Is pdvWireless Inc (NASDAQ:PDVW) a good equity to bet on right now? We like to check what the smart money thinks first before doing extensive research. Although there have been several high profile failed hedge fund picks, the consensus picks among hedge fund investors have historically outperformed the market after adjusting for known risk attributes. It’s not surprising given that hedge funds have access to better information and more resources to find the winners in the stock market.

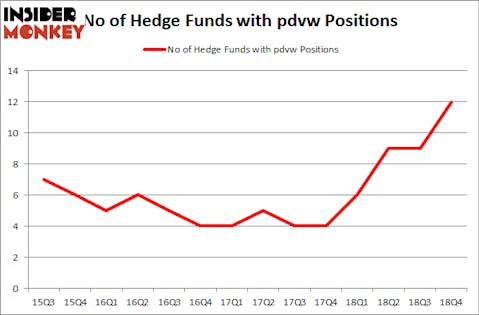

Is pdvWireless Inc (NASDAQ:PDVW) a great investment right now? Hedge funds are in a bullish mood. The number of long hedge fund bets increased by 3 in recent months. Our calculations also showed that pdvw isn’t among the 30 most popular stocks among hedge funds. PDVW was in 12 hedge funds’ portfolios at the end of December. There were 9 hedge funds in our database with PDVW positions at the end of the previous quarter.

To most traders, hedge funds are seen as unimportant, outdated financial tools of the past. While there are more than 8000 funds trading today, Our experts choose to focus on the aristocrats of this club, about 750 funds. These money managers have their hands on bulk of the hedge fund industry’s total capital, and by keeping an eye on their matchless equity investments, Insider Monkey has revealed a number of investment strategies that have historically outstripped the market. Insider Monkey’s flagship hedge fund strategy outstripped the S&P 500 index by nearly 5 percentage points annually since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

Let’s go over the latest hedge fund action surrounding pdvWireless Inc (NASDAQ:PDVW).

What does the smart money think about pdvWireless Inc (NASDAQ:PDVW)?

Heading into the first quarter of 2019, a total of 12 of the hedge funds tracked by Insider Monkey were long this stock, a change of 33% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards PDVW over the last 14 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were boosting their stakes significantly (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Cerberus Capital Management, managed by Stephen Feinberg, holds the most valuable position in pdvWireless Inc (NASDAQ:PDVW). Cerberus Capital Management has a $131.1 million position in the stock, comprising 13.7% of its 13F portfolio. Coming in second is Owl Creek Asset Management, managed by Jeffrey Altman, which holds a $99 million position; 3.3% of its 13F portfolio is allocated to the company. Other peers that hold long positions encompass Daniel Lascano’s Lomas Capital Management, Daniel Gold’s QVT Financial and Michael Price’s MFP Investors.

Consequently, some big names have jumped into pdvWireless Inc (NASDAQ:PDVW) headfirst. Lomas Capital Management, managed by Daniel Lascano, established the most valuable position in pdvWireless Inc (NASDAQ:PDVW). Lomas Capital Management had $12.2 million invested in the company at the end of the quarter. D. E. Shaw’s D E Shaw also made a $1 million investment in the stock during the quarter. The other funds with brand new PDVW positions are Ken Griffin’s Citadel Investment Group and Peter Muller’s PDT Partners.

Let’s now take a look at hedge fund activity in other stocks similar to pdvWireless Inc (NASDAQ:PDVW). These stocks are Omeros Corporation (NASDAQ:OMER), Re/Max Holdings Inc (NYSE:RMAX), Omega Flex, Inc. (NASDAQ:OFLX), and Synthorx, Inc. (NASDAQ:THOR). This group of stocks’ market values match PDVW’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| OMER | 7 | 40210 | -1 |

| RMAX | 5 | 46656 | -5 |

| OFLX | 5 | 8298 | 1 |

| THOR | 5 | 300834 | 5 |

| Average | 5.5 | 99000 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 5.5 hedge funds with bullish positions and the average amount invested in these stocks was $99 million. That figure was $260 million in PDVW’s case. Omeros Corporation (NASDAQ:OMER) is the most popular stock in this table. On the other hand Re/Max Holdings Inc (NYSE:RMAX) is the least popular one with only 5 bullish hedge fund positions. Compared to these stocks pdvWireless Inc (NASDAQ:PDVW) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately PDVW wasn’t nearly as popular as these 15 stock and hedge funds that were betting on PDVW were disappointed as the stock returned 0.6% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.