A whopping number of 13F filings filed with U.S. Securities and Exchange Commission has been processed by Insider Monkey so that individual investors can look at the overall hedge fund sentiment towards the stocks included in their watchlists. These freshly-submitted public filings disclose money managers’ equity positions as of the end of the three-month period that ended June 28, so let’s proceed with the discussion of the hedge fund sentiment on Spark Therapeutics Inc (NASDAQ:ONCE).

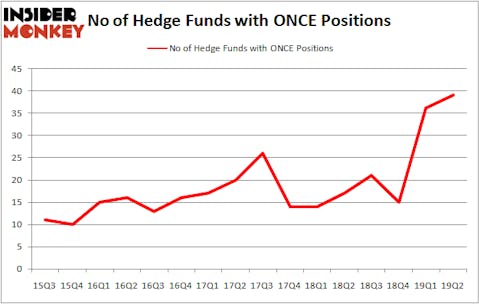

Spark Therapeutics Inc (NASDAQ:ONCE) was in 39 hedge funds’ portfolios at the end of June. ONCE investors should pay attention to an increase in hedge fund interest lately. There were 36 hedge funds in our database with ONCE positions at the end of the previous quarter. Our calculations also showed that ONCE isn’t among the 30 most popular stocks among hedge funds (view the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the eyes of most stock holders, hedge funds are perceived as worthless, old financial tools of the past. While there are greater than 8000 funds with their doors open today, We choose to focus on the aristocrats of this group, approximately 750 funds. It is estimated that this group of investors handle bulk of all hedge funds’ total asset base, and by shadowing their best investments, Insider Monkey has determined a few investment strategies that have historically beaten the S&P 500 index. Insider Monkey’s flagship hedge fund strategy beat the S&P 500 index by around 5 percentage points a year since its inception in May 2014. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 25.7% since February 2017 (through September 30th) even though the market was up more than 33% during the same period. We just shared a list of 10 short targets in our latest quarterly update .

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s analyze the latest hedge fund action surrounding Spark Therapeutics Inc (NASDAQ:ONCE).

What does smart money think about Spark Therapeutics Inc (NASDAQ:ONCE)?

At Q2’s end, a total of 39 of the hedge funds tracked by Insider Monkey were long this stock, a change of 8% from the first quarter of 2019. Below, you can check out the change in hedge fund sentiment towards ONCE over the last 16 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Magnetar Capital was the largest shareholder of Spark Therapeutics Inc (NASDAQ:ONCE), with a stake worth $90.6 million reported as of the end of March. Trailing Magnetar Capital was Casdin Capital, which amassed a stake valued at $90.6 million. Alpine Associates, Pentwater Capital Management, and Paulson & Co were also very fond of the stock, giving the stock large weights in their portfolios.

Now, key hedge funds were breaking ground themselves. Pentwater Capital Management, managed by Matthew Halbower, established the biggest position in Spark Therapeutics Inc (NASDAQ:ONCE). Pentwater Capital Management had $79.9 million invested in the company at the end of the quarter. John Paulson’s Paulson & Co also made a $77.6 million investment in the stock during the quarter. The following funds were also among the new ONCE investors: Carl Tiedemann and Michael Tiedemann’s TIG Advisors, Renaissance Technologies, and Joseph Edelman’s Perceptive Advisors.

Let’s go over hedge fund activity in other stocks similar to Spark Therapeutics Inc (NASDAQ:ONCE). These stocks are John Bean Technologies Corporation (NYSE:JBT), Mercury Systems Inc (NASDAQ:MRCY), Lazard Ltd (NYSE:LAZ), and RLI Corp. (NYSE:RLI). All of these stocks’ market caps resemble ONCE’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| JBT | 10 | 101572 | 1 |

| MRCY | 21 | 111111 | 6 |

| LAZ | 16 | 589512 | 0 |

| RLI | 15 | 172039 | 2 |

| Average | 15.5 | 243559 | 2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.5 hedge funds with bullish positions and the average amount invested in these stocks was $244 million. That figure was $1284 million in ONCE’s case. Mercury Systems Inc (NASDAQ:MRCY) is the most popular stock in this table. On the other hand John Bean Technologies Corporation (NYSE:JBT) is the least popular one with only 10 bullish hedge fund positions. Compared to these stocks Spark Therapeutics Inc (NASDAQ:ONCE) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately ONCE wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on ONCE were disappointed as the stock returned -5.3% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market in Q3.

Disclosure: None. This article was originally published at Insider Monkey.