Our extensive research has shown that imitating the smart money can generate significant returns for retail investors, which is why we track nearly 900 active prominent money managers and analyze their quarterly 13F filings. The stocks that are heavily bought by hedge funds historically outperformed the market, though there is no shortage of high profile failures like hedge funds’ 2018 losses in Facebook and Apple. Let’s take a closer look at what the funds we track think about Outfront Media Inc. (REIT) (NYSE:OUT) in this article.

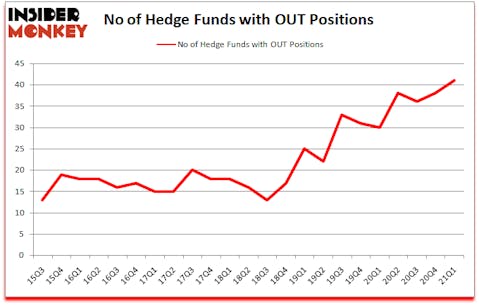

Is Outfront Media Inc. (REIT) (NYSE:OUT) the right pick for your portfolio? Money managers were in a bullish mood. The number of bullish hedge fund bets increased by 3 recently. Outfront Media Inc. (REIT) (NYSE:OUT) was in 41 hedge funds’ portfolios at the end of March. The all time high for this statistic was previously 38. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. Our calculations also showed that OUT isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings).

In today’s marketplace there are numerous formulas market participants employ to analyze publicly traded companies. A duo of the most innovative formulas are hedge fund and insider trading sentiment. We have shown that, historically, those who follow the top picks of the elite fund managers can trounce the S&P 500 by a very impressive amount (see the details here). Also, our monthly newsletter’s portfolio of long stock picks returned 206.8% since March 2017 (through May 2021) and beat the S&P 500 Index by more than 115 percentage points. You can download a sample issue of this newsletter on our website .

Jeffrey Tannenbaum of Fir Tree

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, Federal Reserve has been creating trillions of dollars electronically to keep the interest rates near zero. We believe this will lead to inflation, which is why we are checking out this inflation play. We go through lists like 10 best gold stocks to buy to identify promising stocks. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. With all of this in mind we’re going to take a glance at the recent hedge fund action encompassing Outfront Media Inc. (REIT) (NYSE:OUT).

Do Hedge Funds Think OUT Is A Good Stock To Buy Now?

At Q1’s end, a total of 41 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 8% from the previous quarter. By comparison, 30 hedge funds held shares or bullish call options in OUT a year ago. With hedge funds’ positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were increasing their stakes considerably (or already accumulated large positions).

More specifically, Citadel Investment Group was the largest shareholder of Outfront Media Inc. (REIT) (NYSE:OUT), with a stake worth $95.8 million reported as of the end of March. Trailing Citadel Investment Group was Fir Tree, which amassed a stake valued at $68.9 million. Rima Senvest Management, EMS Capital, and P2 Capital Partners were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Hidden Lake Asset Management allocated the biggest weight to Outfront Media Inc. (REIT) (NYSE:OUT), around 6.95% of its 13F portfolio. Land & Buildings Investment Management is also relatively very bullish on the stock, designating 5.48 percent of its 13F equity portfolio to OUT.

As industrywide interest jumped, some big names were leading the bulls’ herd. Anomaly Capital Management, managed by Ben Jacobs, created the largest position in Outfront Media Inc. (REIT) (NYSE:OUT). Anomaly Capital Management had $28.7 million invested in the company at the end of the quarter. Dmitry Balyasny’s Balyasny Asset Management also made a $20.8 million investment in the stock during the quarter. The other funds with new positions in the stock are David Brown’s Hawk Ridge Management, Phill Gross and Robert Atchinson’s Adage Capital Management, and Peter S. Park’s Park West Asset Management.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Outfront Media Inc. (REIT) (NYSE:OUT) but similarly valued. These stocks are Wolverine World Wide, Inc. (NYSE:WWW), Trinity Industries, Inc. (NYSE:TRN), Empire State Realty OP, L.P. (NYSE:ESBA), Cohen & Steers, Inc. (NYSE:CNS), Evoqua Water Technologies Corp. (NYSE:AQUA), United States Cellular Corporation (NYSE:USM), and Sprouts Farmers Market Inc (NASDAQ:SFM). This group of stocks’ market caps are similar to OUT’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WWW | 16 | 121591 | 2 |

| TRN | 28 | 987877 | 6 |

| ESBA | 1 | 114 | 1 |

| CNS | 17 | 84194 | 2 |

| AQUA | 23 | 328118 | -3 |

| USM | 10 | 97007 | -1 |

| SFM | 21 | 404513 | -4 |

| Average | 16.6 | 289059 | 0.4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.6 hedge funds with bullish positions and the average amount invested in these stocks was $289 million. That figure was $746 million in OUT’s case. Trinity Industries, Inc. (NYSE:TRN) is the most popular stock in this table. On the other hand Empire State Realty OP, L.P. (NYSE:ESBA) is the least popular one with only 1 bullish hedge fund positions. Compared to these stocks Outfront Media Inc. (REIT) (NYSE:OUT) is more popular among hedge funds. Our overall hedge fund sentiment score for OUT is 88. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 17.4% in 2021 through June 18th and still managed to beat the market by 6.1 percentage points. Hedge funds were also right about betting on OUT, though not to the same extent, as the stock returned 8% since the end of March (through June 18th) and outperformed the market as well.

Follow Outfront Media Inc. (NYSE:OUT)

Follow Outfront Media Inc. (NYSE:OUT)

Receive real-time insider trading and news alerts

Suggested Articles:

- How to Best Use Insider Monkey To Increase Your Returns

- 10 Best Cheap Stocks To Buy Now

- 30 Best Movies on Netflix

Disclosure: None. This article was originally published at Insider Monkey.