It is already common knowledge that individual investors do not usually have the necessary resources and abilities to properly research an investment opportunity. As a result, most investors pick their illusory “winners” by making a superficial analysis and research that leads to poor performance on aggregate. Since stock returns aren’t usually symmetrically distributed and index returns are more affected by a few outlier stocks (i.e. the FAANG stocks dominating and driving S&P 500 Index’s returns in recent years), more than 50% of the constituents of the Standard and Poor’s 500 Index underperform the benchmark. Hence, if you randomly pick a stock, there is more than 50% chance that you’d fail to beat the market. At the same time, the 20 most favored S&P 500 stocks by the hedge funds monitored by Insider Monkey generated an outperformance of more than 8 percentage points so far in 2019. Of course, hedge funds do make wrong bets on some occasions and these get disproportionately publicized on financial media, but piggybacking their moves can beat the broader market on average. That’s why we are going to go over recent hedge fund activity in Roper Technologies, Inc. (NYSE:ROP).

Is Roper Technologies, Inc. (NYSE:ROP) the right pick for your portfolio? The best stock pickers are getting more optimistic. The number of long hedge fund bets rose by 2 in recent months. Our calculations also showed that ROP isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

To the average investor there are a multitude of methods stock market investors use to assess stocks. A couple of the most useful methods are hedge fund and insider trading interest. Our experts have shown that, historically, those who follow the best picks of the top investment managers can outperform the broader indices by a very impressive amount (see the details here).

Blair Levinsky of Waratah Capital Advisors

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. Let’s analyze the recent hedge fund action surrounding Roper Technologies, Inc. (NYSE:ROP).

Hedge fund activity in Roper Technologies, Inc. (NYSE:ROP)

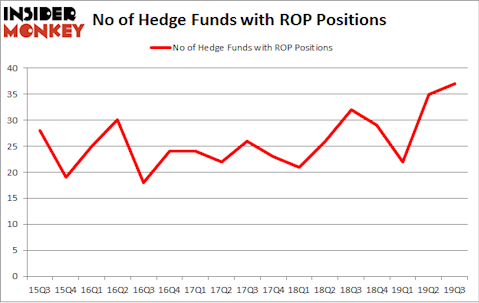

At the end of the third quarter, a total of 37 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 6% from the second quarter of 2019. The graph below displays the number of hedge funds with bullish position in ROP over the last 17 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Akre Capital Management was the largest shareholder of Roper Technologies, Inc. (NYSE:ROP), with a stake worth $558.9 million reported as of the end of September. Trailing Akre Capital Management was Millennium Management, which amassed a stake valued at $85.5 million. Point72 Asset Management, Waratah Capital Advisors, and Bristol Gate Capital Partners were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Waratah Capital Advisors allocated the biggest weight to Roper Technologies, Inc. (NYSE:ROP), around 5.95% of its portfolio. Lansing Management is also relatively very bullish on the stock, dishing out 5.77 percent of its 13F equity portfolio to ROP.

As aggregate interest increased, key money managers have been driving this bullishness. Maverick Capital, managed by Lee Ainslie, initiated the largest position in Roper Technologies, Inc. (NYSE:ROP). Maverick Capital had $0.9 million invested in the company at the end of the quarter. Ray Dalio’s Bridgewater Associates also initiated a $0.6 million position during the quarter. The other funds with new positions in the stock are Matthew Hulsizer’s PEAK6 Capital Management and Parvinder Thiara’s Athanor Capital.

Let’s go over hedge fund activity in other stocks similar to Roper Technologies, Inc. (NYSE:ROP). We will take a look at China Telecom Corporation Limited (NYSE:CHA), Welltower Inc. (NYSE:WELL), Canadian Imperial Bank of Commerce (NYSE:CM), and Ford Motor Company (NYSE:F). This group of stocks’ market valuations are similar to ROP’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CHA | 8 | 24410 | 1 |

| WELL | 15 | 364970 | -2 |

| CM | 15 | 220104 | 3 |

| F | 35 | 1152594 | -4 |

| Average | 18.25 | 440520 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.25 hedge funds with bullish positions and the average amount invested in these stocks was $441 million. That figure was $1045 million in ROP’s case. Ford Motor Company (NYSE:F) is the most popular stock in this table. On the other hand China Telecom Corporation Limited (NYSE:CHA) is the least popular one with only 8 bullish hedge fund positions. Compared to these stocks Roper Technologies, Inc. (NYSE:ROP) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Unfortunately ROP wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on ROP were disappointed as the stock returned 1.2% during the first two months of the fourth quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market in Q4.

Disclosure: None. This article was originally published at Insider Monkey.