We are still in an overall bull market and many stocks that smart money investors were piling into surged through November 22nd. Among them, Facebook and Microsoft ranked among the top 3 picks and these stocks gained 52% and 49% respectively. Hedge funds’ top 3 stock picks returned 39.1% this year and beat the S&P 500 ETFs by nearly 13 percentage points. Investing in index funds guarantees you average returns, not superior returns. We are looking to generate superior returns for our readers. That’s why we believe it isn’t a waste of time to check out hedge fund sentiment before you invest in a stock like S&P Global Inc. (NYSE:SPGI).

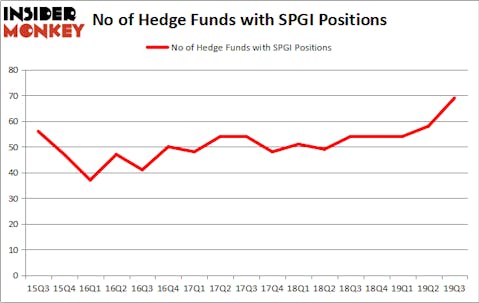

S&P Global Inc. (NYSE:SPGI) was in 69 hedge funds’ portfolios at the end of the third quarter of 2019. SPGI investors should pay attention to an increase in enthusiasm from smart money lately. There were 58 hedge funds in our database with SPGI holdings at the end of the previous quarter. Our calculations also showed that SPGI isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the Russell 2000 ETFs by 40 percentage points since May 2014 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in stocks that are in our short portfolio.

John Armitage of Egerton Capital

We’re going to take a peek at the key hedge fund action regarding S&P Global Inc. (NYSE:SPGI).

Hedge fund activity in S&P Global Inc. (NYSE:SPGI)

At Q3’s end, a total of 69 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 19% from the second quarter of 2019. Below, you can check out the change in hedge fund sentiment towards SPGI over the last 17 quarters. With the smart money’s sentiment swirling, there exists an “upper tier” of notable hedge fund managers who were boosting their stakes significantly (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Cantillon Capital Management, managed by William von Mueffling, holds the biggest position in S&P Global Inc. (NYSE:SPGI). Cantillon Capital Management has a $688.5 million position in the stock, comprising 6.7% of its 13F portfolio. Coming in second is Egerton Capital Limited, managed by John Armitage, which holds a $469.7 million position; 3.4% of its 13F portfolio is allocated to the company. Remaining members of the smart money with similar optimism include Lone Pine Capital, William B. Gray’s Orbis Investment Management and Farallon Capital. In terms of the portfolio weights assigned to each position Valley Forge Capital allocated the biggest weight to S&P Global Inc. (NYSE:SPGI), around 23.04% of its portfolio. IBIS Capital Partners is also relatively very bullish on the stock, dishing out 10.79 percent of its 13F equity portfolio to SPGI.

As industrywide interest jumped, key money managers were leading the bulls’ herd. Junto Capital Management, managed by James Parsons, created the most valuable position in S&P Global Inc. (NYSE:SPGI). Junto Capital Management had $38.2 million invested in the company at the end of the quarter. Sander Gerber’s Hudson Bay Capital Management also made a $10.3 million investment in the stock during the quarter. The following funds were also among the new SPGI investors: Matthew Tewksbury’s Stevens Capital Management, Anand Parekh’s Alyeska Investment Group, and Jeffrey Talpins’s Element Capital Management.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as S&P Global Inc. (NYSE:SPGI) but similarly valued. We will take a look at Zoetis Inc (NYSE:ZTS), Vale SA (NYSE:VALE), The Blackstone Group Inc. (NYSE:BX), and Crown Castle International Corp. (NYSE:CCI). This group of stocks’ market values are closest to SPGI’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ZTS | 46 | 2229489 | 6 |

| VALE | 28 | 1453835 | 7 |

| BX | 41 | 1571733 | 11 |

| CCI | 34 | 1849678 | 1 |

| Average | 37.25 | 1776184 | 6.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 37.25 hedge funds with bullish positions and the average amount invested in these stocks was $1776 million. That figure was $3925 million in SPGI’s case. Zoetis Inc (NYSE:ZTS) is the most popular stock in this table. On the other hand Vale SA (NYSE:VALE) is the least popular one with only 28 bullish hedge fund positions. Compared to these stocks S&P Global Inc. (NYSE:SPGI) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 34.7% in 2019 through November 22nd and outperformed the S&P 500 ETF (SPY) by 8.5 percentage points. Hedge funds were also right about betting on SPGI as the stock returned 8.3% during Q4 (through 11/22) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.