At Insider Monkey, we pore over the filings of nearly 750 top investment firms every quarter, a process we have now completed for the latest reporting period. The data we’ve gathered as a result gives us access to a wealth of collective knowledge based on these firms’ portfolio holdings as of March 31. In this article, we will use that wealth of knowledge to determine whether or not Ooma Inc (NYSE:OOMA) makes for a good investment right now.

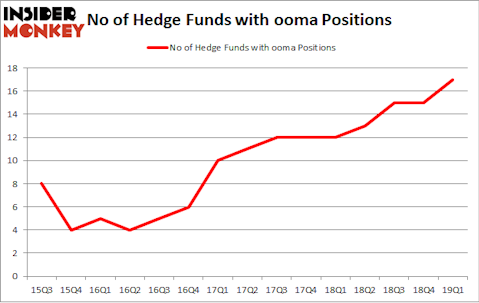

Ooma Inc (NYSE:OOMA) was in 17 hedge funds’ portfolios at the end of the first quarter of 2019. OOMA has experienced an increase in activity from the world’s largest hedge funds of late. There were 15 hedge funds in our database with OOMA holdings at the end of the previous quarter. Our calculations also showed that ooma isn’t among the 30 most popular stocks among hedge funds.

To most traders, hedge funds are viewed as worthless, outdated investment vehicles of the past. While there are greater than 8000 funds in operation today, Our researchers hone in on the moguls of this club, approximately 750 funds. These money managers administer bulk of the smart money’s total asset base, and by paying attention to their top stock picks, Insider Monkey has uncovered a few investment strategies that have historically outperformed the S&P 500 index. Insider Monkey’s flagship hedge fund strategy beat the S&P 500 index by around 5 percentage points a year since its inception in May 2014 through the end of May. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 30.9% since February 2017 (through May 30th) even though the market was up nearly 24% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 11.9% in less than a couple of weeks whereas our long picks outperformed the market by 2 percentage points in this volatile 2 week period.

We’re going to take a glance at the fresh hedge fund action regarding Ooma Inc (NYSE:OOMA).

Hedge fund activity in Ooma Inc (NYSE:OOMA)

At Q1’s end, a total of 17 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 13% from the previous quarter. On the other hand, there were a total of 12 hedge funds with a bullish position in OOMA a year ago. With the smart money’s sentiment swirling, there exists a select group of noteworthy hedge fund managers who were increasing their stakes meaningfully (or already accumulated large positions).

The largest stake in Ooma Inc (NYSE:OOMA) was held by Woodson Capital Management, which reported holding $20.6 million worth of stock at the end of March. It was followed by Renaissance Technologies with a $14.7 million position. Other investors bullish on the company included Tiger Management, Headlands Capital, and Portolan Capital Management.

As one would reasonably expect, specific money managers were leading the bulls’ herd. Two Sigma Advisors, managed by John Overdeck and David Siegel, initiated the most valuable position in Ooma Inc (NYSE:OOMA). Two Sigma Advisors had $0.4 million invested in the company at the end of the quarter. David Harding’s Winton Capital Management also made a $0.3 million investment in the stock during the quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Ooma Inc (NYSE:OOMA) but similarly valued. We will take a look at Chaparral Energy, Inc. (NYSE:CHAP), Marlin Business Services Corp. (NASDAQ:MRLN), Gold Standard Ventures Corp (NYSE:GSV), and SmartFinancial, Inc. (NASDAQ:SMBK). All of these stocks’ market caps are closest to OOMA’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CHAP | 13 | 100399 | -1 |

| MRLN | 5 | 85316 | 0 |

| GSV | 3 | 1129 | -3 |

| SMBK | 6 | 23070 | 1 |

| Average | 6.75 | 52479 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 6.75 hedge funds with bullish positions and the average amount invested in these stocks was $52 million. That figure was $71 million in OOMA’s case. Chaparral Energy, Inc. (NYSE:CHAP) is the most popular stock in this table. On the other hand Gold Standard Ventures Corp (NYSE:GSV) is the least popular one with only 3 bullish hedge fund positions. Compared to these stocks Ooma Inc (NYSE:OOMA) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately OOMA wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on OOMA were disappointed as the stock returned -10.5% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market in Q2.

Disclosure: None. This article was originally published at Insider Monkey.