The market has been volatile in the last few months as the Federal Reserve continued its rate cuts and uncertainty looms over trade negotiations with China. Small cap stocks have been hit hard as a result, as the Russell 2000 ETF (IWM) has underperformed the larger S&P 500 ETF (SPY) by more than 10 percentage points over the last 12 months. SEC filings and hedge fund investor letters indicate that the smart money seems to be paring back their overall long exposure since summer months, though some funds increased their exposure dramatically at the end of Q2 and the beginning of Q3. In this article, we analyze what the smart money thinks of Paylocity Holding Corporation (NASDAQ:PCTY) and find out how it is affected by hedge funds’ moves.

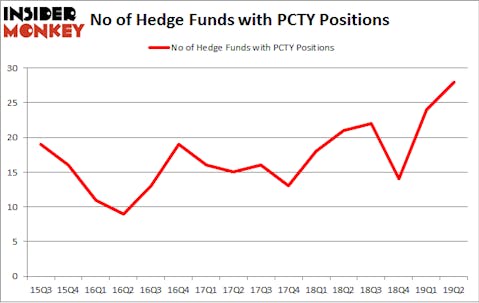

Paylocity Holding Corporation (NASDAQ:PCTY) has experienced an increase in hedge fund sentiment in recent months. Our calculations also showed that PCTY isn’t among the 30 most popular stocks among hedge funds.

In today’s marketplace there are plenty of indicators investors put to use to appraise their holdings. Some of the less utilized indicators are hedge fund and insider trading moves. We have shown that, historically, those who follow the top picks of the elite money managers can trounce the broader indices by a superb margin (see the details here).

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s review the new hedge fund action surrounding Paylocity Holding Corporation (NASDAQ:PCTY).

What does smart money think about Paylocity Holding Corporation (NASDAQ:PCTY)?

Heading into the third quarter of 2019, a total of 28 of the hedge funds tracked by Insider Monkey were long this stock, a change of 17% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in PCTY over the last 16 quarters. With hedge funds’ sentiment swirling, there exists a select group of key hedge fund managers who were upping their stakes significantly (or already accumulated large positions).

More specifically, Millennium Management was the largest shareholder of Paylocity Holding Corporation (NASDAQ:PCTY), with a stake worth $36.4 million reported as of the end of March. Trailing Millennium Management was Echo Street Capital Management, which amassed a stake valued at $34.4 million. Two Sigma Advisors, Citadel Investment Group, and D E Shaw were also very fond of the stock, giving the stock large weights in their portfolios.

As industrywide interest jumped, specific money managers were breaking ground themselves. Algert Coldiron Investors, managed by Peter Algert and Kevin Coldiron, established the most outsized position in Paylocity Holding Corporation (NASDAQ:PCTY). Algert Coldiron Investors had $2.9 million invested in the company at the end of the quarter. Paul Tudor Jones’s Tudor Investment Corp also initiated a $1.7 million position during the quarter. The following funds were also among the new PCTY investors: Matthew Tewksbury’s Stevens Capital Management, Ben Levine, Andrew Manuel and Stefan Renold’s LMR Partners, and Michael Gelband’s ExodusPoint Capital.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Paylocity Holding Corporation (NASDAQ:PCTY) but similarly valued. We will take a look at JBG SMITH Properties (NYSE:JBGS), Huazhu Group Limited (NASDAQ:HTHT), Toll Brothers Inc (NYSE:TOL), and Popular Inc (NASDAQ:BPOP). This group of stocks’ market valuations match PCTY’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| JBGS | 17 | 291239 | 0 |

| HTHT | 14 | 164741 | 0 |

| TOL | 20 | 368947 | -8 |

| BPOP | 30 | 740514 | -3 |

| Average | 20.25 | 391360 | -2.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20.25 hedge funds with bullish positions and the average amount invested in these stocks was $391 million. That figure was $213 million in PCTY’s case. Popular Inc (NASDAQ:BPOP) is the most popular stock in this table. On the other hand Huazhu Group Limited (NASDAQ:HTHT) is the least popular one with only 14 bullish hedge fund positions. Paylocity Holding Corporation (NASDAQ:PCTY) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks (view the video below) among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on PCTY, though not to the same extent, as the stock returned 4% during the third quarter and outperformed the market as well.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.