Hedge funds are known to underperform the bull markets but that’s not because they are bad at investing. Truth be told, most hedge fund managers and other smaller players within this industry are very smart and skilled investors. Of course, they may also make wrong bets in some instances, but no one knows what the future holds and how market participants will react to the bountiful news that floods in each day. Hedge funds underperform because they are hedged. The Standard and Poor’s 500 Index ETFs returned approximately 27.5% through the end of November (including dividend payments). Conversely, hedge funds’ top 20 large-cap stock picks generated a return of 37.4% during the same period. An average long/short hedge fund returned only a fraction of this due to the hedges they implement and the large fees they charge. Our research covering the last 18 years indicates that investors can outperform the market by imitating hedge funds’ consensus stock picks rather than directly investing in hedge funds. That’s why we believe it isn’t a waste of time to check out hedge fund sentiment before you invest in a stock like Rogers Communications Inc. (NYSE:RCI).

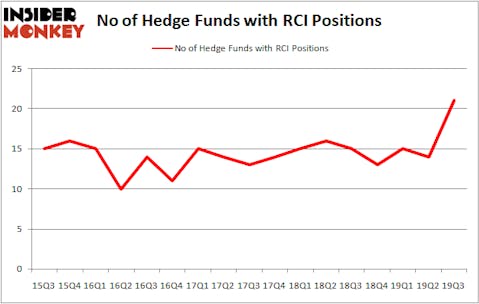

Is Rogers Communications Inc. (NYSE:RCI) a good stock to buy now? The best stock pickers are in an optimistic mood. The number of long hedge fund positions advanced by 7 recently. Our calculations also showed that RCI isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings). RCI was in 21 hedge funds’ portfolios at the end of the third quarter of 2019. There were 14 hedge funds in our database with RCI holdings at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the eyes of most stock holders, hedge funds are perceived as slow, old investment vehicles of the past. While there are greater than 8000 funds trading at present, We look at the moguls of this group, around 750 funds. Most estimates calculate that this group of people command most of the hedge fund industry’s total capital, and by monitoring their unrivaled investments, Insider Monkey has discovered many investment strategies that have historically beaten the S&P 500 index. Insider Monkey’s flagship short hedge fund strategy defeated the S&P 500 short ETFs by around 20 percentage points per annum since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. We’re going to check out the fresh hedge fund action regarding Rogers Communications Inc. (NYSE:RCI).

Hedge fund activity in Rogers Communications Inc. (NYSE:RCI)

At the end of the third quarter, a total of 21 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 50% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards RCI over the last 17 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Renaissance Technologies has the biggest position in Rogers Communications Inc. (NYSE:RCI), worth close to $196.6 million, comprising 0.2% of its total 13F portfolio. On Renaissance Technologies’s heels is Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, which holds a $70.5 million position; the fund has 0.2% of its 13F portfolio invested in the stock. Other hedge funds and institutional investors that are bullish encompass Noam Gottesman’s GLG Partners, David E. Shaw’s D E Shaw and John Overdeck and David Siegel’s Two Sigma Advisors. In terms of the portfolio weights assigned to each position Signition LP allocated the biggest weight to Rogers Communications Inc. (NYSE:RCI), around 2.09% of its 13F portfolio. Hudson Bay Capital Management is also relatively very bullish on the stock, designating 0.23 percent of its 13F equity portfolio to RCI.

As aggregate interest increased, key hedge funds were leading the bulls’ herd. Hudson Bay Capital Management, managed by Sander Gerber, created the most valuable position in Rogers Communications Inc. (NYSE:RCI). Hudson Bay Capital Management had $8.3 million invested in the company at the end of the quarter. Benjamin A. Smith’s Laurion Capital Management also initiated a $1 million position during the quarter. The other funds with brand new RCI positions are Steve Cohen’s Point72 Asset Management, Donald Sussman’s Paloma Partners, and George Zweig, Shane Haas and Ravi Chander’s Signition LP.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Rogers Communications Inc. (NYSE:RCI) but similarly valued. These stocks are D.R. Horton, Inc. (NYSE:DHI), ResMed Inc. (NYSE:RMD), Rockwell Automation Inc. (NYSE:ROK), and ORIX Corporation (NYSE:IX). This group of stocks’ market values resemble RCI’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DHI | 53 | 2555525 | 6 |

| RMD | 20 | 135795 | 10 |

| ROK | 26 | 468953 | -5 |

| IX | 4 | 7651 | -2 |

| Average | 25.75 | 791981 | 2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 25.75 hedge funds with bullish positions and the average amount invested in these stocks was $792 million. That figure was $440 million in RCI’s case. D.R. Horton, Inc. (NYSE:DHI) is the most popular stock in this table. On the other hand ORIX Corporation (NYSE:IX) is the least popular one with only 4 bullish hedge fund positions. Rogers Communications Inc. (NYSE:RCI) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Unfortunately RCI wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); RCI investors were disappointed as the stock returned -0.9% during the first two months of the fourth quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market in Q4.

Disclosure: None. This article was originally published at Insider Monkey.