Although the masses and most of the financial media blame hedge funds for their exorbitant fee structure and disappointing performance, these investors have proved to have great stock picking abilities over the years (that’s why their assets under management continue to swell). We believe hedge fund sentiment should serve as a crucial tool of an individual investor’s stock selection process, as it may offer great insights of how the brightest minds of the finance industry feel about specific stocks. After all, these people have access to smartest analysts and expensive data/information sources that individual investors can’t match. So should one consider investing in Prothena Corporation plc (NASDAQ:PRTA)? The smart money sentiment can provide an answer to this question.

Prothena Corporation plc (NASDAQ:PRTA) shareholders have witnessed an increase in support from the world’s most elite money managers in recent months. Our calculations also showed that PRTA isn’t among the 30 most popular stocks among hedge funds.

In the eyes of most stock holders, hedge funds are assumed to be slow, old financial tools of yesteryear. While there are more than 8000 funds in operation at present, Our researchers choose to focus on the aristocrats of this club, about 750 funds. It is estimated that this group of investors shepherd most of all hedge funds’ total asset base, and by tracking their best equity investments, Insider Monkey has identified many investment strategies that have historically outrun Mr. Market. Insider Monkey’s flagship hedge fund strategy outpaced the S&P 500 index by around 5 percentage points per annum since its inception in May 2014 through June 18th. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 28.2% since February 2017 (through June 18th) even though the market was up nearly 30% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 8.2% in a month whereas our long picks outperformed the market by 2.5 percentage points in this volatile 5 week period (our long picks also beat the market by 15 percentage points so far this year).

We’re going to go over the fresh hedge fund action encompassing Prothena Corporation plc (NASDAQ:PRTA).

How have hedgies been trading Prothena Corporation plc (NASDAQ:PRTA)?

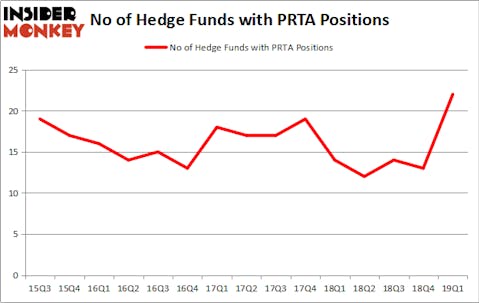

At the end of the first quarter, a total of 22 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 69% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in PRTA over the last 15 quarters. With hedgies’ sentiment swirling, there exists an “upper tier” of key hedge fund managers who were adding to their stakes meaningfully (or already accumulated large positions).

Among these funds, Woodford Investment Management held the most valuable stake in Prothena Corporation plc (NASDAQ:PRTA), which was worth $144.6 million at the end of the first quarter. On the second spot was OrbiMed Advisors which amassed $29.5 million worth of shares. Moreover, Citadel Investment Group, Palo Alto Investors, and EcoR1 Capital were also bullish on Prothena Corporation plc (NASDAQ:PRTA), allocating a large percentage of their portfolios to this stock.

With a general bullishness amongst the heavyweights, key hedge funds have been driving this bullishness. OrbiMed Advisors, managed by Samuel Isaly, established the biggest position in Prothena Corporation plc (NASDAQ:PRTA). OrbiMed Advisors had $29.5 million invested in the company at the end of the quarter. Sahm Adrangi’s Kerrisdale Capital also made a $0.7 million investment in the stock during the quarter. The other funds with new positions in the stock are Peter Muller’s PDT Partners, David Costen Haley’s HBK Investments, and Jeffrey Talpins’s Element Capital Management.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Prothena Corporation plc (NASDAQ:PRTA) but similarly valued. We will take a look at Phunware, Inc. (NASDAQ:PHUN), Replimune Group, Inc. (NASDAQ:REPL), Catchmark Timber Trust Inc (NYSE:CTT), and Pintec Technology Holdings Limited (NASDAQ:PT). All of these stocks’ market caps are similar to PRTA’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PHUN | 8 | 20348 | 6 |

| REPL | 5 | 75343 | -1 |

| CTT | 9 | 48454 | -1 |

| PT | 1 | 675 | 0 |

| Average | 5.75 | 36205 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 5.75 hedge funds with bullish positions and the average amount invested in these stocks was $36 million. That figure was $242 million in PRTA’s case. Catchmark Timber Trust Inc (NYSE:CTT) is the most popular stock in this table. On the other hand Pintec Technology Holdings Limited (NASDAQ:PT) is the least popular one with only 1 bullish hedge fund positions. Compared to these stocks Prothena Corporation plc (NASDAQ:PRTA) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately PRTA wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on PRTA were disappointed as the stock returned -17.6% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market in Q2.

Disclosure: None. This article was originally published at Insider Monkey.