Insider Monkey has processed numerous 13F filings of hedge funds and successful investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds’ and successful investors’ positions as of the end of the first quarter. You can find write-ups about an individual hedge fund’s trades on numerous financial news websites. However, in this article we will take a look at their collective moves and analyze what the smart money thinks of Orchard Therapeutics plc (NASDAQ:ORTX) based on that data.

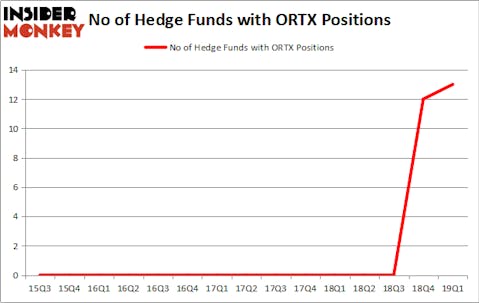

Is Orchard Therapeutics plc (NASDAQ:ORTX) ready to rally soon? Hedge funds are buying. The number of long hedge fund positions rose by 1 in recent months. Our calculations also showed that ORTX isn’t among the 30 most popular stocks among hedge funds. ORTX was in 13 hedge funds’ portfolios at the end of March. There were 12 hedge funds in our database with ORTX positions at the end of the previous quarter.

If you’d ask most traders, hedge funds are viewed as worthless, outdated investment tools of years past. While there are more than 8000 funds in operation today, We choose to focus on the elite of this group, around 750 funds. Most estimates calculate that this group of people handle bulk of the smart money’s total capital, and by tracking their unrivaled equity investments, Insider Monkey has revealed many investment strategies that have historically exceeded the broader indices. Insider Monkey’s flagship hedge fund strategy outrun the S&P 500 index by around 5 percentage points annually since its inception in May 2014 through June 18th. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 28.2% since February 2017 (through June 18th) even though the market was up nearly 30% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 8.2% in a month whereas our long picks outperformed the market by 2.5 percentage points in this volatile 5 week period (our long picks also beat the market by 15 percentage points so far this year).

Let’s analyze the key hedge fund action encompassing Orchard Therapeutics plc (NASDAQ:ORTX).

Hedge fund activity in Orchard Therapeutics plc (NASDAQ:ORTX)

At the end of the first quarter, a total of 13 of the hedge funds tracked by Insider Monkey were long this stock, a change of 8% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards ORTX over the last 15 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Deerfield Management was the largest shareholder of Orchard Therapeutics plc (NASDAQ:ORTX), with a stake worth $143.5 million reported as of the end of March. Trailing Deerfield Management was RA Capital Management, which amassed a stake valued at $91.3 million. Adage Capital Management, Driehaus Capital, and Cormorant Asset Management were also very fond of the stock, giving the stock large weights in their portfolios.

As aggregate interest increased, key hedge funds have jumped into Orchard Therapeutics plc (NASDAQ:ORTX) headfirst. Berylson Capital Partners, managed by James Thomas Berylson, created the most outsized position in Orchard Therapeutics plc (NASDAQ:ORTX). Berylson Capital Partners had $2.2 million invested in the company at the end of the quarter.

Let’s check out hedge fund activity in other stocks similar to Orchard Therapeutics plc (NASDAQ:ORTX). We will take a look at SSR Mining Inc. (NASDAQ:SSRM), The Children’s Place Inc. (NASDAQ:PLCE), Sirius International Insurance Group, Ltd. (NASDAQ:SG), and Rush Enterprises, Inc. (NASDAQ:RUSHA). All of these stocks’ market caps are similar to ORTX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SSRM | 13 | 106970 | 1 |

| PLCE | 22 | 254916 | 3 |

| SG | 1 | 3942 | 0 |

| RUSHA | 19 | 102027 | -2 |

| Average | 13.75 | 116964 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.75 hedge funds with bullish positions and the average amount invested in these stocks was $117 million. That figure was $315 million in ORTX’s case. The Children’s Place Inc. (NASDAQ:PLCE) is the most popular stock in this table. On the other hand Sirius International Insurance Group, Ltd. (NASDAQ:SG) is the least popular one with only 1 bullish hedge fund positions. Orchard Therapeutics plc (NASDAQ:ORTX) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately ORTX wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); ORTX investors were disappointed as the stock returned -19.1% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.