds. Investors who agreed with us and replicated these trades are up double digits whereas the market is down double digits. Our article also called for a total international travel ban to prevent the spread of the coronavirus especially from Europe. We were one step ahead of the markets and the president.

Does Stanley Black & Decker, Inc. (NYSE:SWK) represent a good buying opportunity at the moment? Let’s quickly check the hedge fund interest towards the company. Hedge fund firms constantly search out bright intellectuals and highly-experienced employees and throw away millions of dollars on satellite photos and other research activities, so it is no wonder why they tend to generate millions in profits each year. It is also true that some hedge fund players fail inconceivably on some occasions, but net net their stock picks have been generating superior risk-adjusted returns on average over the years.

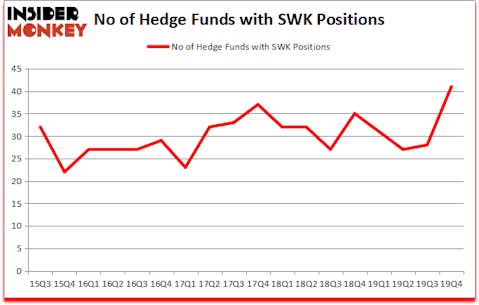

Is Stanley Black & Decker, Inc. (NYSE:SWK) ready to rally soon? Prominent investors are getting more bullish. The number of bullish hedge fund positions inched up by 13 in recent months. Our calculations also showed that SWK isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video below for Q3 rankings). SWK was in 41 hedge funds’ portfolios at the end of the fourth quarter of 2019. There were 28 hedge funds in our database with SWK holdings at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the eyes of most shareholders, hedge funds are assumed to be underperforming, old investment tools of the past. While there are more than 8000 funds in operation today, We choose to focus on the leaders of this group, around 850 funds. These money managers command the lion’s share of the smart money’s total asset base, and by paying attention to their top equity investments, Insider Monkey has unearthed numerous investment strategies that have historically beaten Mr. Market. Insider Monkey’s flagship short hedge fund strategy defeated the S&P 500 short ETFs by around 20 percentage points annually since its inception in March 2017. Our portfolio of short stocks lost 35.3% since February 2017 (through March 3rd) even though the market was up more than 35% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Richard S. Pzena of Pzena Investment Management

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences, and and go through short-term trade recommendations like this one. We even check out the recommendations of services with hard to believe track records. In January, we recommended a long position in one of the most shorted stocks in the market, and that stock returned more than 50% despite the large losses in the market since our recommendation. Keeping this in mind we’re going to go over the key hedge fund action regarding Stanley Black & Decker, Inc. (NYSE:SWK).

What have hedge funds been doing with Stanley Black & Decker, Inc. (NYSE:SWK)?

Heading into the first quarter of 2020, a total of 41 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 46% from the third quarter of 2019. On the other hand, there were a total of 35 hedge funds with a bullish position in SWK a year ago. With hedgies’ capital changing hands, there exists an “upper tier” of notable hedge fund managers who were upping their holdings meaningfully (or already accumulated large positions).

More specifically, Citadel Investment Group was the largest shareholder of Stanley Black & Decker, Inc. (NYSE:SWK), with a stake worth $498.5 million reported as of the end of September. Trailing Citadel Investment Group was Pzena Investment Management, which amassed a stake valued at $376 million. Millennium Management, Ariel Investments, and Holocene Advisors were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Appian Way Asset Management allocated the biggest weight to Stanley Black & Decker, Inc. (NYSE:SWK), around 5.19% of its 13F portfolio. Albar Capital is also relatively very bullish on the stock, setting aside 4.87 percent of its 13F equity portfolio to SWK.

As one would reasonably expect, key money managers were breaking ground themselves. Scopus Asset Management, managed by Alexander Mitchell, created the most outsized position in Stanley Black & Decker, Inc. (NYSE:SWK). Scopus Asset Management had $30.4 million invested in the company at the end of the quarter. Robert Pohly’s Samlyn Capital also made a $27.3 million investment in the stock during the quarter. The other funds with brand new SWK positions are Gregg Moskowitz’s Interval Partners, Donald Sussman’s Paloma Partners, and Javier Velazquez’s Albar Capital.

Let’s now review hedge fund activity in other stocks similar to Stanley Black & Decker, Inc. (NYSE:SWK). We will take a look at Pioneer Natural Resources Company (NYSE:PXD), Microchip Technology Incorporated (NASDAQ:MCHP), Digital Realty Trust, Inc. (NYSE:DLR), and FleetCor Technologies, Inc. (NYSE:FLT). This group of stocks’ market valuations are similar to SWK’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PXD | 53 | 1070714 | 3 |

| MCHP | 46 | 1428178 | 14 |

| DLR | 26 | 175397 | 7 |

| FLT | 44 | 2121544 | -1 |

| Average | 42.25 | 1198958 | 5.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 42.25 hedge funds with bullish positions and the average amount invested in these stocks was $1199 million. That figure was $1599 million in SWK’s case. Pioneer Natural Resources Company (NYSE:PXD) is the most popular stock in this table. On the other hand Digital Realty Trust, Inc. (NYSE:DLR) is the least popular one with only 26 bullish hedge fund positions. Stanley Black & Decker, Inc. (NYSE:SWK) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks lost 12.9% in 2020 through March 9th but beat the market by 1.9 percentage points. Unfortunately SWK wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); SWK investors were disappointed as the stock returned -27.2% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as most of these stocks already outperformed the market in Q1.

Disclosure: None. This article was originally published at Insider Monkey.