Coronavirus is probably the #1 concern in investors’ minds right now. It should be. We estimate that COVID-19 will kill around 5 million people worldwide and there is a 3.3% probability that Donald Trump will die from the new coronavirus (read the details). In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. Our extensive research has shown that imitating the smart money can generate significant returns for retail investors, which is why we track nearly 835 active prominent money managers and analyze their quarterly 13F filings. The stocks that are heavily bought by hedge funds historically outperformed the market, though there is no shortage of high profile failures like hedge funds’ 2018 losses in Facebook and Apple. Let’s take a closer look at what the funds we track think about S&P Global Inc. (NYSE:SPGI) in this article.

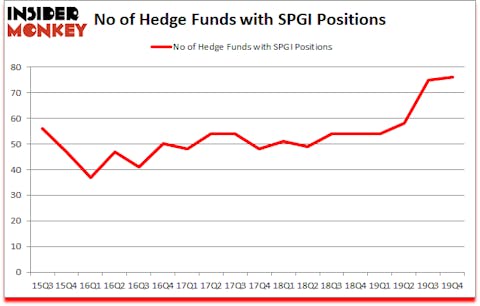

S&P Global Inc. (NYSE:SPGI) has experienced an increase in enthusiasm from smart money of late. Our calculations also showed that SPGI isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video below for Q3 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 72.9% since March 2017 and outperformed the S&P 500 ETFs by more than 41 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

William Von Mueffling of Cantillon Capital Management

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences, and and go through short-term trade recommendations like this one. We even check out the recommendations of services with hard to believe track records. In January, we recommended a long position in one of the most shorted stocks in the market, and that stock returned more than 50% despite the large losses in the market since our recommendation. Keeping this in mind let’s take a look at the new hedge fund action surrounding S&P Global Inc. (NYSE:SPGI).

What does smart money think about S&P Global Inc. (NYSE:SPGI)?

At Q4’s end, a total of 76 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 1% from the previous quarter. On the other hand, there were a total of 54 hedge funds with a bullish position in SPGI a year ago. With hedge funds’ sentiment swirling, there exists a select group of key hedge fund managers who were increasing their stakes significantly (or already accumulated large positions).

More specifically, Cantillon Capital Management was the largest shareholder of S&P Global Inc. (NYSE:SPGI), with a stake worth $714.8 million reported as of the end of September. Trailing Cantillon Capital Management was Egerton Capital Limited, which amassed a stake valued at $454.8 million. Orbis Investment Management, Third Point, and Millennium Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Rings Capital Management allocated the biggest weight to S&P Global Inc. (NYSE:SPGI), around 45.14% of its 13F portfolio. Valley Forge Capital is also relatively very bullish on the stock, designating 22.36 percent of its 13F equity portfolio to SPGI.

With a general bullishness amongst the heavyweights, key money managers have been driving this bullishness. Rings Capital Management, managed by Dan Juran, established the most outsized position in S&P Global Inc. (NYSE:SPGI). Rings Capital Management had $66.5 million invested in the company at the end of the quarter. Renaissance Technologies also made a $17.2 million investment in the stock during the quarter. The other funds with new positions in the stock are Stephen J. Errico’s Locust Wood Capital Advisers, Kevin McCarthy’s Breakline Capital, and Bruce Kovner’s Caxton Associates LP.

Let’s go over hedge fund activity in other stocks similar to S&P Global Inc. (NYSE:SPGI). We will take a look at Duke Energy Corporation (NYSE:DUK), Equinor ASA (NYSE:EQNR), Target Corporation (NYSE:TGT), and Canadian National Railway Company (NYSE:CNI). This group of stocks’ market valuations match SPGI’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DUK | 37 | 1534613 | 5 |

| EQNR | 14 | 424786 | -1 |

| TGT | 53 | 2495450 | -2 |

| CNI | 29 | 2000657 | 0 |

| Average | 33.25 | 1613877 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 33.25 hedge funds with bullish positions and the average amount invested in these stocks was $1614 million. That figure was $3765 million in SPGI’s case. Target Corporation (NYSE:TGT) is the most popular stock in this table. On the other hand Equinor ASA (NYSE:EQNR) is the least popular one with only 14 bullish hedge fund positions. Compared to these stocks S&P Global Inc. (NYSE:SPGI) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks also gained 0.1% in 2020 through March 2nd and beat the market by 4.1 percentage points. Hedge funds were also right about betting on SPGI as the stock returned 6.2% so far in Q1 (through March 2nd) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.