At Insider Monkey, we pore over the filings of nearly 750 top investment firms every quarter, a process we have now completed for the latest reporting period. The data we’ve gathered as a result gives us access to a wealth of collective knowledge based on these firms’ portfolio holdings as of June 28. In this article, we will use that wealth of knowledge to determine whether or not Primerica, Inc. (NYSE:PRI) makes for a good investment right now.

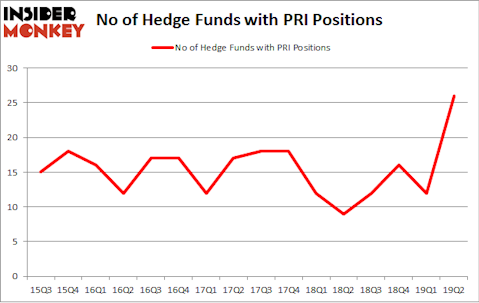

Primerica, Inc. (NYSE:PRI) shareholders have witnessed an increase in support from the world’s most elite money managers in recent months. PRI was in 26 hedge funds’ portfolios at the end of June. There were 12 hedge funds in our database with PRI holdings at the end of the previous quarter. Our calculations also showed that PRI isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to take a look at the latest hedge fund action surrounding Primerica, Inc. (NYSE:PRI).

Hedge fund activity in Primerica, Inc. (NYSE:PRI)

Heading into the third quarter of 2019, a total of 26 of the hedge funds tracked by Insider Monkey were long this stock, a change of 117% from the first quarter of 2019. Below, you can check out the change in hedge fund sentiment towards PRI over the last 16 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Primerica, Inc. (NYSE:PRI) was held by Cantillon Capital Management, which reported holding $110.7 million worth of stock at the end of March. It was followed by Brave Warrior Capital with a $91 million position. Other investors bullish on the company included Millennium Management, GLG Partners, and Citadel Investment Group.

Consequently, key hedge funds have jumped into Primerica, Inc. (NYSE:PRI) headfirst. Millennium Management, managed by Israel Englander, assembled the most outsized position in Primerica, Inc. (NYSE:PRI). Millennium Management had $38.9 million invested in the company at the end of the quarter. Peter Seuss’s Prana Capital Management also initiated a $10.3 million position during the quarter. The following funds were also among the new PRI investors: Renaissance Technologies, Paul Tudor Jones’s Tudor Investment Corp, and John Overdeck and David Siegel’s Two Sigma Advisors.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Primerica, Inc. (NYSE:PRI) but similarly valued. These stocks are Lincoln Electric Holdings, Inc. (NASDAQ:LECO), First Citizens BancShares Inc. (NASDAQ:FCNCA), MDU Resources Group Inc (NYSE:MDU), and Entegris Inc (NASDAQ:ENTG). This group of stocks’ market caps match PRI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LECO | 22 | 279642 | -4 |

| FCNCA | 17 | 144918 | -1 |

| MDU | 21 | 307440 | 3 |

| ENTG | 24 | 567258 | 2 |

| Average | 21 | 324815 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21 hedge funds with bullish positions and the average amount invested in these stocks was $325 million. That figure was $334 million in PRI’s case. Entegris Inc (NASDAQ:ENTG) is the most popular stock in this table. On the other hand First Citizens BancShares Inc. (NASDAQ:FCNCA) is the least popular one with only 17 bullish hedge fund positions. Compared to these stocks Primerica, Inc. (NYSE:PRI) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks (view the video below) among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on PRI as the stock returned 6.4% during Q3 and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.