Investing in small cap stocks has historically been a way to outperform the market, as small cap companies typically grow faster on average than the blue chips. That outperformance comes with a price, however, as there are occasional periods of higher volatility. The last 12 months is one of those periods, as the Russell 2000 ETF (IWM) has underperformed the larger S&P 500 ETF (SPY) by more than 10 percentage points. Given that the funds we track tend to have a disproportionate amount of their portfolios in smaller cap stocks, they have seen some volatility in their portfolios too. Actually their moves are potentially one of the factors that contributed to this volatility. In this article, we use our extensive database of hedge fund holdings to find out what the smart money thinks of Paychex, Inc. (NASDAQ:PAYX).

Is Paychex, Inc. (NASDAQ:PAYX) a buy right now? The best stock pickers are betting on the stock. The number of bullish hedge fund positions moved up by 13 recently. Our calculations also showed that PAYX isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to view the recent hedge fund action regarding Paychex, Inc. (NASDAQ:PAYX).

Hedge fund activity in Paychex, Inc. (NASDAQ:PAYX)

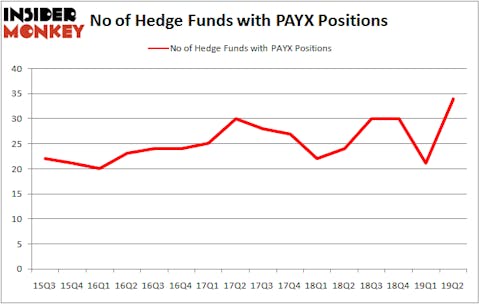

At the end of the second quarter, a total of 34 of the hedge funds tracked by Insider Monkey were long this stock, a change of 62% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in PAYX over the last 16 quarters. With the smart money’s sentiment swirling, there exists a select group of key hedge fund managers who were upping their stakes significantly (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Robert Joseph Caruso’s Select Equity Group has the most valuable position in Paychex, Inc. (NASDAQ:PAYX), worth close to $299.1 million, comprising 2% of its total 13F portfolio. The second largest stake is held by Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, which holds a $278.8 million position; 0.6% of its 13F portfolio is allocated to the company. Remaining members of the smart money that are bullish consist of Cliff Asness’s AQR Capital Management, Joel Greenblatt’s Gotham Asset Management and John Overdeck and David Siegel’s Two Sigma Advisors.

As industrywide interest jumped, specific money managers were breaking ground themselves. Millennium Management, managed by Israel Englander, established the most valuable position in Paychex, Inc. (NASDAQ:PAYX). Millennium Management had $29.3 million invested in the company at the end of the quarter. Richard Chilton’s Chilton Investment Company also made a $4.6 million investment in the stock during the quarter. The other funds with brand new PAYX positions are Peter Seuss’s Prana Capital Management, Dmitry Balyasny’s Balyasny Asset Management, and Paul Tudor Jones’s Tudor Investment Corp.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Paychex, Inc. (NASDAQ:PAYX) but similarly valued. These stocks are Credit Suisse Group AG (NYSE:CS), O’Reilly Automotive Inc (NASDAQ:ORLY), Public Service Enterprise Group Incorporated (NYSE:PEG), and Tyson Foods, Inc. (NYSE:TSN). All of these stocks’ market caps are closest to PAYX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CS | 11 | 217760 | -3 |

| ORLY | 50 | 1820132 | 7 |

| PEG | 23 | 904765 | -5 |

| TSN | 39 | 1442476 | -4 |

| Average | 30.75 | 1096283 | -1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 30.75 hedge funds with bullish positions and the average amount invested in these stocks was $1096 million. That figure was $862 million in PAYX’s case. O’Reilly Automotive Inc (NASDAQ:ORLY) is the most popular stock in this table. On the other hand Credit Suisse Group AG (NYSE:CS) is the least popular one with only 11 bullish hedge fund positions. Paychex, Inc. (NASDAQ:PAYX) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately PAYX wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on PAYX were disappointed as the stock returned 1.3% during the third quarter and slightly underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Disclosure: None. This article was originally published at Insider Monkey.